Credit card reporting takes place within 30 days after the last payment has been made. Anything outside this period may be recorded as late payment. However, not all lenders disclose late payments. Some late payments are erroneously recorded, while others are genuine. Whichever way, a late payment is not good for your credit score. It is important to check your credit report regularly to see if there are no late payments. Depending on the type of late payment entered, there are certain steps you can consider to have it removed. Read on to learn how to remove late payments from your credit report.

Can Late Payments Be Removed?

First and foremost, it is important to know that a late payment that has been correctly recorded on a credit report cannot be removed. Some companies claim to offer removal services for late payments, but this is hardly true. However, if a payment is erroneously reported as late to a credit bureau, it can be removed from your credit report. The problem with a late payment entry is that it can stay on your credit report for about 5 up to 7 years.

How to Remove Late Payments From Your Credit Report

If a late payment has been incorrectly reported, you can remove it by filing a dispute with any of the credit bureaus. All disputes are diligently investigated and resolved accordingly. If the credit bureau finds that the late payment is a result of a mistake, it will be removed from your report. You can also call your credit card issuer or creditor and report the late payment that was mistakenly recorded. If you fail to report this error, you will be violating the federal Fair Credit Reporting Act (FICRA).

The chances of removing an error that has been accurately recorded on your credit report will be very slim. It is your responsibility to ensure that you make timely payments to safeguard your credit score. In such a situation, credit bureaus have little or no help to offer if you fail to control your payments.

You can also request your attorney to write a goodwill letter requesting for the removal of late payment from your report. This letter should explain the reasons for late payment. If you genuinely believe that you have sufficient extenuating circumstances to warrant the removal of late payment accurately recorded on your credit report, you should state them in your letter.

For instance, unforeseen challenges like job loss, illness, accident, or death of your loved one could have strained your finances, which led to late payment. In the letter, you should take responsibility for your current predicament and also state how you intend to avoid the same scenario in the future. Once you send the letter of goodwill to the creditor, you need to make a follow-up.

For accurate late payments, you can still try to ask the lender to remove them although they are not obliged to do so. They may accommodate you if you have genuine concerns. However, you should not have high expectations because your request can be declined.

What Do I Say To My Credit Card Company to Remove Late Payments?

When a late payment is recorded on your report, you can still try to request your lender to remove it. The following are some of the reasons you can present to the lender to try to convince them to remove the payments.

- You paid late due to illness or other unforeseen natural disasters.

- Your bank made a mistake. If that is the case, should have all the necessary supporting documentation.

- Explain that it was a genuine mistake since you always pay your bills on time.

- Offer something to prove that you are genuine.

Unprecedented hardships are inevitable, so take your time to prepare your case. This might be stressful, but remember that you will be dealing with humans too.

How Long Does It Take To Get Rid of a Late Payment on Your Credit Score?

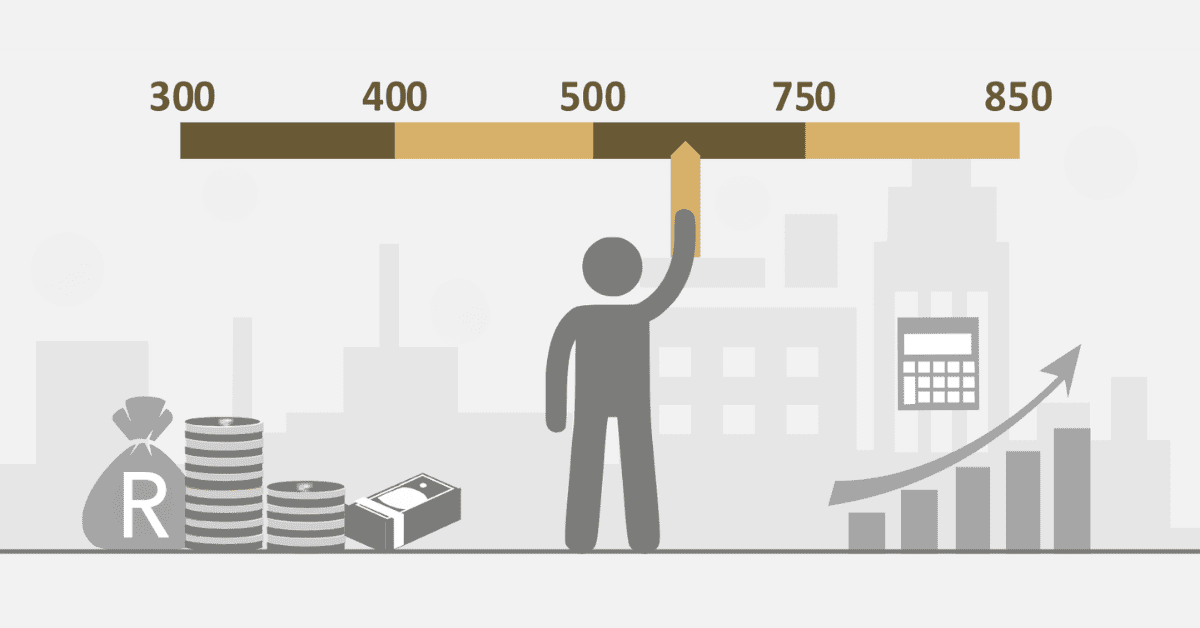

Late payments can only be removed from your credit report after seven years. The good thing is that they are not permanent, and they will also not affect your credit score in the long run. In other words, late payments can negatively impact your score during the early months after clearing the debt.

How Many Late Payments Is Too Much?

If a late payment is less than 30 days, your creditor will not report it to credit bureaus, so you will be safe. Once the late payment exceeds 30 days, it will be recorded on your credit report. You should still repay the missed payment. When you fail to repay the late payment and miss the next due date, you will receive a 60-day notice on your credit report. You will receive more notices in 30-day intervals for all the payments you miss. This will cause more harm to your account. If the late payments reach 180 days, the credit card issuer may close your account and engage credit agents to recover the total amount you owe plus interest.

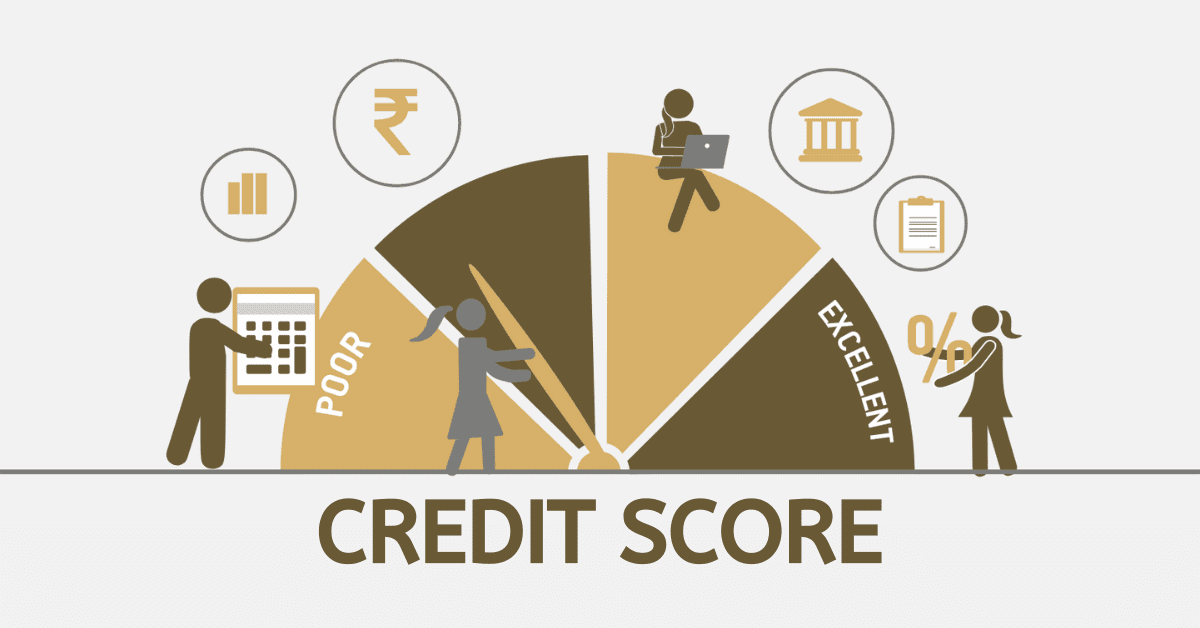

Lenders are in business, so it is your responsibility to ensure that you make timely payments to avoid penalties and interest. The worst impact of late payments is that they negatively impact your credit score. Once your credit score is damaged, it will be challenging for you to qualify for a loan. If you are lucky to get approved, you will charged high interest. One way of resolving this challenge is to ask the lender or credit bureau to remove the late payment from your credit report. However, it is difficult to remove a late payment that has been accurately recorded.