When you obtain your car insurance, the insurer considers different aspects to calculate your premium including your credit score. With a high credit score, you can enjoy affordable auto insurance. This article explains all the important aspects of credit scores and how they affect your car insurance rate.

Does Credit Score Affect Your Car Insurance Rate

Yes. Many insurers believe there is a correlation between low credit scores and bad financial behavior. The insurance company is concerned about your credit history to see if you can manage to pay your premiums over a long period. A poor credit score is commonly caused by issues like late or missed payments. In some cases, a low score can be associated with financial indiscipline. Therefore, poor credit is likely to increase your coverage rate by more than 80% since the insurer would develop little trust in your credit score.

Different studies suggest that credit-based scores can be used to predict the behavior of a driver when it comes to filing insurance claims. Some of the studies found that drivers with bad credit pose a high risk to insurers since they are likely to file costly claims. Likewise, if you pose more risk to the insurer, you will be charged higher insurance rates.

What Is a Good Credit Score for Insurance?

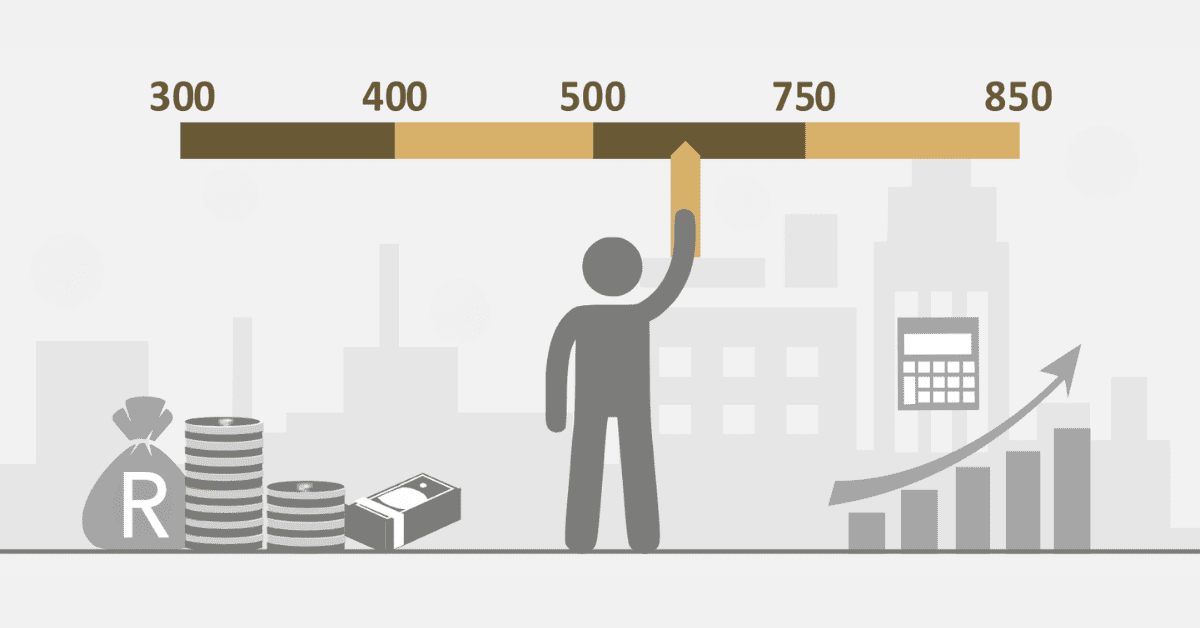

In South Africa, a good credit score for insurance ranges from 670 to 739. However, insurance companies can use different scoring models, but you need an average credit of 600 to be safe when you apply for a policy. With a higher credit score, you have more chances of getting more competitive insurance for your vehicle.

How Your Credit Score Can Help You Save on Car Insurance

A poor credit score often leads to high insurance premiums for your car because of the risk you pose to the insurer. However, if you have a high credit score, you can receive lower insurance rates, and this will help you save a lot of money. Money saved from insurance premiums can be used for other purposes to improve your welfare.

Before applying for auto insurance, it is vital to check your credit record. If your score is poor, it would be a good idea to conduct research first to enlist the services of an insurance company that offers competitive premiums based on your credit score. You also need to improve your credit score so the insurer can lower your insurance rates over time.

How Is Credit Score Used in Insurance?

Credit-based insurance scores are commonly used by insurance companies to assess the risk posed by different drivers. A credit score helps the insurer to evaluate your credit history to see if you can sustain your monthly payments of premiums. If you have experienced late or missed payments on any of your credit accounts, your credit score would also be negatively affected.

Insurance companies consider the same factors just as lenders to assess your level of risk. They will make hard inquiries on your credit to check your report for elements like late payments or missed payments. When the insurer discovers that you have previously tried to open several credit accounts within a short space, they would conclude that you are not in control of your finances. As a result, your application for auto insurance can be declined, or you will be charged high premiums.

Insurance companies are also interested in checking your payment to determine if you will be capable of maintaining payment of your premiums. Missed payments on your credit report will impact negatively on your credit score. As a result, your application for auto insurance may be rejected due to poor record. If you are lucky to be approved, there will be a likelihood of getting high premiums.

On top of reviewing your credit score, your insurer may also check the types of credit accounts you have and the duration you have held those accounts. If you maintain your credit account for a longer period, it will appear more favorable to insurers. Having several credit accounts with a good payment history gives you an added advantage when you apply for car insurance. People who can manage their finances well receive favorable treatment from insurance companies.

If you want to purchase insurance for your car, you need to remember that your credit score will affect your policy rates. When you have a poor credit score, you are likely to get high premiums. In contrast, a high credit score leads to favorable premiums. Since insurance companies check your credit score to determine your premiums on auto insurance, it is vital to check your credit report regularly. Dispute all errors that can negatively impact your credit score. Additionally, ensure you pay all your bills on time to improve your credit score.