Having a low credit score can make you feel like there is a major barrier in your way, preventing you from getting loans and other credit opportunities. However, it is important to understand that having a less-than-perfect credit history does not automatically mean that you are completely unable to borrow. Individuals with low credit scores have a range of options to choose from, and it’s important to have a good understanding of these alternatives. This knowledge will enable you to make well-informed decisions about your finances.

Although having a low credit score can present difficulties, it is not an impossible barrier when it comes to getting loans. If you take the time to explore different lending options and make an effort to improve your financial situation, you can increase your chances of getting loans with better terms down the line. It is important to keep in mind that being responsible with your finances and having a strategic plan is needed when it comes to dealing with credit and loans.

The limitation on low credit can disqualify you from certain benefits. Learn more about the possibilities of securing a loan with a bad credit score in South Africa.

Can I get a loan with a bad credit score South Africa?

Securing a loan when you have a bad credit score can present its challenges, but it is important to note that it is not an impossible feat. When evaluating someone’s creditworthiness, lenders usually take credit scores into account. Having a low credit score can make it harder for you to get a loan because lenders see it as a sign of higher risk.

Nevertheless, there are still viable alternatives for individuals with poor credit scores who require financial aid. You could consider looking into loans that are specifically tailored for individuals who have a poor credit history.

People generally view credit scores as a way to assess someone’s creditworthiness. Having a low credit score can make it harder for you to get a loan because lenders see it as a sign of higher risk. Nevertheless, there are still viable options for individuals who have poor credit scores and require financial aid. You could consider looking into loans that are specifically tailored for individuals with poor credit.

When individuals in South Africa have poor credit scores, they often encounter higher interest rates when they apply for loans, as opposed to those who have a better credit history. The main reason for this difference is that lenders see a higher level of risk when they lend money to people with a low credit score.

What’s the easiest loan to get with bad credit?

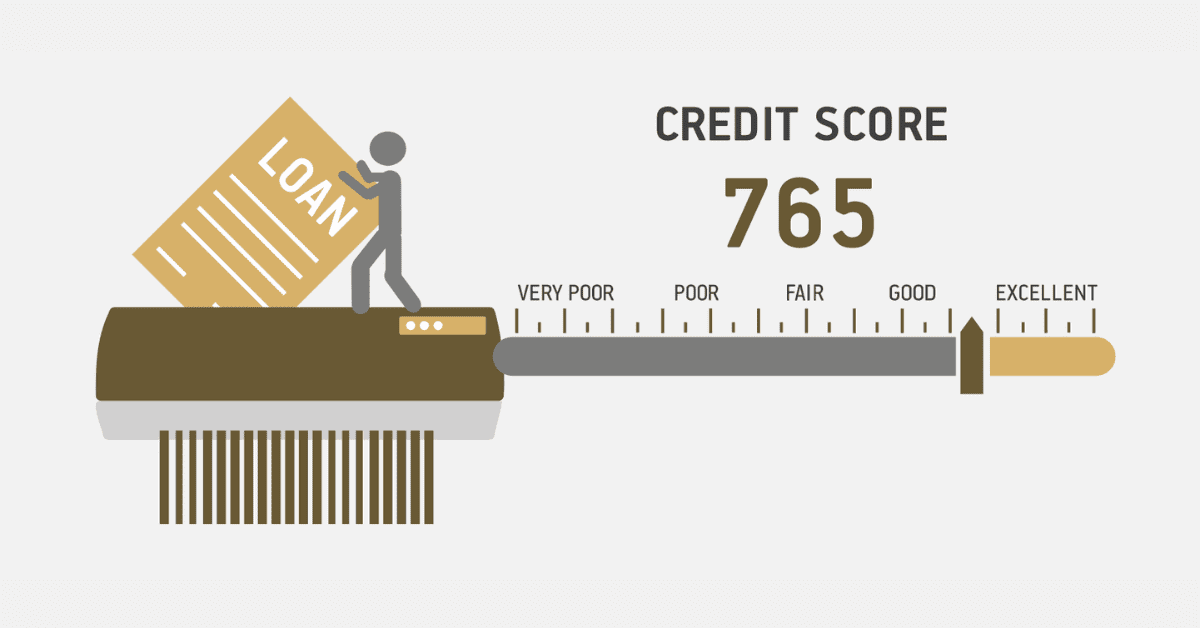

Are you looking for a loan but concerned about your low credit score? There are various options available for individuals who are seeking to secure a loan, even if they have a less-than-perfect credit history. It’s worth mentioning that having bad credit could potentially impose certain restrictions on the borrowing amount available to you. Although personal loans are generally versatile and can be used for various purposes, lenders may be more cautious when considering individuals with a track record of bad credit.

Individuals with low credit can receive personal loans of not more than R20,000. However, this threshold can differ among financial institutions. It is important to check with your bank to know their threshold on personal loans given to low-credit individuals.

Which loan does not check credit score?

When it comes to giving out loans to individuals, one of the most important things is credit score. The credit score gives you the leverage to request a loan with very little interest. Hence, there is always the need for you to ensure you have a good credit score.

In certain situations, some banks do give out loans by doing credit score checks. The question as to why and how may be complicated but there is a certainty in securing a loan without a credit score check.

Payday and personal loans are offered to individuals without having to do a background check. In this case, the bank looks at your account, and personal details and verifies your information to offer you this loan.

Does Wonga do credit checks?

When you submit a loan application with Wonga, just have it at the back of your mind there will be credit checks as part of the application process. This means that once they receive your loan application, they will carefully examine your credit history and evaluate your creditworthiness. The reason for conducting this credit check is to assess your financial history and ascertain whether you have the means to repay the loan. Lenders typically perform credit checks as part of their standard practice to make well-informed decisions regarding loan approvals.