Long-term equity investment is considered one of the best practices in building up funds, especially in the economic arena of South Africa. This is a move where an investor buys shares in a business venture. In that way, he or she will hold a part in the business or venture. The South African economy is so extensive in its sectors that it offers adequate opportunity in light of the equity investor. This way of investment best suits long-term goals, such as retirement, whereby it ascertains compound growth and equity returns that effectively overcome inflation. The article discusses why equity investment works best for long-term goals and how this happens within South Africa.

Why Equity Investment Works Best For Long-Term Goals?

Of all the alternatives available to reach long-term goals, equity is amongst the best investments, which have a greater possibility of paying a huge return in an extended period. One of the most rewarding attributes of equity investment is that it tends to beat inflation over time. In South Africa, the rate of Inflation is taken to be in a fluctuating mode of operation; that is, money will slowly lose its purchasing ability.

The main benefits are that equities are bound to return more than the rate of inflation and thus preserve and increase investor wealth, especially for well-established firms. Apart from this, another reason why equity investment is suitable for long-term goals is the compounding factor. Dividends and returns get reinvested to create more income, which in turn accelerates the wealth growth over time. Compounding can aggressively increase the worth of an investment over 10, 20, or 30 years; hence, in South Africa, equity investments are good for retirement savings or educational funds.

Through investment in equity, one gets diversification that spreads risk across various sectors within the South African economy, which relates to mining, technology, and agriculture. It is this sort of diversification into a set of firms that allows an investor to lessen the impact of volatility and create stable growth in the long run. Due to the same reason, over the years, South Africa’s stock market has always proved resilient in instances where the market declines because it usually regains its peaks. Hence, this equity investment is suitable and ideal for long-term financial goals.

What is an Equity Investment?

It includes buying shares in a firm. In so doing, the investor becomes the partial owner of the company, at the very least. The Johannesburg Stock Exchange is where Equities for investment in South Africa are located, with its accredited list being those companies that are publicly listed. In turn, the investor receives shares of the respective company as one of the owners, and returns are based on the performance and profitability of the corporation.

There are several kinds of equity investment. A few of them entail individual stocks, ETFs, and mutual funds. Each share type has different risk and return profiles, but the bottom line remains constant. This means that when the value of the firm hikes up, so does the price of the shareholder’s shares. For instance, if a large SA technology agency had huge growth, the owners of that firm stand to benefit from the increase in share price.

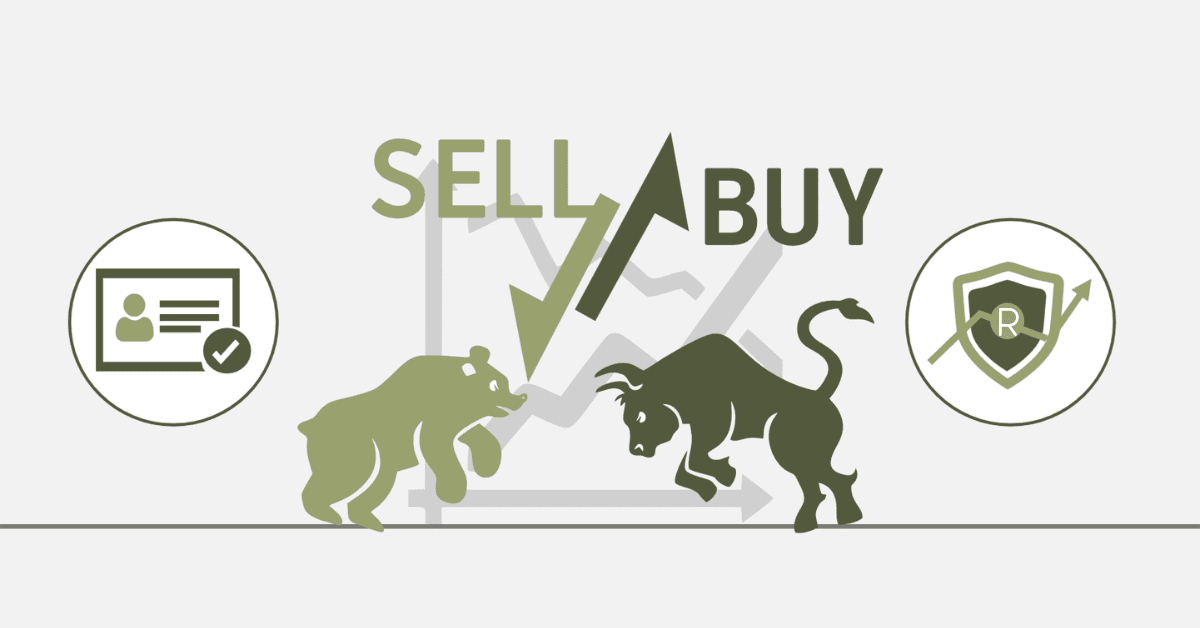

More so, equity investments belong to an entirely different class of investment from fixed-income investments in the nature of bonds. Bonds guarantee periodic earnings in terms of an interest rate return earned on them, while equities promise comparatively better returns through capital appreciation and dividends. However, equity investors bear greater risks because the turbulence in the stock market may bring about temporary losses. Still, in the case of the long-term investor, this turbulence gets averaged out by holding on to stocks for a lengthier period, which enables recovery and growth of the stocks over time.

Are Equity Investments a Good Idea?

It is a good idea to invest in equity for those willing to indulge in high risk and, therefore, accommodate the possibility of higher returns. Historically, South Africa has a robust long-term growth profile of the South African stock market, thus enticing investors who wish to grow their wealth. For example, the JSE is a home for some of the strong and well-performing companies operating in diversified industries, and such opportunities abound for profitable equity investment. As such, they apply better to long-term-oriented goals such as retirement or funding a child’s education.

In the long run, while the performance of equities has been shown to increase and decrease in the short term, over some time, they will prove to be better performing than other class assets such as bonds and savings accounts. In like matters, that would make them an effective vehicle to help build wealth over a longer time horizon.

However, equity investments are never devoid of risk. Fluctuations are high in the stock market, and political instability or a change in interest rates in South Africa often plays a devastating role in the sector-specific performance of equities. At one time or another, an investor may need to hold his nerve during falling periods and remain committed to long-term goals. Another reason, probably the most important one, is that diversification plays its main role in equity investment: to avoid risk and huge loss of any part of an investment portfolio when losses may occur in one sector.

How Do You Earn Money From Equity?

There are two significant methods of gaining money from equity investment in South Africa. Namely, these are capital appreciation and dividends. Capital appreciation applies to the increased value of the shares that the investor owns. Suppose you bought South African company shares at R50 each, and over time, the prices appreciate to R100. This means that you will have doubled your investment value. Such a capital gain may be realized once you sell at a higher cost compared to when you bought them.

Dividends are one of the ways one earns from equity. Most firms in SA pay the owners a portion of the profits made by the company in the form of dividends. These normally come quarterly or yearly and will provide the investor with a source of regular income. For example, a mining concern listed on the JSE would have the opportunity, following good performance, to pay some returns to its shareholders due to the investment placed within. Dividend reinvestment is used last to enhance an investor’s gains.

Most investors would rather not take the dividend in cash but instead, reinvest the dividend payout back into purchasing more company shares. This increases their stake further and compounds the growth of the investment at higher amounts as time progresses. Being a long-term investor, this reinvestment strategy works all the more effectively since the compounding effect starts to amplify to lead toward greater accumulation of wealth.

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)

![Internal Rate of Return [IRR] – Calculation](https://www.searche.co.za/wp-content/uploads/internal-rate-of-return.webp)