Managing your financial health is more at your fingertips in this digital age, especially in South Africa, where financial institutions such as Nedbank have leveraged technology to empower their customers. One of the innovations is the Nedbank App, an all-inclusive tool that eases banking and allows one to monitor their loan rating. This is because it is crucial since a credit score can greatly affect financial opportunities. If you can understand and improve it, you open doors to better loan conditions, interest rates

How To Check Credit Score On Nedbank Money Application

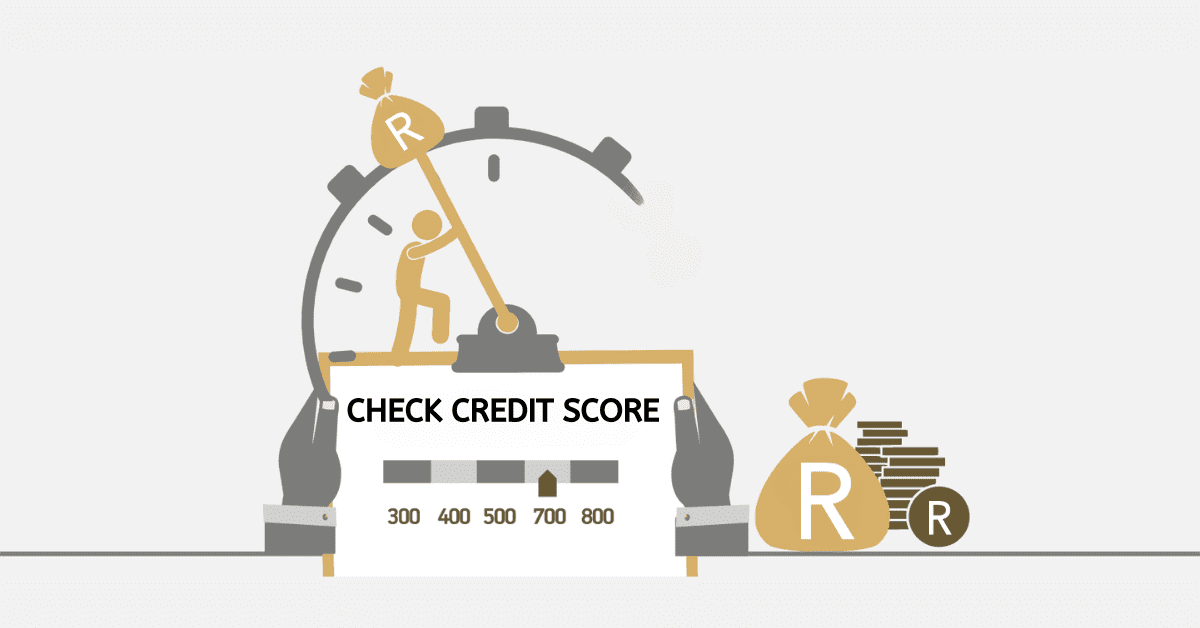

Just follow these simple steps to check your credit score via the Nedbank Money App:

- Open the Nedbank app on your device.

- Log in using your credentials.

- Check the menu & pick “Financial Wellness Dashboard”.

- Once there, click on “My Smart Money”.

- Browse the page to discover your loan reading on the application.

On the Nedbank Money App, the credit score feature is free of charge, and unlimited checks are enabled for the credit score. The feature is set to give the user an in-depth understanding of their overdraft profile, a critical function in managing their financial health.

Your loan rating is a reflection of your financial behavior. A high reading indicates responsible money management, while a low rating may suggest the need for improvement. Nedbank’s credit-scoring tool provides hints and tips to help improve your credit score, making it easier to secure a loan when needed.

The Nedbank Money App also gives you regularly provided credit health tips and advice. It gives you a snapshot of what affects your credit profile — what can help or hurt it.

In conjunction with Experian, one of the country’s major credit bureaus, Nedbank offers you current information used to compile your credit score. This, therefore, ensures that the score being reflected by the app is also current and accurate.

In totality, the Nedbank Money App is like a power tool in your hands to deal with your credit score. The app helps you access your credit score without a problem and preps you with the knowledge to beef it up. This way, you will be proactive concerning the health of your finances. After all, a good credit score is like a passport to a great financial future.

What Is A Good Credit Score For Nedbank?

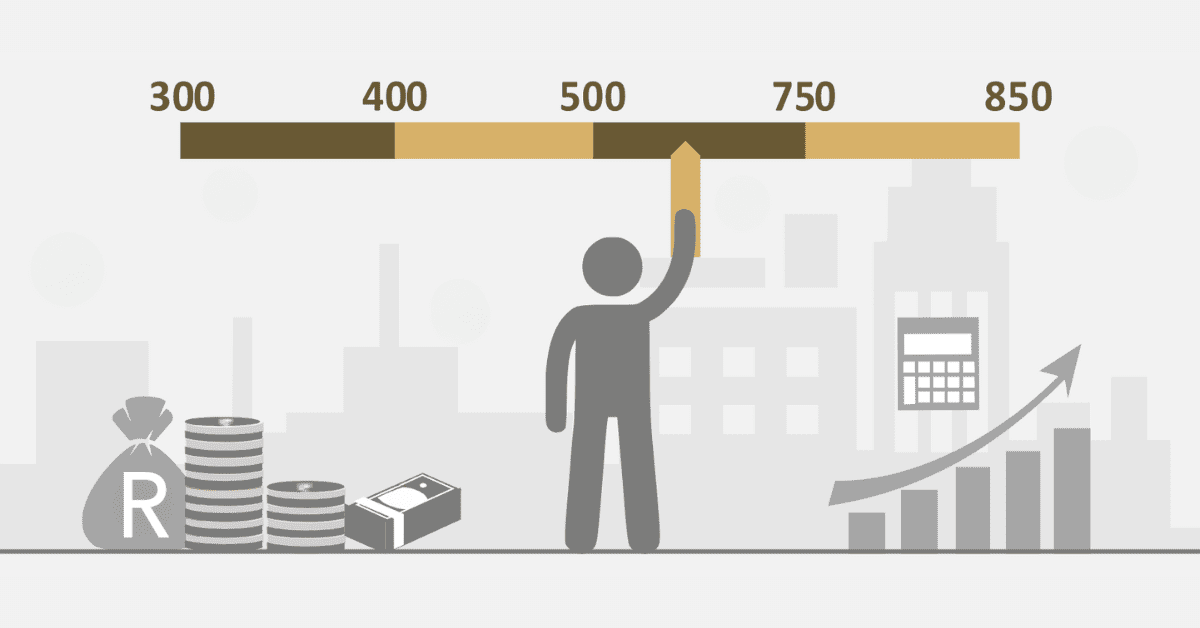

The credit score is an integral part of an individual’s financial health in South Africa, ranging from 0 to 999 in split categories from poor to excellent. A good score, according to Nedbank, stands at 621. Achieving this score or higher indicates that you are doing well regarding your credit profile.

The score range on Nedbank’s Money App is between 520 and 730. The higher the score, the better the management of your credit facility, which signals less risk to your credit facility, or, in plain talk, you are more likely to pay your installments on time.

But remember that lenders have different yardsticks for gauging a good credit score. Therefore, keeping a score of 621 and above using the Nedbank Money App brings personalized credit offers and interest rates and increases the chances of approval by other lenders for offering credit.

Where Do You See Your Credit Score On The Nedbank App?

In the Nedbank Money App, your credit score is conveniently located within the “Financial Wellness Dashboard.” After logging in with your credentials, navigate to the menu and select this option. Within the dashboard, you’ll find a section titled “My Smart Money.” Clicking on that will take you to a page displaying your credit score. In collaboration with Experian, one of the major credit bureaus in South Africa, users will get a feature that makes sure the credit score being seen is the most recent and most accurate. The app also provides monthly reports to track your progress.

Does Nedbank Use Experian Credit Score?

Yes, Nedbank uses Experian for management credit scores. Experian ranks amidst the big credit bureaus in South Africa, and affiliation with Nedbank assures that all credit scores on the Nedbank Money App are valid and current. This partnership enables Nedbank to fully offer credit tools by giving customers access to the most current information used to derive their credit scores. So, when you see your credit score at the Nedbank Money App, you view an Experian-derived score. Further, the relationship has been underpinned by Nedbank’s commitment to deliver to customers financial services that are reliable and transparent.

How Do I Increase My Credit On Nedbank App?

Enhancing your credit score on the Nedbank Money App involves responsible handling of your finances. Timely payments of all your bills are very important. Pay more than the minimum installment on your bills and wipe off your credit card debt. Avoid using more than 50% of your available credit. If you’ve struggled with debt, check for any court-issued judgments or administration orders against your name.