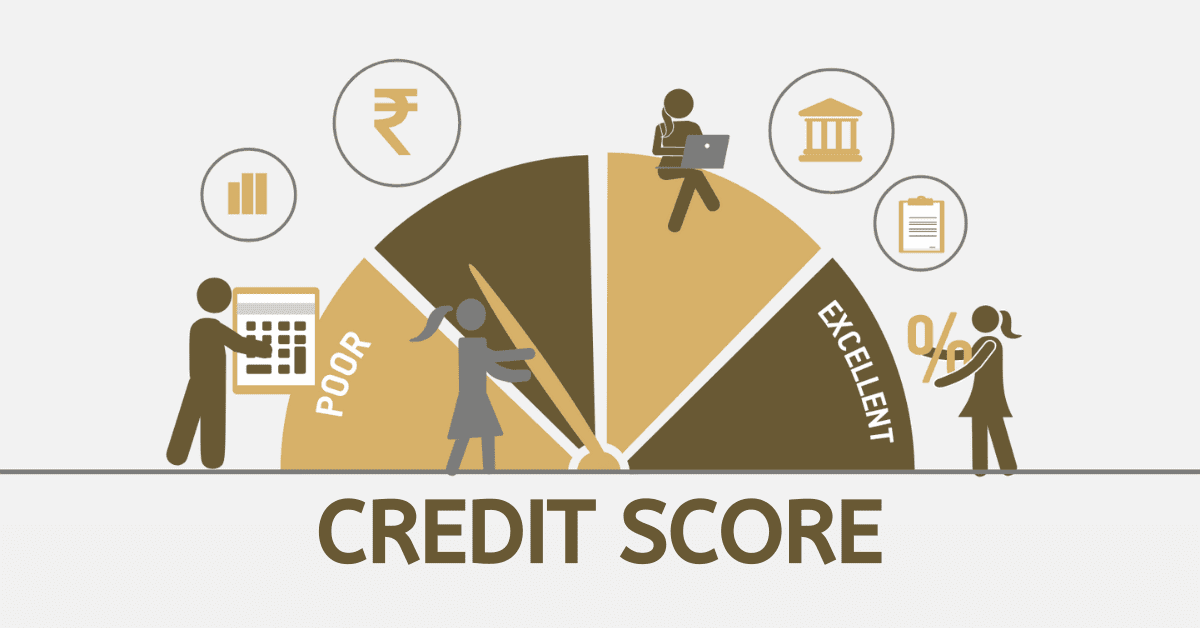

A credit card is a crucial part of South Africa’s financial management. They are a significant factor in determining a person’s credit rating. These ratings are numeric representations that reflect an individual’s creditworthiness, which is decided by the credit history. Lenders consider it an important criterion when deciding whether to grant credit and at what interest rate. Responsible credit card management has credit score advantages, and it also shows reliability with possible lenders. On the flip side, too much usage or debt can hurt it, thus making future borrowing more expensive or almost impossible. This paper will explore the mechanics of how these cards affect loan

How Does My Credit Card Impact A Credit Score?

These cards can also positively and negatively affect loan ratings in South Africa. Let’s see how they influence your credit rating:

- Payment History: Credit history comes above all the other factors. Paying on time positively impacts your rating, but a delayed settlement will lower it.

- Credit Utilization: This is the loan used compared to the overall limit. It is recommended that your usage is kept as low as possible. The recommended percentage is below 30% of your limit to be viewed as a responsible user and increase your score.

- Length of Credit History: The age of your loan accounts can be another factor that will influence your reading. Older profiles are generally considered a positive sign of creditworthiness since they show that the person has managed loans for a longer time.

- Credit Inquiries: Every time you apply for a charge plate, a hard inquiry will be made, temporarily impacting your rating. Nevertheless, this consequence is normally trivial and short-term.

- Variety of Credit Types: Having different types of charge plates will also improve your score since it shows that you can manage all products responsibly.

- Total Accounts and Debt: Your rating will also depend on the number of credit profiles you have and the total amount of loans you have. Excessive indebtedness or multiple accounts can imply poor behavior.

Does A Credit Card Increase Hurt Your Credit Score?

Seeking a limit increase on your card in South Africa might positively and negatively affect your rating. When you ask for a raise, the issuer of the plate can perform a hard inquiry on your report to assess whether you deserve the larger limit. This credit report check can ding your credit score, though it will usually only be by less than five points. Nevertheless, this effect is transient and only impacts your FICO score for 12 months, but it stays in your credit report for two years.

On the other hand, should your credit limit rise, your credit score will get even higher due to the better credit utilization ratio. In this case, that will be because the sum of your available credit gets higher, and if you continue or reduce the current balance, the amount of what you owe as a percentage will also decrease. A smaller loan utilization is desirable for your rating, showing you don’t exceed your limit.

How Long Do Credit Cards Take To Increase A Credit Score?

How long it takes you to improve your readings with that card depends on several factors. These include your current loan status, how you handle your plate, and how often your reports are updated. In South Africa, a credit score is usually displayed on the credit record after three months. However, it is advised to wait for six months after that to ensure the positive changes are adequately implemented.

Consistent and responsible credit card use is crucial in your credit score improvement journey. Such measures include making on-time payments regardless of the amount, using a small credit portion limit, and not applying for many credit cards or large increases in a short period. Eventually, these good habits will lead to a more attractive credit score. However, patience and discipline are key features one must possess since the process won’t be overnight. If you have had major setbacks, fixing your credit usually takes one to two years. Regularly checking your credit report helps you follow your progress and know how your behaviors impact the score.

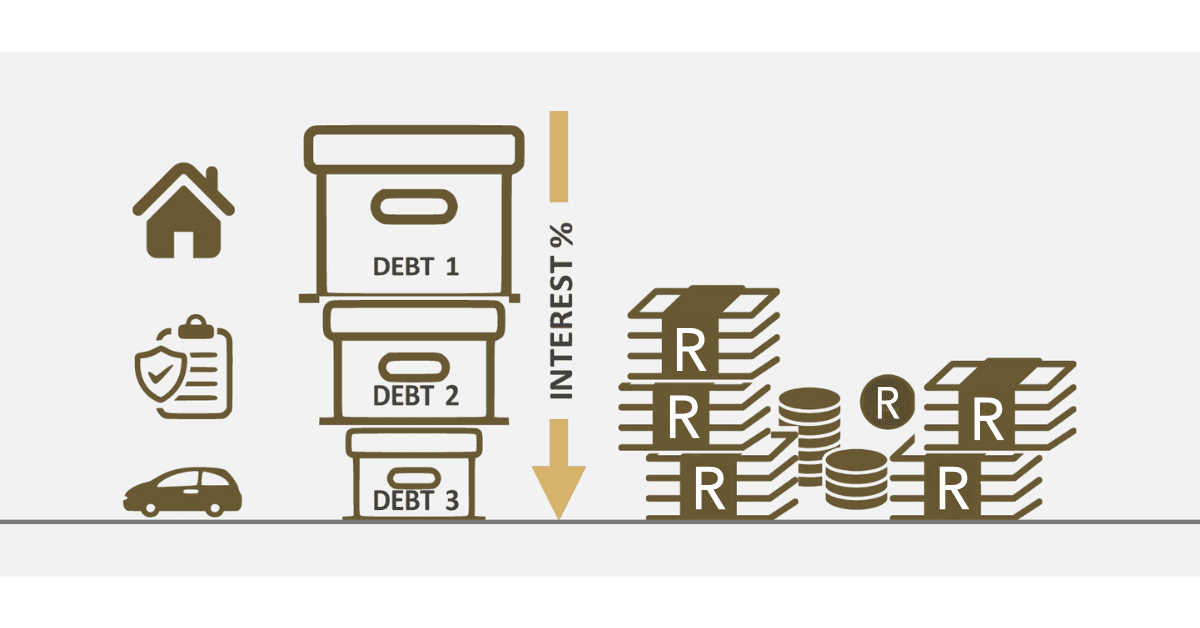

What Happens If You Use Your Credit Card A Lot?

Frequent usage of your card in South Africa will positively and negatively affect your monetary health and loan ratings. Here’s what can happen:

- Rewards and Benefits: Many companies provide rewards, cashback, or point systems, encouraging people to use their cards actively. Continuous usage will exponentially gain these benefits over time.

- Credit Score Impact: If you can pay off the balance in full every billing cycle, frequent use can actually grow your credit score by indicating responsible credit management. However, carrying a credit balance, especially at a higher rate than your credit limit, can raise your credit utilization ratio and, consequently, lower your credit score.

- Debt Accumulation: Increased credit usage without full settlement can result in huge debt since interest compounds, especially if you make minimum payments. This may get overwhelming with time and may cause financial strains.

- Risk of Overspending: Frequent use of such credit facilities may result in budget overruns as it can be easier to lose track of what is being charged to the card, especially if the spending is not well budgeted.

- Potential for Fraud: The greater your credit use, the higher the likelihood your credit card details may be compromised. Checking your bank statement frequently is paramount to quickly finding any unauthorized transactions.