In South Africa, long-term venturing is something vital when building wealth or securing your financial future. Again, this calls for utmost patience and being consistent when looking to achieve goals on retirement, savings for your children’s education, or even buying a dream home. However, several investors get tempted earlier to withdraw their funds due to short-term needs or because of the volatility within the market. This can throw your financial goals asunder and bring you opportunities to realize missed growth. Thus, understanding why you’ll want to stay the course and not give in to a short-term yearning to use your long-term investments is going to make all the difference toward attaining financial freedom.

Can You Take Money Out of a Long-Term Savings Account?

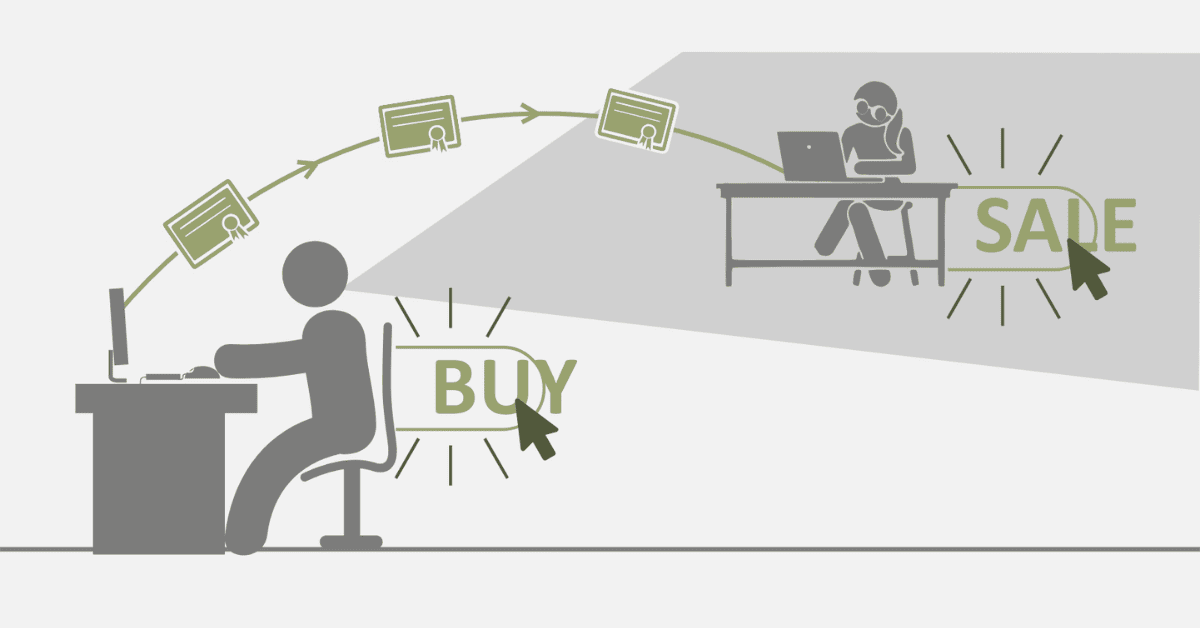

Even though there might be a way to withdraw the money saved from long-term investments or savings from interest in a similar manner in South Africa, it is usually not advised. Investments done for the long term are made in such a way that they will be allowed to grow and raise the most over extensive years, including retirement products such as annuities, unit trusts, or TFSA. They encapsulate compound interest, reinvested dividends, and market appreciation. Any withdrawals will disrupt this growth process; because of such premature withdrawal, you could miss significant earnings.

There are also penalties or tax implications levied on most long-term investment instruments when there is premature access. For example, withdrawal from a retirement annuity before you are 55 years of age has considerable tax penalties that could dent the total value of your savings. Most other kinds of investment come with lock-in periods and early withdrawal fees. This may drastically reduce the amount a person gets to access.

Why You Shouldn’t Withdraw From a Long-Term Investment

Several negative impacts come with this step if taken. To start by, it reduces compounding—your investment’s earned earnings supposedly start to earn their earnings. The longer you keep your money invested, the stronger this effect is. When you withdraw funds, you break this cycle, lowering all future investment potential in the growth.

First, market timing is just really, really tough, and even some of the savviest investors get it wrong. Second, pulling money out when the market is down or your investment has turned sour locks in losses and potentially impairs positive rebounds. By definition, over short horizons, market fluctuation is very volatile, yet its long-term direction is upwards. Remaining invested would help you pass through smoothly and benefit from the rising tide.

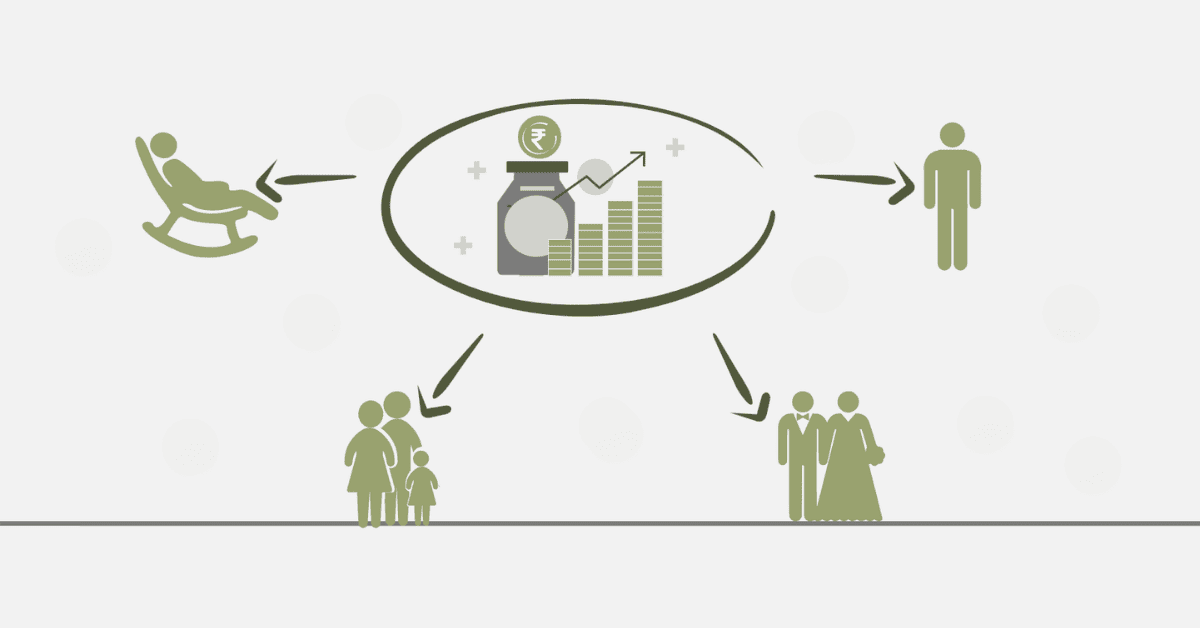

Thirdly, it can create a situation where your long-term investment plans are derailed. Be it for retirement, saving for a child’s education, or any critical buy, the money you have invested prematurely will leave you relatively short of your goals. The earlier you withdraw, the less time it has to grow; hence, there will be shortfalls that will be hard to recover from.

This, alongside the fact that some South African investments earn benefits in terms of taxes while held long-term, implies that you stand a risk of losing such benefits if you pull out early. In a nutshell, staying invested ensures that you maximize your returns. It minimizes your risks and keeps your monetary goals within reach.

What Happens If I Pull Cash Out of an Investment Account?

Raising funds from your account, especially in SA, can have several immediate and long-term impacts. Among the most immediate of these effects is the potential for capital loss. If you withdraw during a market downturn, you might sell your assets at a loss, crystal clear at reducing your investments. These costs could have been avoided if you had stayed invested and allowed the market to recover over time.

Other things that follow include the interruption of your financial plan. Most investment strategies are created with a specific time horizon in mind. Early withdrawal can expose a portfolio to losing the realization of long-term financial objectives, such as retirement, home acquisition, and child education. It also interferes with the compounding effect, which is so important in creating wealth.

Beyond that, there could also be tax consequences, particularly with retirement accounts or tax-advantaged savings accounts; tapping those accounts could create tax penalties or increase the rate of taxes you might pay, which in turn would further reduce the worth of your investment. It could also lower the net amount you receive since early withdrawals can incur fees.

What Are the Consequences of Taking Money Out of Your Retirement?

Withdrawing retirement savings in South Africa is very expensive before retirement age. The worst impact could be the loss of compound growth. Retirement investments are usually designed to grow for several decades, and early withdrawals will disrupt this growth and reduce the overall retirement fund.

Moreover, SARS imposes tax penalties for withdrawals from your retirement funds. Sometimes, these penalties are so huge that they slice the amount you are to get considerably. An example is withdrawals from pension money before the age of 55; such is charged at a higher rate, which may tailor down most of your retirement savings.

Further, cashing out from your retirement fund prematurely will have repercussions on your long-term security. You might be left to depend on government pensions and even work way past the age of retirement. This may result in a reduced quality of life in retirement years and additional pressure on available finances.

Final Thoughts

Long-term investments will guarantee your financial protection in South Africa. Although it becomes compelling to withdraw from investments, especially during moments of economic crisis or when the markets are really down, early withdrawal is highly prejudicial. Maintaining the course allows an investment to grow and minimizes risk, availing financial goals at all times. So, think long-term before making any decisions that may disrupt your financial journey.