Among many popular ways, investing in shares is the best way to make long-term investments and generate income. Share value increases with the increment of the company in which you have invested. The technological and financial service sectors in South Africa have made purchasing shares easier. Such improvements include virtual trading platforms enabling you to buy and sell shares in your house or office. This article should guide you in buying shares in South Africa. You’ll understand the market, the benefits of investing, and potential earnings.

How to Purchase Shares In South Africa: A Step-by-Step Guide

The first is to identify the intended share. In this case, research has to be done to look for the desired companies. Some factors that one may consider include the company’s financial health, growth potential, and the operation industry.

The second is selecting a broker. You should choose a regulated online one providing access to the JSE. The agent will help you make your transactions. They also act as an intermediary between you and the stock exchange. When one has chosen that agent, the next thing to do is open an account. To create a trading profile with a selected broker, typically, you must provide some of your personal information and a deposit.

Once it is set up, you can start buying shares. This is a better place to start small and keep increasing your investments as your experience rises. This way, you learn without risking too much money.

Understanding the Stock Market

The stock market is the market you walk into to buy or sell shares of public limited companies. If you buy a share, you take a stake in the business. This will represent an ownership claim on the company’s assets and earnings. This means that the value of your shares will increase proportionally with the increase in the size and profitability of your company.

The price of a share equals supply and demand in the market. The price goes up if more people want to buy a share than sell it. The value drops if the same group wants to sell it rather than buy it.

The JSE is the most ranked in Africa. The exchange is a market for the safe exchange of securities. Most of the large firms in the country are listed within its structure, making it a significant player in the country’s economy.

Why Investing in Shares?

Share investment has several benefits, one of which is high returns. The stocks previously showed a higher return rate than any other form of investment, such as bonds or savings deposits. This was because businesses generally grow at a faster rate compared to inflation or interest rates. The other advantage to the stocks is that they act as a hedge against inflation; the returns usually end up being more than the inflation rate, and the purchasing power of your investment grows.

It means that as the value of the goods and services increases, your investment can buy the same value or more. Also, many companies share their profit portion with the investors in the form of dividends that yield a regular source of income for the investors. They can be handy for retirees or others who need an income.

Finally, purchasing shares gives one a stake and the right to vote at the shareholder meeting. Thus, they can influence the company’s decisions.

How Do You Earn Profit from Shares?

The first way profits come from shares is through capital appreciation. If the stock’s price increases, you may sell it for an amount more than the one you paid for, resulting in a capital gain. This is perhaps the most familiar way to make money from stock. However, the stock market price is uncertain and can fall, too.

A second way is in the form of dividends. When some companies give up a percentage of their profit to the shareholders, it is called a dividend. Thus, these provide an income flow to the holders.

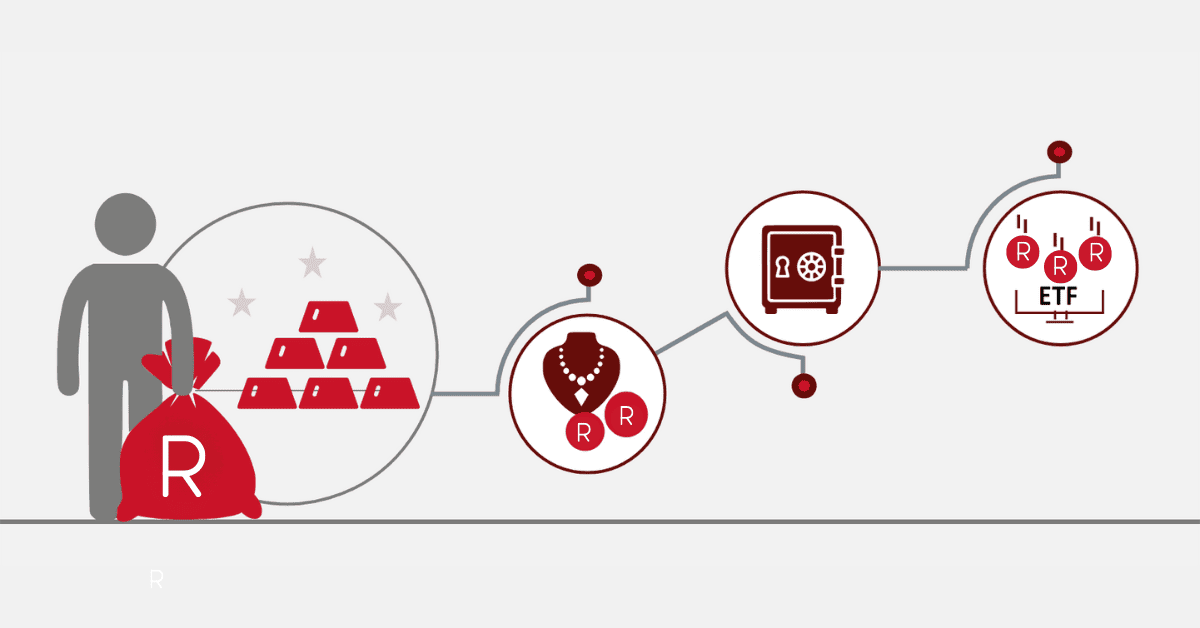

Which Type of Share is Best for Beginners?

Blue-chip stocks are usually advised to new investors. This represents the stock shares of large, well-established, and financially stable companies with a history of dependable performance. They are considered a safe investment because these companies are less likely to go bankrupt or suffer severe financial distress. In addition, blue-chip companies will often pay regular dividends, providing a steady income stream for investors.

How Much Money Can You Make from Stocks in a Month?

This is a potential monthly return from stocks, but the return may differ on the quantity put in, the performance of the stocks put in, and the dividend yield. However, one must remember that venturing into stocks is a long-term strategy. As a result, the value of those stocks may move in the short term.

So, though it would be possible to make a good month’s wage out of the share, it would be worth bearing in mind in the long run. The reason is that the stock market, on average, increases in value in the long run—just as its value shows.

Another essential point to note is that the earnings of these stocks for a given month can be highly varied based on these factors. But yet again, it is a suitable caution to do research and weigh your financial objectives and the level of risk you are likely to be comfortable with before getting started in the stocks.