If you owe taxes to the South African Revenue Service (SARS), you may be wondering how long you have to pay, as well as other important questions related to tax payments.

In this blog post, we will answer how long you have to pay if you owe SARS taxes and provide information on topics such as when you can do your tax return South Africa. You’ll also learn how to pay the tax money you owe and what happens if you don’t pay the SARS tax.

This post intends to provide a better understanding of the payment process and the consequences of not paying taxes. Let’s dive in!

How Long Do You Have To Pay If You Owe SARS Taxes?

If you owe SARS taxes, you must pay them by the due date stated in your assessment. In general, it’s usually by the end of the following month from the tax assessment date.

However, you can also apply for an extension on the payment date if you need more time. To do so, you must submit a Request for Extension of Payment form to SARS before the due date.

SARS will start charging you interest and penalties if you don’t clear the taxes you owe by the due date. The interest rate is 10% per annum, and the penalties are a percentage of the outstanding amount. The exact percentage depends on how much money you owe and how long it has been since the due date.

It’s important to note that SARS will not accept payments from taxpayers who have defaulted on their payments. In such cases, you must arrange with SARS to settle the debt before making any payments. You can contact the SARS Call Centre for assistance setting up a payment plan.

How Do I Pay The SARS Tax Money I Owe?

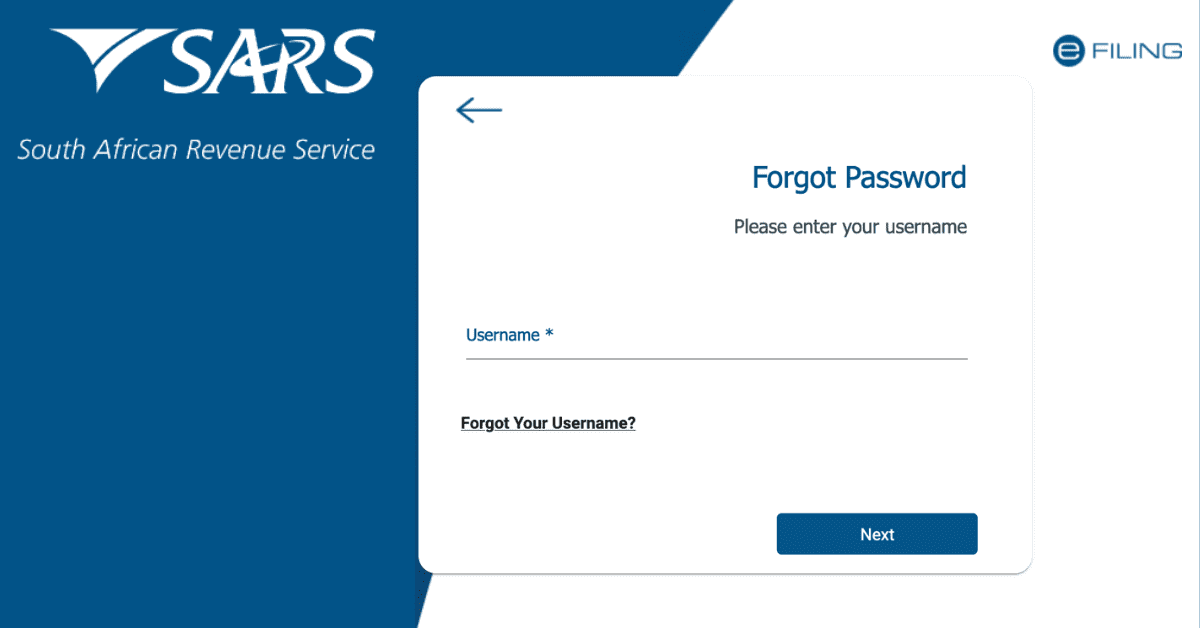

You have a few payment options if you owe money to the South African Revenue Service (SARS). You can pay directly online using SARS eFiling or the SARS app. You can also use direct deposit into SARS bank accounts, EFT, internet banking transfers, cheques, and more.

The most convenient way to pay your SARS tax is online. You only need an internet connection, a valid email address, and a SARS account number.

You can also make payment arrangements directly with SARS if you cannot make the payment in one go. You can do this through their website or by calling them on 0800 00 7277.

Other payment methods are available for taxpayers who do not have internet access, such as cash payments at any SARS branch or participating retailers. If you want to make payments via cheque, you can send them to the SARS offices or post office box.

When Can I Do My Tax Return For 2026 South Africa?

The South African Revenue Service (SARS) set a deadline date for non-provisional and provisional taxpayers to submit their 2026 tax returns on the 25th of October, 2026, and 23rd of January, 2026, respectively. Taxpayers must submit their returns online via eFiling or SARS MobiApp.

Taxpayers are encouraged to submit their returns as early as possible to avoid any unnecessary delays or mistakes that could occur when submitting close to the deadline.

Taxpayers can check their assessment outcome by logging in to their SARS eFiling profile. They can also view any correspondence or payments sent by SARS and monitor the progress of their refund requests.

How Long Do I Have To Pay SARS After An Assessment?

When paying SARS taxes, the South African Revenue Service has a timeline that needs to be followed. Once SARS has issued you a tax assessment, you must clear the amount due by the end of the following month from the tax assessment date.

You should pay your tax assessment as soon as possible. If you fail to make payment on time, you may be liable for specific penalties and interest. You may also be subject to audit or legal proceedings.

Can I Clear My Tax Return In Installments?

Yes, if you owe SARS taxes, you can pay them in installments. The South African Revenue Service allows taxpayers to pay their tax debt monthly if they cannot pay the total amount at once. However, if you want to pay in instalments, you must contact SARS to arrange this before your due date for payment.

When requesting instalment payments, you should know that interest will be charged on the outstanding amount from the assessment date until the debt is paid in full.

What Happens If You Don’t Pay The SARS Tax?

When you fail to pay the tax money you owe SARS, there are several potential consequences that you may face. Depending on how much tax is owed and how long it has been outstanding, SARS can take several measures against you to recover the debt.

Firstly, you may be issued a demand letter requesting that the tax money be paid by a specific date, or SARS may take legal action against you. If this deadline is not met, SARS may issue an administrative penalty charged at a 10% monthly rate of up to 200% of the total tax amount owed.

SARS can also take further steps, such as issuing a warrant for your arrest, seizing goods or property, and placing a lien on your bank account, which means that all funds will be held until the debt is cleared. SARS can also obtain a court order instructing your company to withhold a portion of your salary until the amount due is paid in full.

Conclusion

Paying your taxes to SARS is a legal obligation and should not be taken lightly. If you owe taxes to SARS, you must ensure they are paid on time. Failure to obey can result in fines and other penalties.

Understanding the amount you owe and the timeline for paying it back is essential to avoid penalties. Additionally, if you need to help to understand your taxes or need assistance with paying them in instalments, it is best to ask for help from a qualified tax professional.