Fixed-income investment is always considered a safer alternative to equities because it is secure and promises returns. Conservative investors, pensioners, and those interested in capital preservation primarily demand fixed-income investments in South Africa. Government and corporate and money market securities are reliable fixed-income avenues, though the latter are not risk-free. Fixed-income ventures are shaped by economic factors, interest-rate volatility, inflation, and credit risk.

How Risky Are Fixed Income Ventures?

Fixed-income investments are less risky than equities but barely risk-free themselves. The level of risk depends on the type of fixed-income instrument, the credit rating of the issuer, and South African economic conditions. Government bonds, for example, are safe as the government treasury backs them. However, corporate bonds are less secure since they are based on the performance of the company’s finances. And if the company goes under, then bondholders will lose.

Interest rate risk is among the most common impacts on fixed-income investments. Interest rate rise translates to bond prices tending to fall, and there can be potential capital loss to the bond seller before bond maturity. Inflation risk also sets in, and rising inflation decreases the real return obtained through the fixed interest. Liquidity risk also arises with some fixed-income securities, and the investor cannot sell his holding promptly at fair terms.

What is the Disadvantage of a Fixed Income Investment?

While fixed-income investments are certain and safe, they are disadvantaged in many aspects. The worst feature of fixed-income investments is the less advantageous return opportunities compared to equities. Stocks appreciate more in the long term, but fixed-income investment focuses on keeping the money safe and earning a return. This makes the investor lose the ability to generate uncommon amounts of money if a high percentage of fixed-income investments is in the portfolio.

But yet another disadvantage is inflation sensitivity. Fixed-income investment provides a return in the form of a fixed interest rate, which is irrelevant to inflation. The implication is that the purchasing power of the return reduces over the long term, and the investor’s lifestyle quality can become adversely affected, particularly in the case of an economy like South Africa, where inflation could be highly volatile.

Second, fixed-income investors are also subject to reinvestment risk. When fixed-income investors’ bond matures, they cannot typically reinvest in alternative fixed-income instruments with the same attractive interest rate, especially during a declining rate cycle. This would mean lower overall returns and would impinge on long-term planning.

Will Fixed Income Investments Lose Money?

Though fixed-income investments are primarily considered riskless, they are not and will occasionally entail money losses. The process through which the investor will lose money because of the change in interest rate is on the simple assumption that when the interest rate goes up, the existing, lower-yielding bonds are less attractive. Therefore, the bond loses value. If the investor needs to sell the bond at this time, he/she may be forced to sell the bond at a loss. Credit risk is also the cause of losses. In the event of default by the corporate bond issuer, the bondholders are unlikely to receive the promised interest and even the money invested. This is why the credit rating of the bond issuers must be evaluated before investment.

Inflation also diminishes the purchasing power of a fixed-income investor. The investor’s purchasing power decreases when the inflation rate is greater than the inflation rate of the bond. Liquidity issues also force the investor to sell the bond in unfavorable conditions if the investor desperately needs cash. Fixed-income investments are more secure than equities but not immune to economic recessions.

Is Fixed Income Safer than Stocks?

Fixed-income ventures are less risky than equities. They are less volatile and pay a fixed income. Fixed income instruments are not like equities, whose share prices fluctuate wildly based on the mood of the market, economic indicators, and the company’s earnings numbers. Fixed income instruments offer steady interest income over the long run. This is attractive to conservative investors, retirees, and income seekers.

While not as perilous as equities, fixed-income securities are not risk-free. Interest rates, inflation, and the risk of lending to others are all possibilities. Stocks have become more fruitful in the long run than fixed-income securities. Thus, they have to be saved by investors with more significant risks and distant goals.

What Does Interest Rate Risk Mean in Fixed Income?

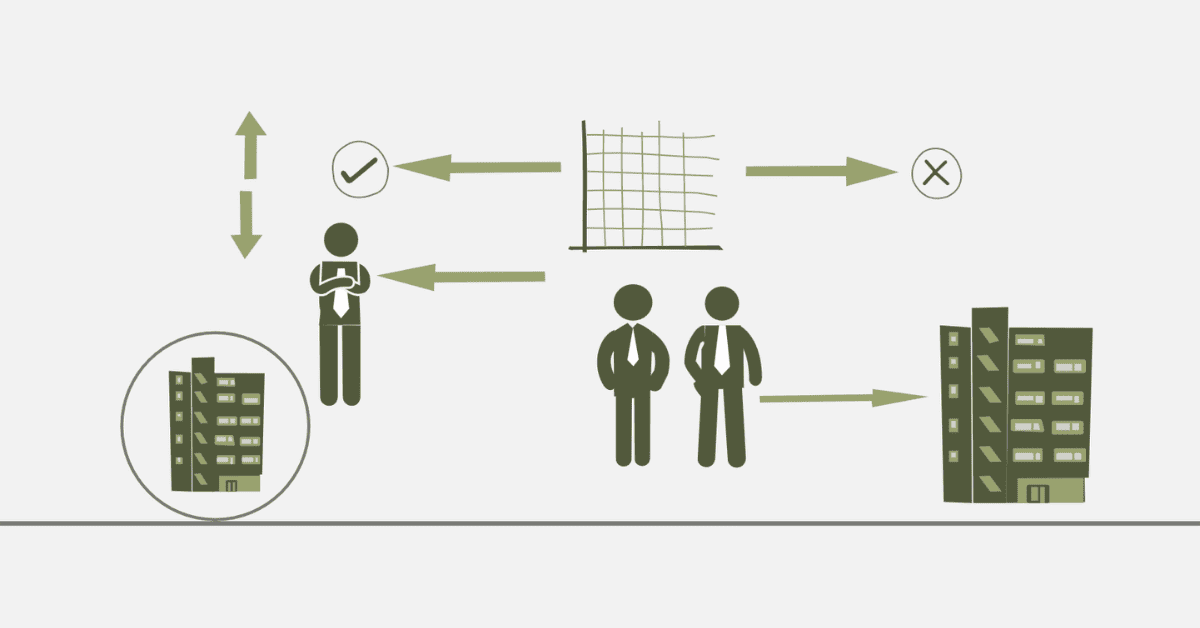

This is also the prevailing force in fixed-income ventures, as interest rate changes impact bond prices and overall return. Typically, interest rates and bond prices also follow the same direction. Thus, when interest rates go up, bond prices fall, and bond prices rise. This inverse relation occurs because the newer, higher-yielding issues are more desirable than pending, low-yielding matters, and therefore, demand decreases, and prices of the old problems are depressed.

The longest bondholders are most exposed to interest rate risk in South Africa. The more extended the bond period, the more susceptible it is to the variation in the interest rate. For example, if an investor purchases a bond for 10 years at a fixed rate and the Reserve Bank of South Africa raises the interest rate substantially, the value of the bond in the secondary market can fall considerably.

Final Thoughts

Fixed-income investments are a core component of diversified South African portfolios, with stability, consistent income, and lower volatility than equities. Fixed-income investments are not risk-free, however. Movements in interest rates, inflation, credit risk, and liquidity problems cover all the risks. Investors ought to analyze risks before investing in fixed-income security.

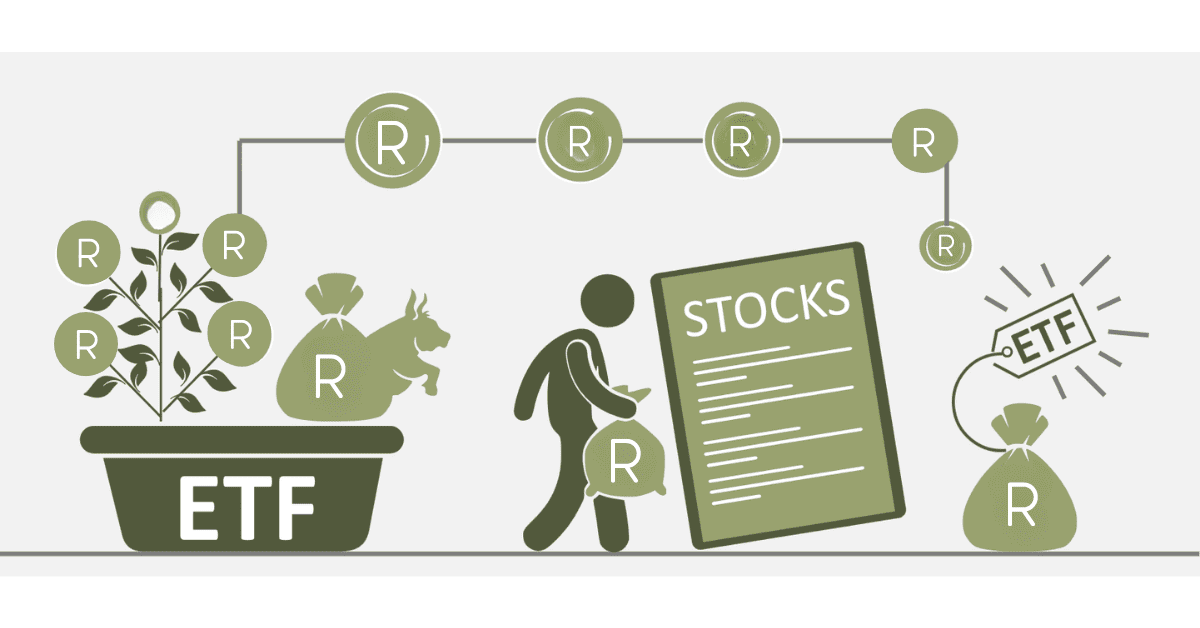

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)