When you apply for credit at Edgars, you will be given a limit, which you should not exceed when you purchase different goods. You’ll get a monthly statement showing the installment to be paid before the billing date. If your account is overdue, you may be charged interest, and you may not be able to buy from the shop until you clear the amount owing. Keeping track of your Edgars account is simple as long as you maintain your limit. This article explains everything you want to know about checking your credit limit on your Edgars account.

How Do I Check My Credit Limit on Edgars Account?

Edgars has made life easier for its customers. It sends a statement every month with all the information you may want about your credit limit and other related details about your account. This statement has information about the amount due, purchases, and payments made. You should call 0860 11 24 42 to receive this statement via your email.

Alternatively, you can also check your credit limit on the Edgars website. To use this platform, you should create a profile, and you can log in to your account at any time to view anything you want related to your account. This facility allows you to track your orders, maintain more than one address, and perform other activities. More importantly, it is faster. You can use it from any place as long as you have access to the internet.

How Do I Increase My Credit Limit on Edgars Online?

You can temporarily increase your credit limit on Edgars online by completing a simple form found on its website. This form is secure, and all the information is encrypted to protect individual data from unauthorized access. Edgars maintains strict industry standards to safeguard confidential information to enhance customer experience and safety.

When you request an increase in credit limit, you can use your card to purchase goods that do not exceed the predetermined amount. Your original credit limit will reflect on the new temporary agreement, and the limit is shown on your statements. As the name suggests, your temporary credit limit increase is valid for a limited period, and it allows you to perform a series of transactions within a certain period. However, you should repay the full amount accrued in your next installment.

Those interested in increasing their limit permanently can make a telephone request or contact Edgars Stores in writing. Upon review of your account and payment history, your credit limit will increase, and it will also reflect on all your statements.

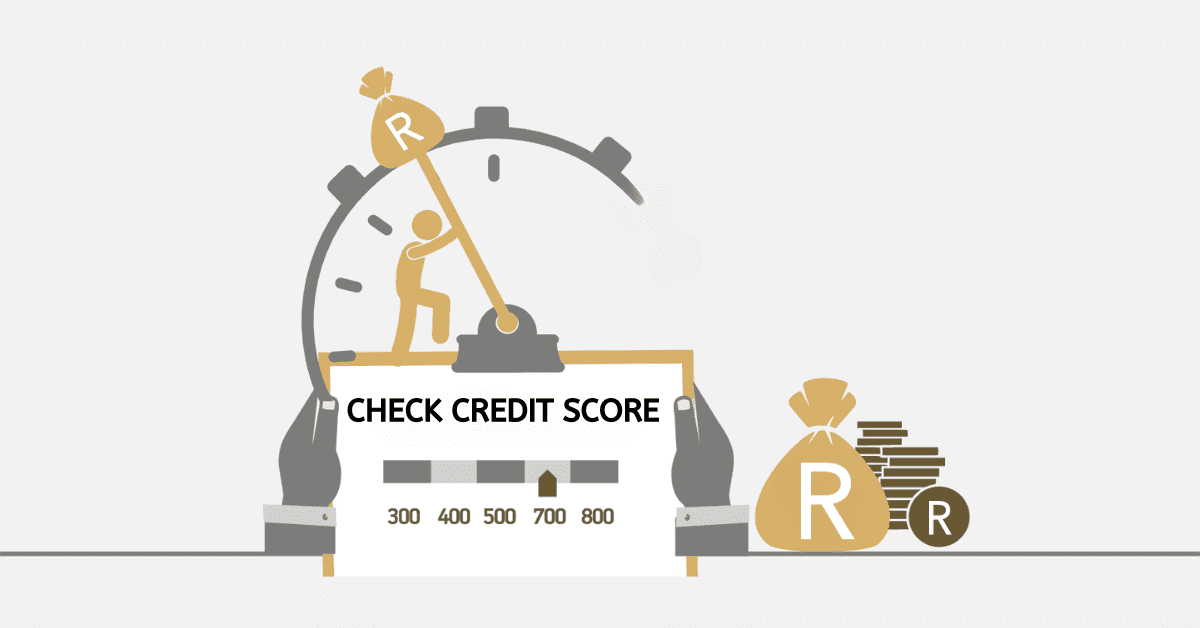

How Do I Check My Edgars Credit?

Checking your Edgars credit is a simple process. There are different methods you can consider to check your credit. You can use your mobile phone to view your account balance

Edgars sends a statement every month to your registered email with all the details about your account. Your credit, purchases, and payments are shown on the monthly statement you get from Edgars. You should call 086 11 24 42 first to set up your email address so you can receive your statement via this channel.

You can also check your credit via the Edgars official website. You should create a profile first with your login details. With this option, you can access your statement anytime as long as you have access to the internet. Make sure you use the correct login details.

Can I Withdraw Money From My Edgars RCS Card?

You cannot use your RCS card to withdraw money from Edgars unless you make special arrangements with the provider. Instead, you can use your card to purchase goods on credit, and you must pay for everything in full before the next billing cycle. Pay the amount in full for all the items you’ve purchased on credit using your RCS card.

Which Credit Bureau Does Edgars Use?

Credit bureaus gather information about different customers to produce credit reports and credit scores. Edgars uses all four major credit bureaus in South Africa, including TransUnion, Experian, Compuscan, and XDS. These credit bureaus are responsible for gathering information about consumers from lenders and other financial institutions that offer credit facilities. Credit reports and credit scores compiled by these credit bureaus are used by lenders to assess potential borrowers’ creditworthiness.

Edgars provides information about account holders to these credit bureaus, and it goes on each account holder’s credit history. The details provided include your payment history, missed payments, current account status, and other relevant data that can be used to compile credit reports and credit scores. If a client provides inaccurate information, Edgars will report it to credit bureaus and this can dent your credit score.

Having a credit account with Edgars is one effective method of building your credit score. You can achieve this by making timely payments every month. To be in full control of your account, you should regularly check your credit on Edgars so that you do not miss any payment which can compromise your credit score. There are different options you can consider to access your account. These tips can go a long way in helping you keep track of the transactions on your Edgars account.