If you intend to apply for a mortgage or auto loan, you may be curious about knowing your credit score since it is used by lenders as a yardstick to measure one’s financial health and creditworthiness. Therefore, you may be compelled to check your credit score regularly to see your current status. Credit scores often refresh at different times, so you might miss some updates. To ensure that you do not miss any update that can affect your credit score, you can refresh it on TransUnion. Here are the guidelines on how to refresh your credit score on TransUnion.

How to Refresh Credit Score on Transunion

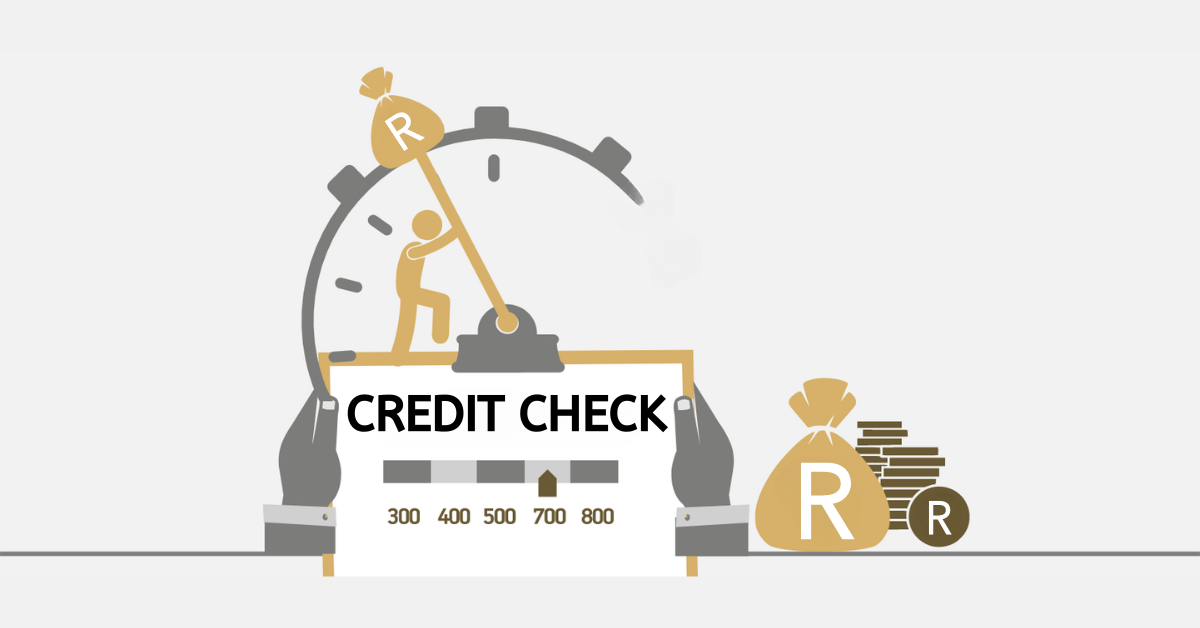

You can refresh your credit score on TransUnion daily on TransUnion. To do this, you must have a TransUnion account, so you need to log in first. Once you access 2your account, you should navigate the site and identify the “Refresh” option. This will give you the latest updates about your credit score.

How Often Does Transunion Update Credit Score?

TransUnion updates its credit scores at least once a month or after every 45 days. As the information on credit reports is updated continually, credit scores may go down or up. However, things that can affect your credit score include bill payments, new balance amounts, or account openings. Therefore, the right time to check your credit score may be around month end when you settle your accounts.

If a creditor sends new details to TransUnion, your score may refresh. The same information may refresh at some point at other credit bureaus. This will lead to variations in your credit score, so you may need to stick to TransUnion to avoid confusion. These credit bureaus get information about clients at different times.

Will My Credit Score Go Down if I Check It on Transunion?

No, your credit score will not go down when you check it on TransUnion. Your credit score check on TransUnion is known as a “soft inquiry”, and it does not impact your credit score or credit report. You can check your score as many times as you want, and it won’t be affected. Before you apply for a loan, you must check your credit score.

However, you should be careful to avoid several loan applications within a short period. The lender will first check your credit report to determine your creditworthiness. This is known as “hard inquiry”, and it negatively affects your credit score. Instead, you should do some research first to identify a lender with the best deal before applying to avoid hard inquiries.

Why Is My Credit Score Going Down Even If I Pay Everything on Time?

In some cases, your credit score may keep going down even when you pay everything on time. This can be caused by different factors. For instance, identity theft can cause this problem. If someone unlawfully obtains your identity details and uses them to open a credit line without your knowledge, your credit score will suffer. Even when you pay all your bills on time, your credit score will constantly drop due to unpaid accounts in your name, which you are not aware of. In some cases, this can be a result of mistaken identities where identical names are mixed, so you end up being assigned an account that belongs to someone.

It is recommended that you constantly check your credit report for any fraudulent activities that may be taking place on your account behind your back. Once you identify something suspicious on your account, quickly notify your credit bureau to have the issue rectified.

High credit utilization can also lead to a reduction of your credit score even when you pay your bills on time. It is important to stick to your credit limit on all cards. Never spend more than 30% of your credit limit since this will lead to a decline in your credit score. Scaling down your credit utilization is one way of maintaining a healthy credit score. Additionally, pay off all your credit card balances before the next billing cycle.

You can miss a payment as a result of high credit utilization, and this will negatively impact your credit score. Unfortunately, late payments will stay on your credit report for five to seven years. To avoid this, you should not wait until the last minute to pay your bills. You also need to pay more than the minimum balance per month to stay on top of your credit.

Applying for several credits in a short period can impact your credit score. Lenders will make hard inquiries on your account which affects your credit score. Even when you pay all your bills, a hard inquiry will negatively impact your credit score. Furthermore, multiple credit applications are often associated with higher risk. The lender will view you as someone incapable of repaying their loans. Therefore, make sure you only apply for a loan when you are satisfied with the deal offered to safeguard your credit score.

There might also be a default judgment on your account you may not be aware of. This includes information obtained from public records like settlement orders of lawsuits. For example, if a summon letter is sent to you but you never receive it, you will never know about the lawsuit. Unfortunately, it will appear on your credit card and impact your credit score. It is vital to check your credit report regularly to avoid such issues. If you disagree with the judgment on your report, you can dispute it.

TransUnion allows clients to check their credit scores anytime. These scores are updated once a month or after 45 days. Before you apply for a loan, you need to check your credit score to see if it is strong enough to guarantee the loan you want. TransUnion offers a facility that allows customers to refresh their scores. The information obtained from lenders is updated at different times, so the refresh option allows clients to access the latest updates about their credit reports and scores.