A credit score check can be either a soft or a hard inquiry, depending on who does the check. If a lender goes in to check on your credit score, that is considered to be a hard inquiry.

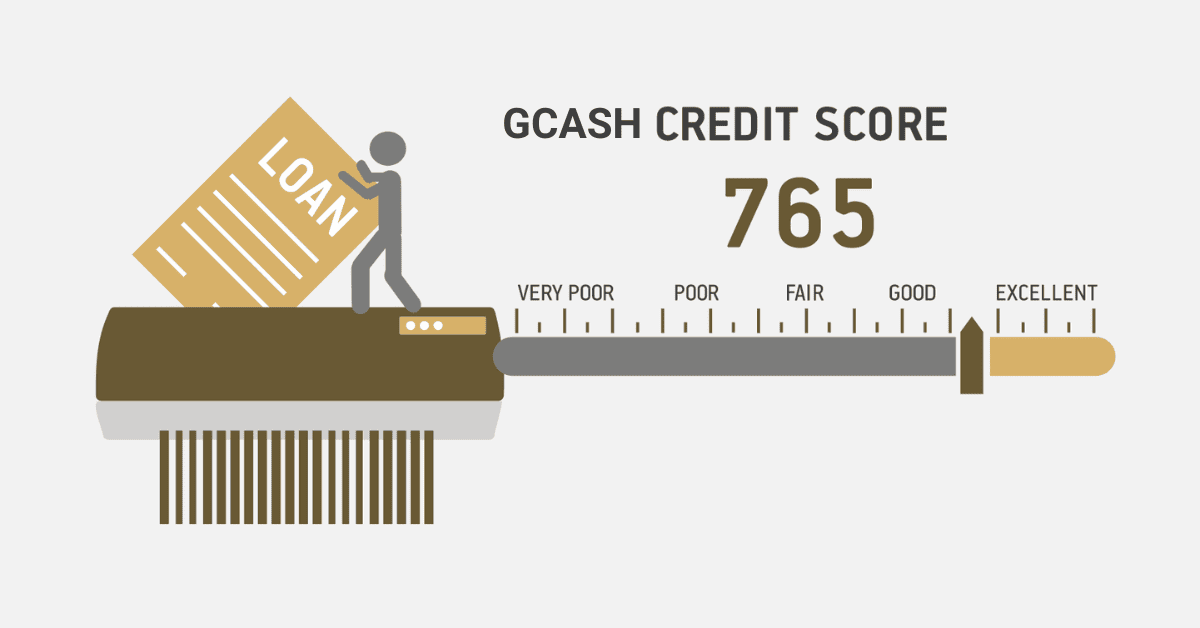

Lenders use credit scores to determine a person’s creditworthiness, as these scores typically fall within a specific range.

Financial firms such as banks and credit card companies rely on credit scores to assess the level of risk involved in lending money or extending credit.

Having a good credit score can lead to benefits such as lower interest rates and higher credit limits. This indicates that the borrower is considered reliable in terms of repaying their bills.

On the other, a lower number may indicate the possibility of elevated interest rates or potential loan rejection, suggesting a lack of financial stability. Credit scores play a significant role in lenders’ decision-making process and help them reduce and assess risks when lending.

If you are wondering about lenders and credit scores, then this blog post is for you. At the end of the day, you should be able to know how lenders check credit scores, how lenders see your debt and other related issues.

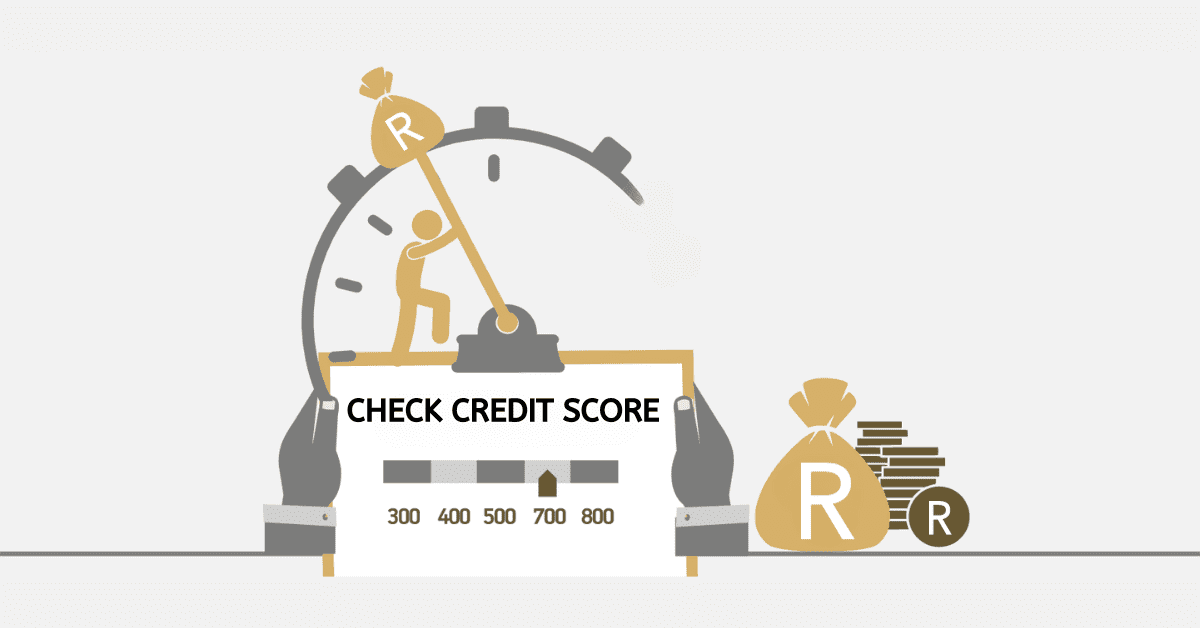

How does a lender determine your credit score?

Typically, lenders and credit card issuers will assess your credit when you apply for loans or credit cards.

When lenders review your credit, they seek to determine the type of borrower you will be. By reviewing your credit score and report, lenders can gain insight into your credit history and how you have managed credit in the past.

Your credit score and report can provide valuable insights into your credit management. However, most loans require additional information about your financial situation and personal background. Regrettably, this information is not included in your credit record.

Typically, they will request that you provide it directly or provide evidence to back it up.

Lenders look at the credit history of an individual from the credit bureau to ascertain the qualification and selection for a loan. Lenders determine your credit score by requesting for your credit history for further checks.

What does a lender look at before granting credit?

Before giving someone credit, lenders carefully look at a number of important factors to make an informed decision about their reputation. These things give you a full picture of the person’s spending habits and how reliable they are as a customer.

The first thing lenders look at is the applicant’s credit background. This requires a careful look at how they have borrowed and paid back money in the past. It looks good for the user if they have a strong payment history with on-time payments and no late payments. On the other hand, late payments, failures, or bankruptcies are red flags that point to possible risks.

Another important thing to think about is how much debt the individual has. Lenders look at the borrower’s debt-to-income ratio to see if they can safely handle more credit. A high ratio could mean that the person is having trouble with money, which makes them a riskier bet.

The different types of credit that an individual has is also looked at. A variety of credit types, such as mortgages, credit cards, and instalment loans, show that you are responsible with money and can handle your money well. It gives lenders a fuller picture of how well the borrower can handle different kinds of loans.

A longer credit past gives lenders more information about how the borrower handles money and how consistent they are. People who apply for new credit should be careful because it could mean they are desperate or have unstable finances.

Lenders look at how long the credit background has been around. Recent bad events, even if they are one-offs, might make people worry. However, a borrower’s creditworthiness goes up if they consistently do good things with their money over time.

Finally, lenders carefully look at a credit applicant’s credit history, amount of debt, credit mix, payment history, and timeline before giving them credit. This thorough review looks at many factors to help lenders make smart choices, lowering risks and promoting responsible lending.

Can lenders see how much debt you have?

Once you have a credit account associated with your name; upon request, lenders can easily see your credit information. This credit information informs lenders how much you owe.

In a case, where you have a pending mortgage as debt on your credit score, any lender seeking your credit history can see the the debt you owe.

Although lenders can not see the tiny details of debt you may have they have a general amount on your existing debt.

What affects credit score the most?

There are a lot of components in the credit that affect your credit score. These items are grouped in percentages to determine the effect on your entire credit score.

Payment history is one of the key factors that affect your credit score the most. This constitutes about 35% of your entire credit validation.

Whether you pay on time or late, credit history is the most important aspect of your credit. It carries a lot of weight as this shows whether you have a good or bad history with your credit.

Can lenders see your bank account balance?

Lenders will not have access to your account but can see your bank account balance. It is possible for lenders to your bank account balance, and here is how.

When you apply for a loan, your lender may request for your bank statement. A bank statement covers your general income and withdrawals within a specific period. This gives a general view of how your bank account has been running and also indicates your account balance.