When it comes to determining the financial health of a company and its growth potential, credit ratings for businesses are an essential factor that must be taken into consideration.

A personal credit score is a type of credit score that offers information about a person’s creditworthiness.

A corporate credit score, on the other hand, provides information about the creditworthiness of a corporation to lenders and suppliers.

A business credit score is a rating that is determined by analyzing your credit history. It provides lenders with valuable information about the financial stability of your business, helping them assess the level of risk involved in lending money to you.

Business credit scores serve as a valuable tool for business owners to assess the financial health of their business, in addition to their intended purpose of assisting lenders.

How can a business credit score be determined? What is considered a good credit score?

How is a business credit score determined?

Most individuals are aware of the significant influence their credit score can have on their financial decisions and investments. Unfortunately, many business owners are not fully aware of the significant impact their business credit score can have on their ability to secure business loans, contracts, and other financial necessities.

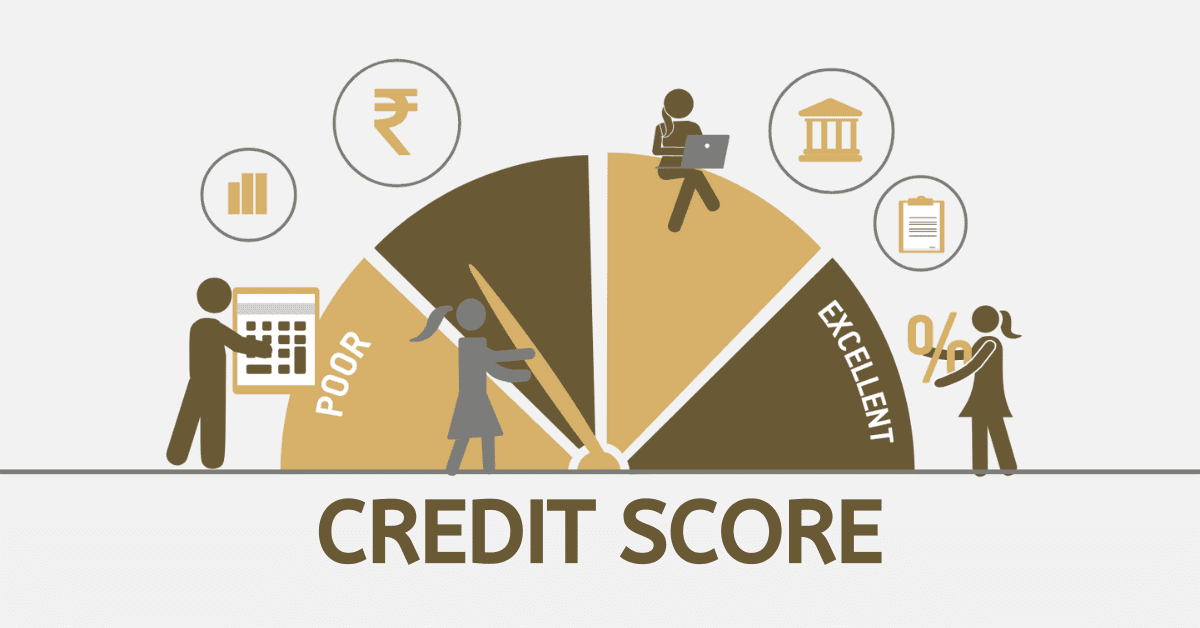

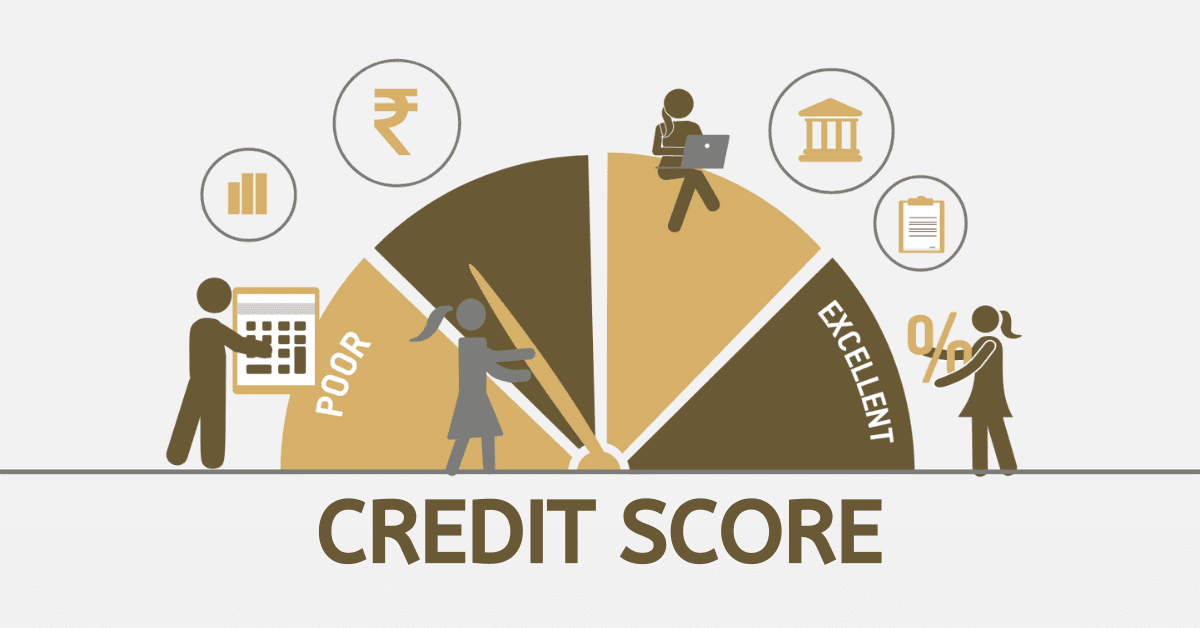

A business credit score is typically evaluated on a scale of 0 to 100. A higher credit score reflects a company’s strong performance and creditworthiness, signalling low risk to potential lenders. On the other hand, if a business credit score is closer to zero, it indicates a higher risk and decreases the likelihood of being offered credit.

The calculation of your business credit score is determined by specific criteria set by credit bureaus, and it is worth noting that each credit bureau may have a slightly different scoring range. Credit bureaus will carefully review your financial history and closely monitor your track record of repaying past business loans and borrowings, as well as the timeliness of your payments.

The credit score assessment criteria consider various factors, such as the timeliness of bill payments and the probability of payment defaults. Your business credit score is a crucial factor that influences the willingness of vendors, suppliers, and lenders to engage in business with you.

Below are some aspects of your financial history that may be assessed:

- The industry of the company

- Business Location

- Bank statement with past repayment history

- Any existing credit facility for the company

- Any previous loan application, whether denied or successful.

- All other company bank account

- Asset and liability ownership

What is a good credit score for a business?

To determine what scores are considered “good,” it is important to be aware of the credit bureaus that your potential lenders or vendors are affiliated with. Here is a quick overview of good business credit scores from well-known reporting agencies.

Business credit scores can differ based on the business credit reporting agencies. Typically, a credit score above 75 is regarded as a good credit score for business purposes.

What affects a credit score for a business?

Here are some key elements that affect your credit score. Although the listed items below can affect your credit score, each information is complementary.

- The way you handle your business’s financial transactions and the types of credit you seek can have an impact on your credit score. Higher levels of credit inquiries associated with applications can have a detrimental effect on the rating.

- Importance of Payment History Late payments on bills and loan obligations can have a negative impact on your credit rating. It is crucial to consistently make timely payments. If your business is new, it may be perceived as a more risky borrower compared to a business with a longer operating history. This is because you have not established your track record yet and have no payment history.

- Announcing bankruptcy will have a detrimental impact on your business’s rating. After being declared bankrupt, it becomes legally impossible for you to repay your debts, which inevitably leads to a significant drop in your credit score.

- Public records can have an impact on your credit score. This includes information like collections, litigation, court judgments, and unpaid taxes.

- Your business credit report contains important information about your business, including its structure, legal entity name, business address, directors, shareholders, years in business, trading history, and time in business. This information is used to calculate your credit score.

How do I check my business credit score in South Africa?

To check your business credit score, you must first know the credit bureaus or credit agencies you are aligned with.

There is an online platform built for customers to check their credit reports anytime.

To confirm your credit score, you must log in with the correct credentials to view your credit score. However, a detailed credit history may not be for free.

Always ensure to stay abreast with your credit bureau platform for easy monitoring and credit analysis.