Have you ever thought about getting your credit score report but wondering where to get it from? Do you consider your bank to generate your credit report for you?

Before we dive into the possibility of getting your credit score report from your bank let us first understand what the credit report system looks at.

The credit report system is a crucial tool in personal finance, as it assesses an individual’s payment history to gauge their creditworthiness. Lenders can obtain valuable insights into potential risks by gathering data on an individual’s borrowing and repayment habits. Regularly checking your credit report is crucial for preventing identity theft, identifying errors, and resolving inaccuracies promptly.

Obtaining loans, credit cards, and low interest rates become more accessible when you have a solid credit history. Over time, individuals can achieve healthier financial lives by gaining control over their financial reputation. To maintain financial stability and make wise choices, it is crucial to monitor your finances regularly.

Can I get a credit score report from my bank?

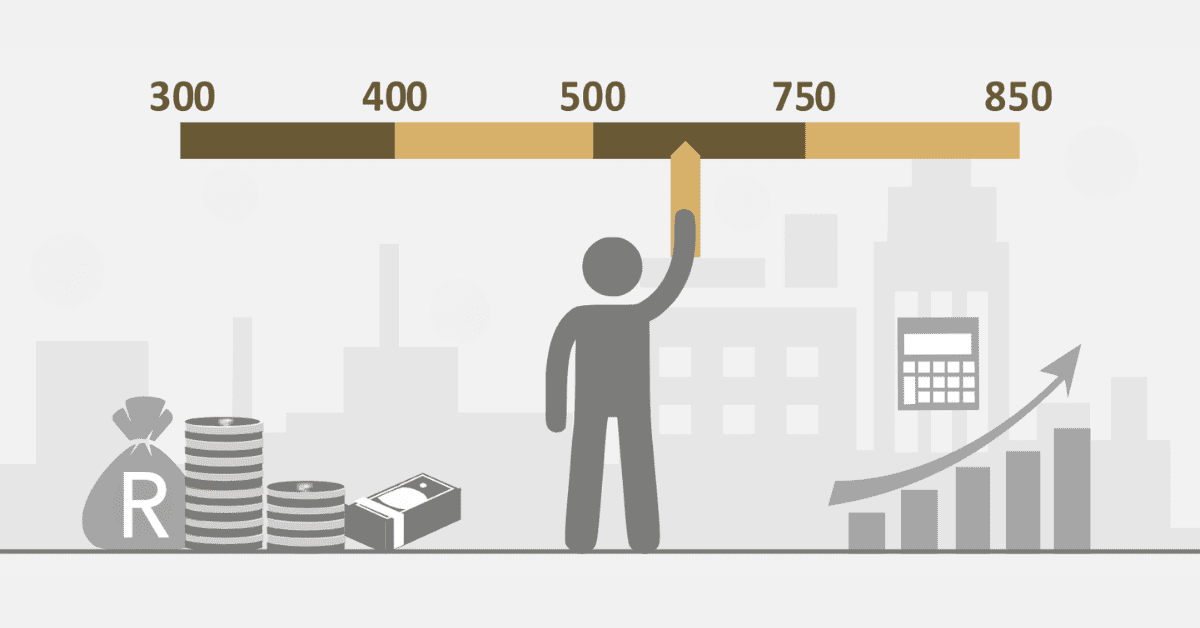

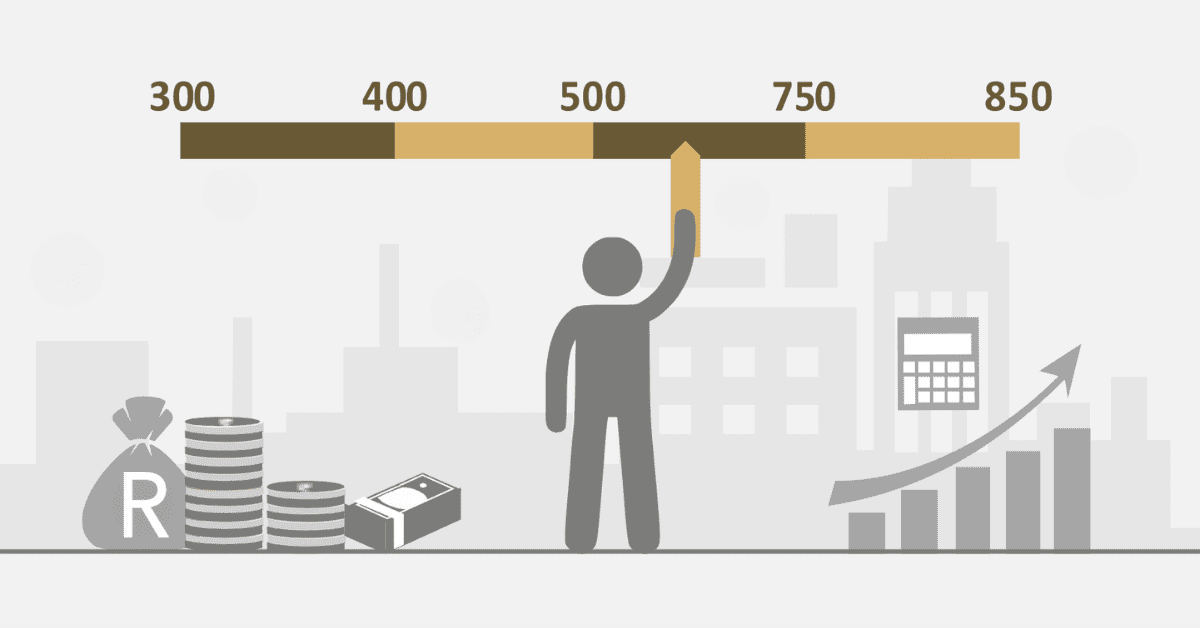

Although credit score report is a sub-set of credit score, there is a clear distinction between the two. Credit score in general describes your financial behaviour using figures.

The credit score views how worthy a person can pay back loans. The credit score report is a much more detailed analysis of an individual’s transaction history and creditworthiness.

In South Africa, a credit report offers a comprehensive overview of an individual’s credit history, encompassing their accounts, payment patterns, and inquiries. Maintaining a strong credit score in South Africa is crucial as it directly impacts loan interest rates and opens up various financial opportunities and choices.

You can not get a credit score report from your bank upon request. The services of the bank do not extend to generating credit reports.

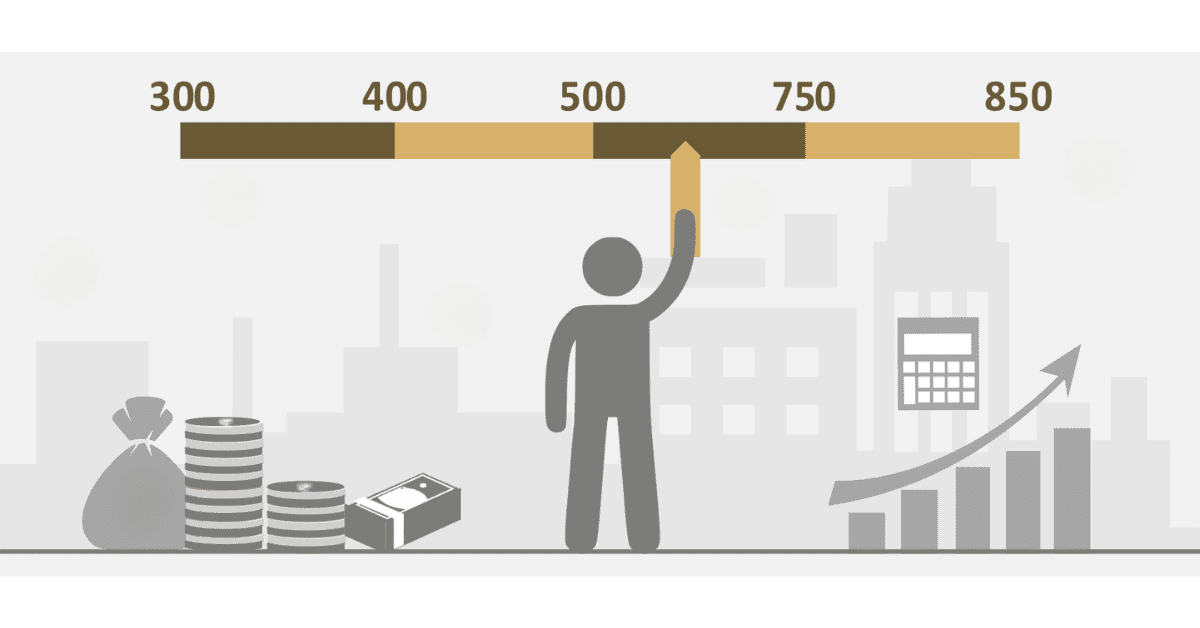

Can I check my credit score through my bank app?

Yes, it is indeed possible to check your credit score through the bank. South African banks have incorporated the capability to provide excellent service to their customers by including it in their mobile applications.

With the mobile application for your bank, you can conveniently keep track of your credit score.

Many banks provide the convenience of checking your credit score directly through their mobile apps or online banking platforms. It is important to note that the availability of this feature can vary depending on the financial institution. To determine if your specific bank offers this service, it’s recommended to contact them directly.

Certain banks offer a specialised section in their mobile app or online banking platform where you can easily access your credit score. This section can provide you with more information about the factors that can affect your score and give you some tips on how to improve it.

Not all banks have the same app interface and therefore, checking your credit score through the bank app may not work well. Some banks do not provide credit scores through their app.

Which banks offer free credit reports?

It is more convenient and joyous when customers can check their credit reports for free. However, the issue arises when there is an assumption about your bank providing you with the credit score report.

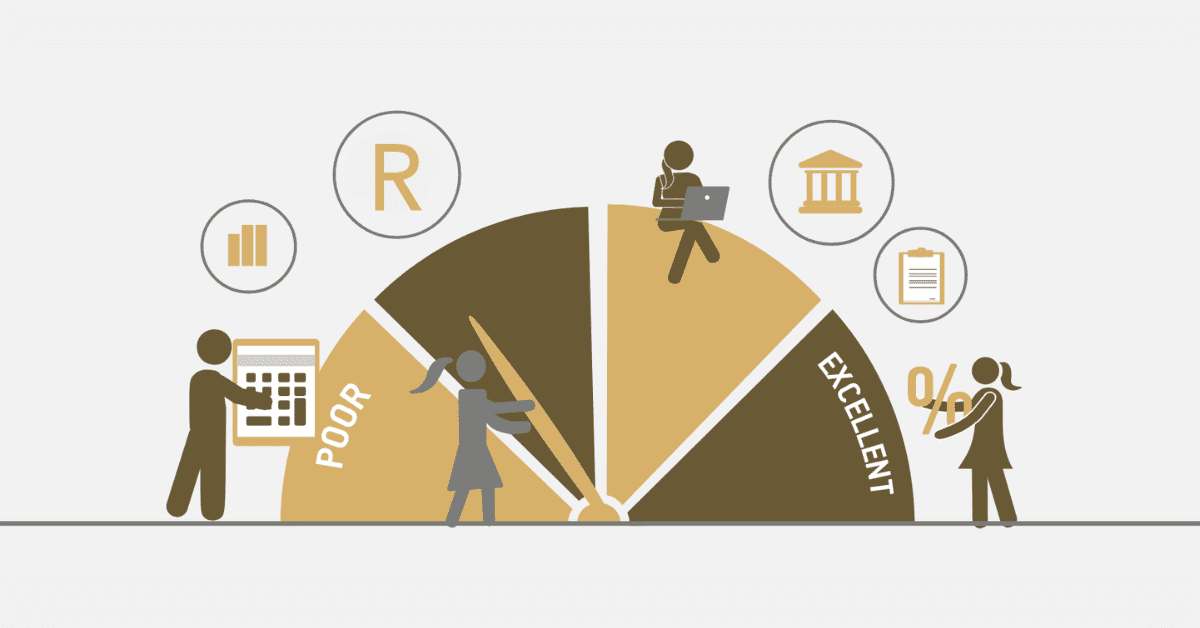

In South Africa, there are a lot of banks that do not provide credit reports for many individuals. Most banks work with third parties like credit companies, and credit bureaus to generate credit score reports about a customer.

The primary mission of banks and other financial institutions is the provision of banking products and services to their customers. Credit reporting and scoring are frequently best handled by specialised credit bureaus due to the specialised knowledge and infrastructure that is required.

Considering the various services that credit bureaus and banks offer, there is no available bank that provides free credit reports.

Do all banks check credit score?

What is the point of checking credit scores? Do banks need to check your credit score?

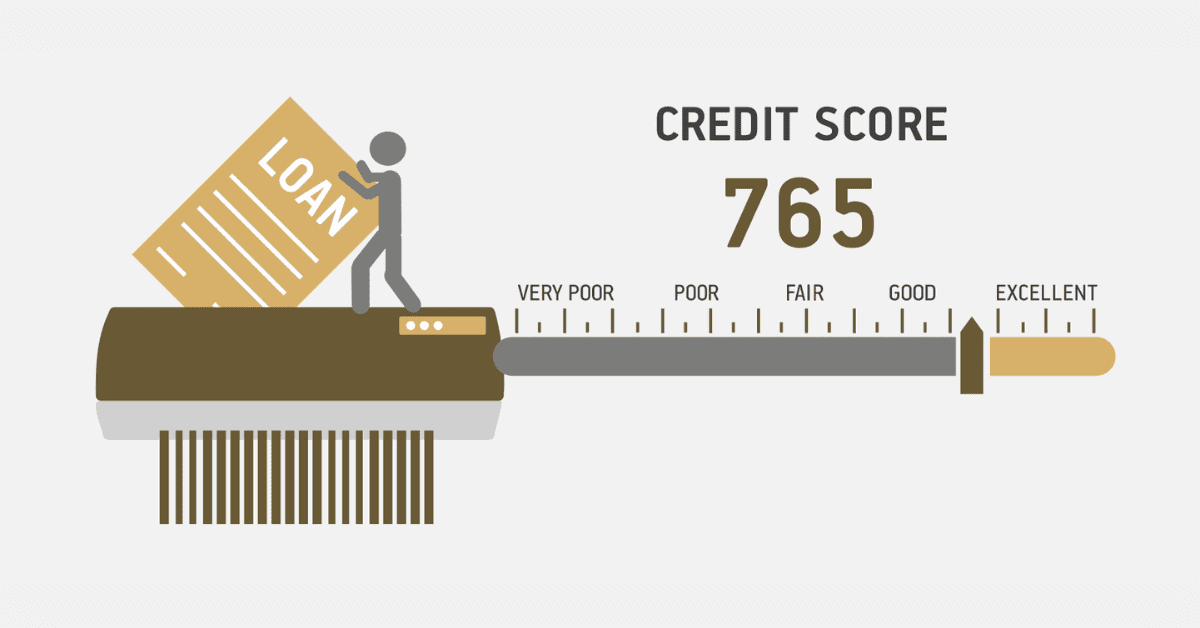

banks are not concerned about your credit score. Whether you are opening a new account or requesting a chequebook, your bank will not ask for your credit score.

The point of checking your credit score is for lenders to get a better understanding of your financial history to facilitate loans for you.

Banks do not have any interest in checking your credit score.