Each day there are new inventions and ideas to make the life of humans better. These inventions are mostly inclined to technology with vast niches in it.

Ever since technology evolved, many adventurous acts have taken place. Some people say it is a way to make human life easy. Others say it is a way to control the masses.

Some say “All they think about is their pocket”.

Of course, all these talks will spark rumours, which could be true or false. These new ideas are created to access, evaluate and track human life in order to provide better solutions.

As of now, there is a new invention which is the social credit score. Certainly, this has been around for a while but there has not been much noise made around it.

But what is the social credit score? How does it work? What does it do? We are about to find out more about the social credit score.

What is the social credit score?

According to some, the Social Credit score is a difficult and controversial system that was created to keep an eye on and rate the actions of people and businesses in many areas of their lives. It involves getting information from many places, like surveillance cameras, online behaviour, financial transactions, and social contacts, so that each person or group can be given a score.

Your social credit score shows how valuable you are to society. Helping others by volunteering, giving money to good causes, and having helpful conversations online are all examples of this.

There are a lot of different habits that this rating system looks at, such as being responsible with money, following the rules, getting along with others, and even getting involved in politics. When compared to bad behaviours like breaking the law or rebelling against the government, good behaviours like paying bills on time or helping can help improve a person’s social credit score. On the other hand, bad behaviours can hurt their score.

How is a social score calculated?

Publicly, there has not been any conclusion on how social score can be calculated. This concept is still in its developmental stages even though it was launched years ago.

However, the social score calculation will focus on the behaviour and choices of individuals.

It will involve your daily interactions on social media, your attitude towards people on social media and variable factors.

These initial indicators will determine whether you need to be rewarded or punished. Each reward will come in points and each punishment will cost you restrictions to certain places and loss of points.

As of now, there has not been a clear way to calculate social score. It is being tested and the above are presumptions to give individuals an idea of how the calculation will go.

How does the social score work?

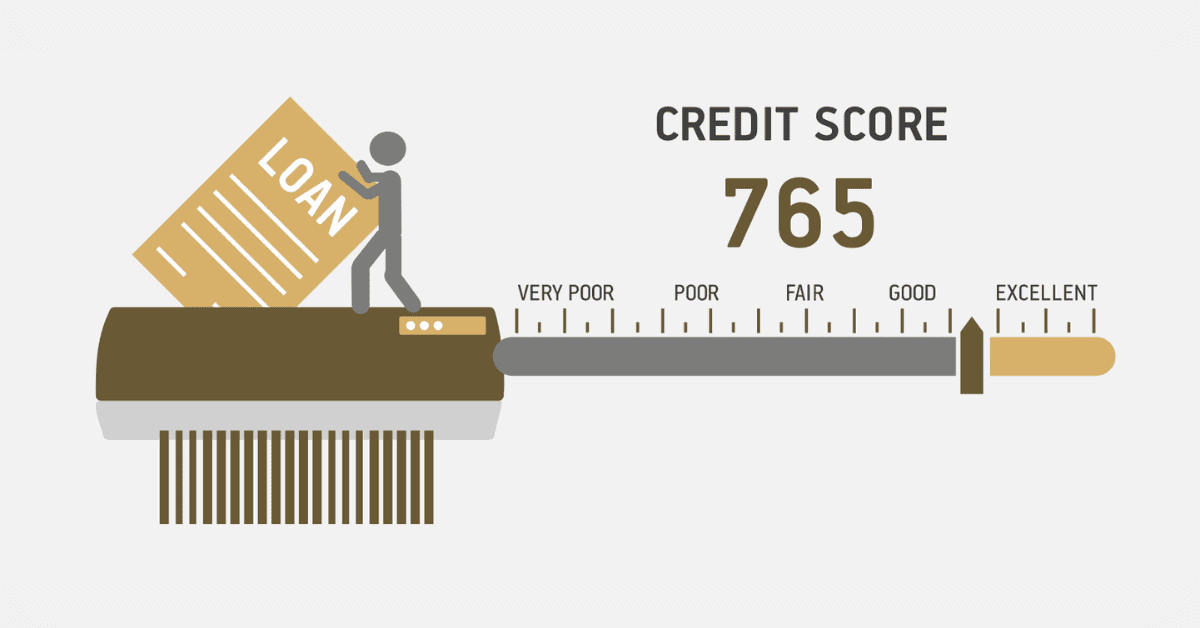

The idea behind the social score is pretty straightforward: each person starts with a certain score, and different actions can either raise or lower that score. Giving to charity, for instance, would raise your number, while smoking would lower it.

Based on their score, people can then be paid or punished. If someone’s score goes low enough, the government could limit their travel, keep them from getting into the best schools, or even take their dog away.

It is something that can be used across all social media systems. Think of experience-based selection in a video game where the main focus is on competition.

What is the social score for a bank?

The social score for banks looks at the trustworthiness and services. This is used as the fundamental to determine the social score for a bank.

Looking at how banks play a major role in the life of businesses and individuals, it is expected that the social score for banks will be of high value.

More development is ongoing and as it gets exciting, we share more insight on the social score of businesses like banks.

What is the social risk score?

A social risk score is a number that shows how likely it is that a person or a group will face problems or bad results in society based on a number of socio-economic and demographic factors. These factors may include amount of income, education, employment, housing, health, criminal history, and other things.

Many times, governments, social service agencies, healthcare providers, and financial institutions use social risk scores to find people or groups that need specific help or actions. Organizations can better target their resources and interventions to meet the needs of those most at risk by figuring out who they are. Their end goal is to reduce the effects of social inequality and improve people’s overall health and happiness.

Some might say these are environmental and moral issues that affect people and businesses. , but the risk that comes with all of that can affect how the business runs.