If you apply for a loan, the lender will check your credit report to assess your creditworthiness. This is known as a hard inquiry, and it negatively affects your credit score for one year. A hard pull by an authorized lender leads to a loss of five points from your score. Additionally, a hard inquiry stays on your report for two years. However, some hard inquiries may be fraudulent, especially when they appear on your report, even when you have not applied for a loan. When faced with such a scenario a case, you can remove the hard inquiries from your report. Read on to learn how to remove hard inquiries from your credit report.

Is It Possible to Remove Inquiries From Your Credit Report?

Depending on the type of hard inquiries, it may be possible to remove them. It is critical to understand the following things about hard inquiries so that you can take appropriate action when you see something suspicious on your credit report. If an authorized lender checks your credit report, the inquiry will be legitimate, so it cannot be removed. Authorized lenders such as banks, credit card companies, loan companies, or landlords can check your report to probe your credit history first to see if you qualify to get the loan.

Hard inquiries can be a result of reporting errors caused by mistakes in personal information like name, phone number, or contact address. Account errors can also contribute to hard inquiries on your credit report. Potential identity theft is another reason for a hard inquiry on your report. If a hard inquiry does not come from an authorized lender, you have a legal right to dispute it so that it can be removed from your credit report.

How to Remove Hard Inquiries From Your Credit Report

If you suspect that the hard pulls on your credit report are a result of fraud or reporting errors, you should take appropriate action to protect your credit profile. You should get copies of your credit report from the credit bureaus operating in South Africa to check if there is any difference in each report. If there are inaccurate inquiries on your report, flag them.

Once you identify suspicious activity on your credit report, you should contact the lender involved to avoid a formal dispute over the issue. Explain to the creditor that you suspect there is an error on your report since you have not applied for credit from them. Ask them to remove the hard inquiry on your credit report. Provide relevant details about the inquiry and it will be removed if you have not applied for the loan.

If the lender ignores your request to have the hard inquiry removed from your credit report, you can launch an official dispute. You can do this online or send a written letter to the lender, including all the necessary details, and provide supporting documents. Keep a copy of your credit dispute, which you can use to track progress about the matter. Although you can dispute hard inquiries by phone, it is difficult to track them.

Once you submit an official dispute, you should wait for a verdict, which usually takes between 30 and 45 days from the date of submission. If the check was a mistake, the credit bureau will contact the lender, and it will be removed from your profile. If the bureau fails to verify the mistake, it will be removed from the report. However, if the lender confirms that the hard inquiry is a genuine credit check, the credit bureau will not remove it from your credit report.

How Many Hard Inquiries Are Bad?

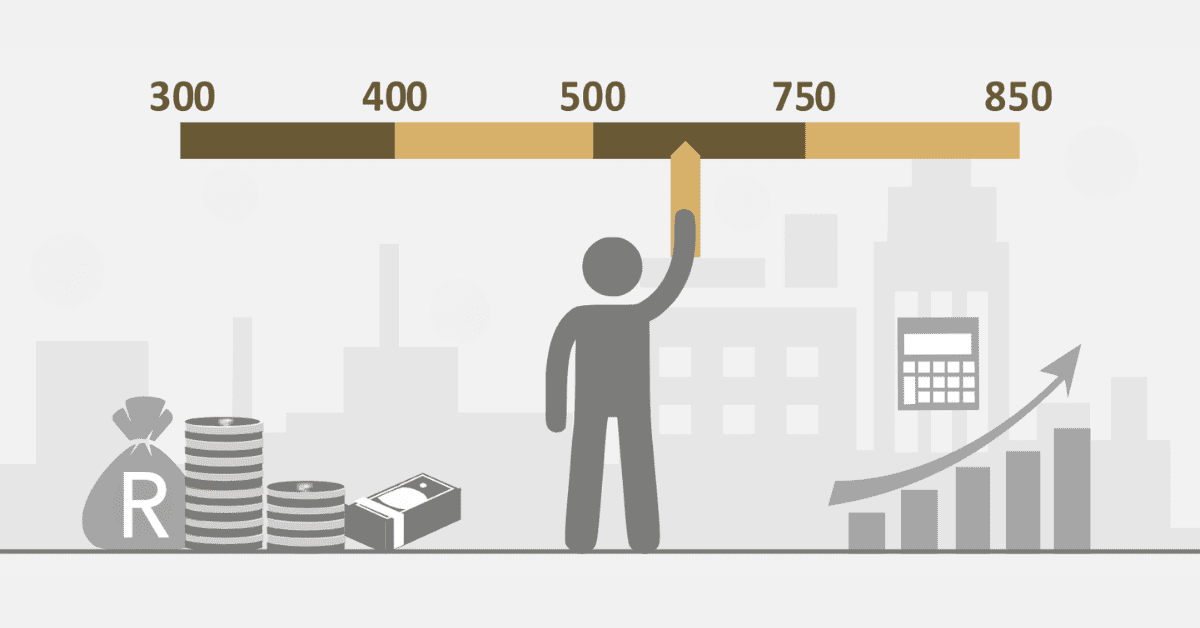

Your credit score can drop by 5 points when a single hard report is recorded on your report. In some cases, only one inquiry might not be harmful to your report. However, multiple hard inquiries on your report can lead to a loss of about 10 points every time they happen.

Research has shown that individuals with more than six recent hard inquiries are likely to file for bankruptcy. Therefore, you must be very careful when looking for a loan. The lender will check your credit report to assess your creditworthiness. It is important to conduct research first to identify a lender with the best deal before you submit multiple applications that can dent your credit score.

How Long Does a Hard Inquiry Last?

A hard inquiry usually stays on your credit report for two years, but it affects your credit score during the first year only. It is important to know that credit inquiries only contribute about 10% of your total FICO score. This is not much, but a hard inquiry can affect your credibility when you apply for a loan.

If you have several hard inquiries in a short space on your report, lenders may be concerned about your financial status. Multiple inquiries on your report might reflect some form of desperation for cash. This might paint a bad image about your capability to repay your loan. On the other hand, soft inquiries like hard inquiries will stay on your credit report for two years. The good thing about soft inquiries is that they don’t affect your credit score.

When you apply for a new credit line, the lender will check your credit report to ascertain your creditworthiness. Multiple hard pulls in a short period can negatively impact your credit score. However, if you believe the hard inquiries are illegitimate, you can have them removed from your credit history. To achieve this, you should contact the lender involved and ask them to remove the inquiry if you have not applied for any loan. Remember, genuine inquiries on your credit report cannot be removed.