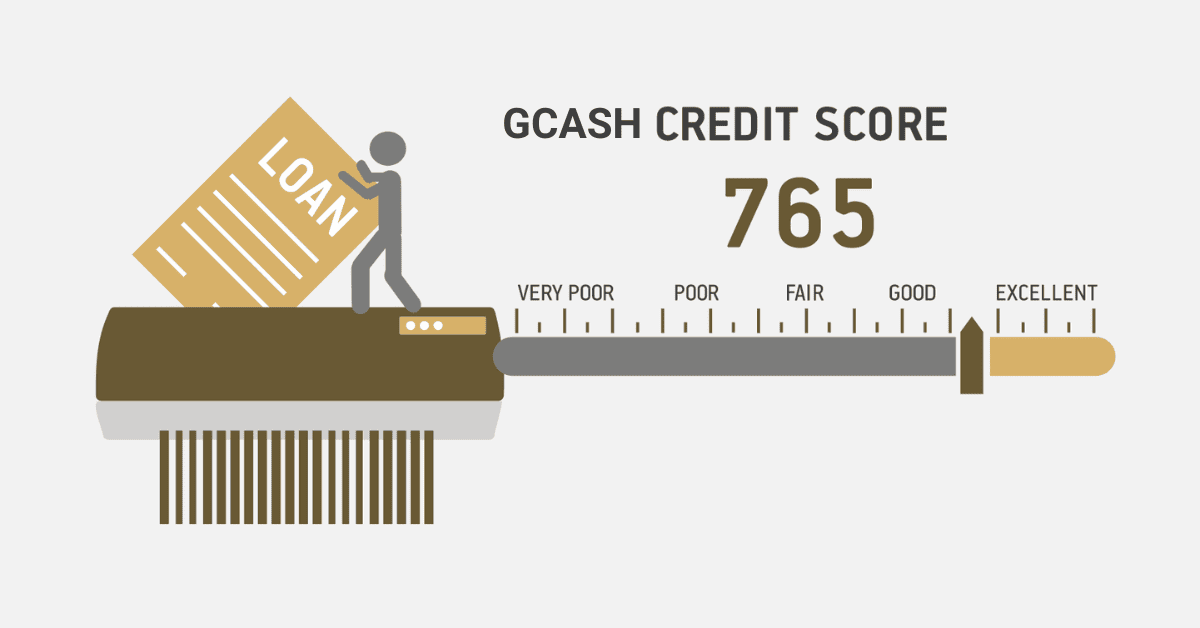

Car purchasing is undoubtedly a pivotal fiscal decision demanding extensive analysis and planning. Although there are several elements when purchasing a car, the most indispensable aspect possibly is your credit grade. It defines your ability to get a car loan, while your credit score mainly determines your interest rate. A credit score is a number rating built off your credit history and report that reflects creditworthiness and financial behavior. A good score, such as in this case, can make the difference between accessing better deals that would save you money on your car loan. A bad credit score would immensely limit your options and cost more.

You may utilize an auto loan calculator to help you determine how much you can take on a loan and settle for a car loan. With this Internet software, one can enter the credit rating, the amount loaned, the settlement periods, and the interest rate to compute the monthly figures cleared in installments in addition to the overall interest. With a car loan calculator, you can compare different scenarios and secure a deal that befits your needs plus falls within your budget.

The eligibility measure, how to utilize a credit rating auto loan calculator, a good credit grade for an automobile loan, the bottom-level credit grades to purchase a vehicle in South Africa, and how to secure an automobile with a bad score will be explained in this post.

Credit Score Auto Loan Calculator

A credit rating car loan calculator helps ease your car purchase and finance planning in South Africa. Available online on platforms such as Absa, AutoTrader, Easy Car Finance, and Standard Bank, the calculators require inputs to operate:

- Credit Rating: It denotes creditworthiness, and you may view it for free via ClearScore or request it through credit agencies such as TransUnion, Experian, XDS, or Compuscan.

- Loan Figure: The overall amount of cash required to fund your car purchase, not involving any down payment, trade-in price, or residual/balloon settlement. Borrow the minimum amount possible to avoid higher interest and fees.

- Repayment Span: The period the vehicle loan will be settled. This will typically scale between twelve and seventy-two months. Choose the shortest affordable period to reduce total interest and build equity in the car faster.

- Interest Rate: The rate accruing as interest on the vehicle credit is mainly represented as an Annual Percentage Rate. It relies on the credit grades, the creditor, and the type and age of the automobile. It’s measured on the primary interest rate, which stands at 11.75 percent, and totals or discounts a margin based on your credit grade and other aspects.

Once this info has been inserted, the calculator determines the overall loan figure, the gross interest, and the aggregate installment over the period of the credit. Use this result to compare options for putting in different inputs until satisfaction with the desired output.

What Is A Good Credit Rating For Automobile Loan?

What forms a good grade for a vehicle credit isn’t a uniform response since various creditors and providers might have differing terms and expectations of their clients. As a rule of thumb above, 650 points are considered good credit score points when qualifying for an auto loan in South Africa, with anything too close to that mark being lethal. A good or excellent credit score can enhance your chances of getting auto loan approval, securing a lower interest rate, and receiving a higher loan amount at better terms and conditions.

However, having a good or excellent credit score does not guarantee the application for an auto loan will be approved as lenders and dealers consider other factors, such as your income, employment history, debt-to-income ratio, vehicle type and value, and down payment. For that reason, it’s advised to hang on to your credit grade, the full fiscal image, and the application.

What Is The Lowest Credit Score To Secure A Vehicle In South Africa?

In South Africa, it hangs on the creditor, dealer, and automobile type, so no fixed lowest credit grade is set to possess a car. Generally, a 600 to 650+ credit score is needed for auto loan approval. Scores below 600 can result in loan refusal, excessive interest rates, and meager loan amounts. However, it also depends on the overall credit profile. A surplus of positive credit information, like the extended history of borrowing, low credit utilization rate, and diverse types of borrowing, can cushion a weak score. On the other hand, limited or negative credit history, high credit utilization ratio, and single credit type block loan approval.

How To Purchase An Automobile With Bad Credit?

However, you may still secure an automobile in South Africa with a poor credit grade. This is through the following:

- Higher Down Payment: With this, there is less risk for the lender, lower loan-to-value ratio, and maybe set as collateral.

- Shopping Around: Lenders and dealers offer varying auto loan requirements and rates. One can compare options using online platforms like AutoTrader, Money Expert, or RCS. A credit-rating automobile loan calculator can approximate monthly installments without a real quotation of the total interest for the entire period.

- Improving Credit Rating: The best approach to purchasing an automobile with bad credit is by enhancing your credit grade in the long run. Clearing arrears promptly, cutting debts, disputing mistakes in the statement of credit, and processing fresh loans only when crucial. Regular check scores, as well as reports of credit to monitor progress, are pivotal.