Errors in your credit report can negatively impact your score. With a poor credit score, you may not qualify for loans with favorable conditions like lower interest. One way of avoiding this is checking your credit report. However, some people believe that this action can affect their scores, but this is not true. Instead, it is safe to check your score regularly. This article explores everything you want to know about checking your credit score.

Does Your Credit Score Go Down When You Check It?

First and foremost, it is vital to know that checking your credit does not harm your score. However, hard checks conducted by other parties, such as lenders and not you, will cost some points. This may lower your credit score. Lenders and credit card companies often check the applicant’s credit history to see if they are credit-worth.

When this happens, you will receive a credit report with your credit history. Data obtained from credit reports is used to calculate credit scores. Hard reports can hurt your score, and they should happen with your consent, but this is not always the case. If you check your free credit report, you will see all the activities that took place.

When you check your credit score, this is known as a soft inquiry, and it does not affect your credit score in any way. To avoid hard inquiries that lead to a drop in your credit score, it is imperative to conduct research first to identify the best credit companies. If you apply for several credit cards at the same time, your score will be affected.

How Many Times Can Your Credit Be Checked Before It Affects Your Score?

If you are checking your credit report, your credit score will not be affected. No matter how many times you check your report, your score will be safe. However, multiple hard credit inquiries in a short period might affect your credit score. People who apply for several credit lines in a short space are often flagged by lenders as high-risk borrowers. In most cases, people with more than six hard inquiries on their credit reports when they apply for new credit lines are likely to declare bankruptcy.

If you are looking for a new credit card or new loan, take your time to avoid piling hard inquiries on your credit report. When your credit report already has hard inquiries, it is a good idea to wait for about six months until they clear. Your next application will reflect your creditworthiness when it does not contain hard inquiries.

Why Does My Credit Score Lower When I Check It?

If you check your credit score, it does not lower, but it might be affected if a credit card issuer or lender does. When you receive an “inquiry” on your report it means your credit report was pulled by someone. To stay alert with your credit current credit score, it is vital to check your credit history regularly. This will not affect your score.

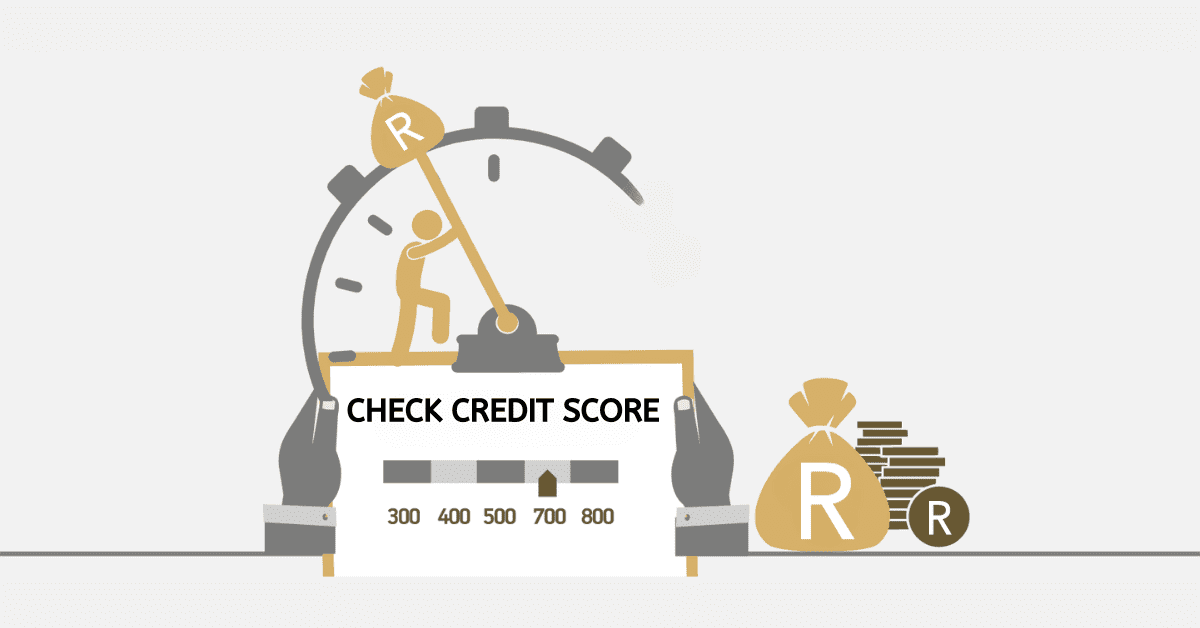

How Can I Check My Credit Score Without Making It Worse?

There are different methods you can use to check your credit score without worsening it in South Africa. You can contact the lender directly to get a free report that outlines your current status. This method does not affect your credit score in any way.

By contacting TransUnion Credit Bureau, you can choose an appropriate package that allows you to get a detailed report about your current credit score. However, other packages can cost you some money to get the score. Alternatively, you can use Clearscore, a popular website and app used to check credit scores for free in South Africa. When you use these free tools, your credit score will not be affected in any way.

You should check your credit report from major bureaus such as Experian, TransUnion, XDS Credit Bureau, and Compuscan at least once every three to six months. Checking your credit report helps you identify errors that can affect your credit score.

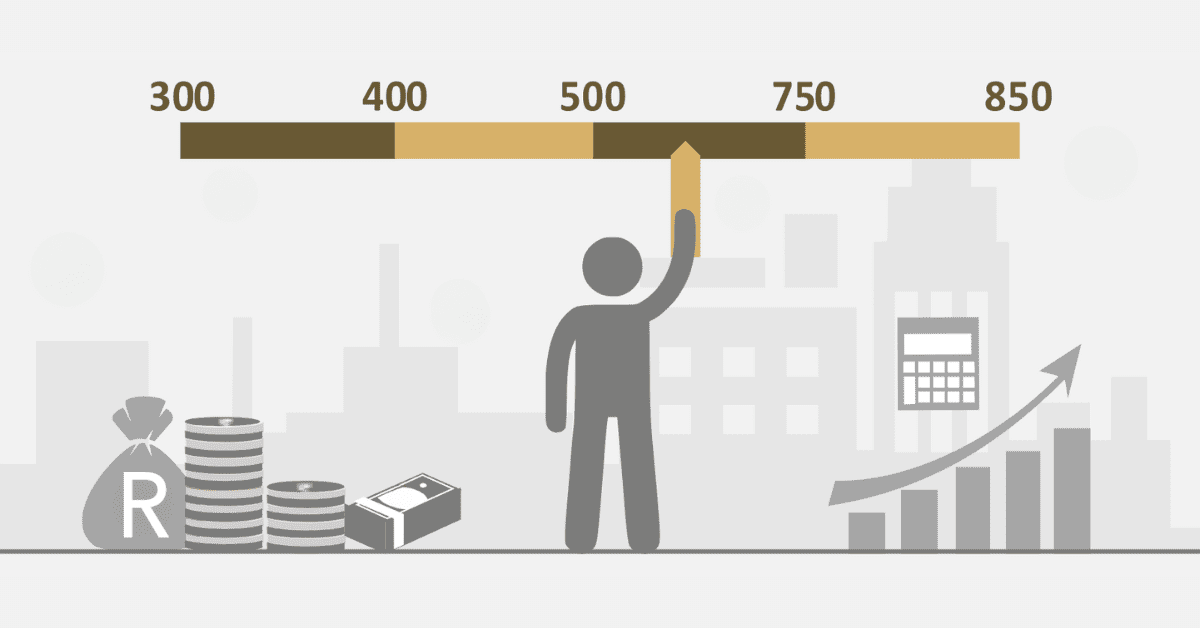

Why Is My Credit Score Going Down if I Pay Everything on Time?

Even when you pay your loan dues or credit card bills on time, your credit card might still go down due to different reasons. A high credit utilization ratio that exceeds 30% can negatively impact your credit score. Your score will decline if you fail to maintain your credit utilization ratio at desirable rates regardless of making timely payments of your bills.

Applying for several credit lines within a short period can impact your credit score even when you pay everything on time. Credit card companies and lenders will conduct hard inquiries on your credit record to see if you qualify for a new loan. Your credit score will be negatively affected as a result of multiple hard inquiries. These inquiries would appear on your credit period for about two years, and your credit score will regain after a few months. When you get several hard inquiry reports, it is a good idea to avoid applying for a new loan.

Identity theft can affect your credit score even when you pay all your bills on time. Mixed identity details can also affect your score when someone’s credit activities are recorded as yours. Check your credit report and notify the credit bureaus for errors or any fraudulent activity conducted in your name. If a default judgment is passed and you are unaware of it, it can affect your credit score. When there are certain issues on your credit report, your score is affected despite early bill payments made.

When you check your credit report, your score is not affected. However, a hard credit inquiry conducted by a credit card company or lender can cause your score to drop. Multiple inquiries on your report may suggest that you are a high-risk borrower. To avoid this situation, you need to do some research first before applying for a loan or a new credit card.