Navigating the financial landscape in South Africa is tough, made worse when one has a low reading loan score. Yes, one would want to give up if a first loan application might unveil this menace. Many credit lenders are willing to offer money to those with low credit scores or tainted credit records. The article below provides ways to help secure a loan despite a low credit score

How To Apply For A Loan With Low Credit Rating

You may think getting debentures is impossible if you have a sunken rating. But that this isn’t true. Hard to believe, but there are financial institutions out there patiently waiting for you to reach out to them, even with your credit score below par. They are willing to trust you with their money; it’s just up to you to show them how you can repay them. So, how does one go about the loan application process in South Africa with not that impressive credit? Let’s get right into the meat of things and find out.

- Check your score: Before applying for a loan, one must know the score and its contributing factors. In SA, one can obtain a free loan report from one of the credit bureaus every year. You should also keep track of your credit report for errors and outdated information and, with time, challenge this whenever such is realized.

- Compare the lenders: Not all lenders have the same criteria and interest rates for low credit score loans. Shop around and compare different lenders’ offers. You can compare South African lenders offering loans to low-credit-score persons using online platforms.

- Pre-qualifying for a loan. Pre-qualification for a loan involves filling out a brief online form, and then an individual can receive an estimate of how much may be borrowed and at what rate. It won’t harm your credit score and will help filter out your options.

- Apply for a loan and compare the best conditions from different lenders. Once you have selected a lender, you are to apply for the loan by filling in your personal and financial details and the documents, if required, along with possible proof of income, bank statements, identity documentation, and other details. So they’ll examine it, and then, if yes, you should receive the overdraft and when to settle it.

Can I Borrow Cash With A Low Loan Score?

Now, the problem with a bad rating is the doubt about whether you can still access advances to facilitate your various needs, either personal or business. In the affirmative, it is somewhere beyond the traditional banks and lenders. However, some alternative lenders and products exist for those with low credit scores or a bad credit history. Among the products, there are:

- Urgent loans for low credit: Fast, hassle-free online loans are available.

- Personal low credit loans: These loans are flexible, enabling you to use the money for anything, such as paying off some debts, getting a car, or even starting a business.

- Car loans for bad credit: They allow you to access a car even with a low credit score or a repo in your credit before.

- Debt consolidation loans for low credit: These loans help you combine all your debts into only one loan, carrying lower interest and the repayment term will be longer.

- Microloans for low credit: Microloans are small loans intended to enable financiers and small businesses to start or grow their ventures.

These may have higher interest rates and fees than a standard advance, yet they can help you still access an overdraft and develop your scores over time.

Where Can I Borrow Money If I Have Bad Credit in South Africa?

In some sources in SA, it is possible that even if you have a low-rated loan record, you will still get the overdraft. These would be:

- Online lenders: These companies offer low credit score loans through their websites or applications. Through platforms, you may compare several online lenders and offers available. However, be very careful of the interest and fees, as they will be higher than those charged on a normal loan.

- Credit unions: Not-for-profit financial organizations offering membership services. You can belong to any of these, and be entitled to loans on very nice terms, with a low interest rate as is feasible.

- Customized loans: These are loans tailored to fit your needs and circumstances. You may get a customized overdraft if you have a steady income, a good relationship with your creditor, or some sort of collateral.

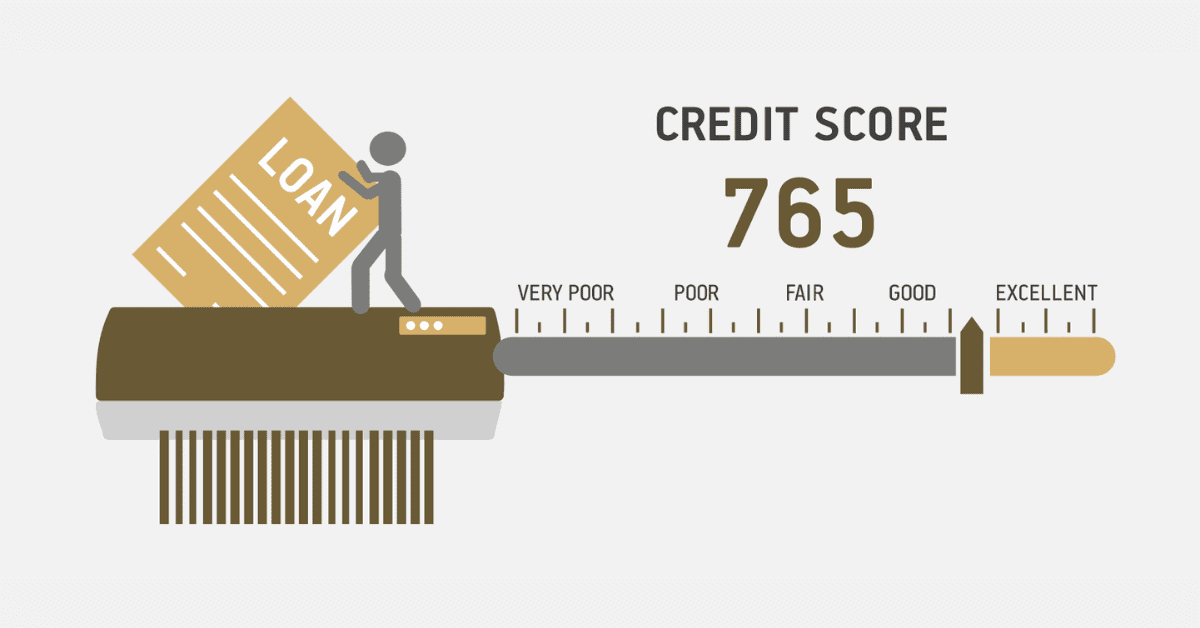

How A Low Credit Score Will Affect Your Loan Request

A low-rated reading might affect your application for the advance altogether or drive the chances too low, while the terms and conditions of the overdrafts could be very stringent. Some of the impacts one can be subjected to because of a low score include:

- Higher interest rates: Lenders charge higher interest to compensate for the risk of lending you money, meaning you pay more on the loan over time.

- Loan amounts may be lower: A lender may cap the money they are ready to lend you based on your credit score. This signifies that you may not borrow enough cash for your needs.

How Do You Fix A Bad Credit Rating?

To repair your bad-rated loan reading, stop adding to the arrears and pay down the existing ones. You will also need to check your credit report for inaccuracies and negative information, disputing the same where necessary. Make sure that all your bills are paid on time, and if possible, retain the old accounts you may be closing since, upon closure, they may easily ruin your credit history. In need, you can also approach a debt counselor for professional advice.