Having R100 000 in one’s pocket opens excellent opportunities for investment in South Africa-from growth of wealth to the start of certain businesses that secure the future; intelligent decisions concerning this money may yield great long-term returns. The correct option typically depends on monetary goals, risk tolerance, and venturing horizon.

What to Do With R100k in South Africa?

- ADVERTISEMENT -

This is the wise start of financial security and investment growth. One of the most prudent options would be investing this R 100 000 in a well-diversified portfolio of equities, mutual funds, and exchange-traded funds. An SA ETF tracking the JSE Top 40 Index provides diversified exposure to the top listed companies at a meager cost. This is an excellent way of spreading the risk, with likely solid returns.

Real estate investment can be another avenue. Though R 100 000 may not buy any property, it would be a good deposit toward investment property. This purchase in growing neighborhoods or commercial real estate has yielded rental income and long-term capital appreciation for many capitalists worldwide. Alternatively, you could sink your coins in a Real Estate Investment Trust. Here, you receive a share of yields from a portfolio of properties without personally owning them.

Lastly, plow some of your money into a TFSA that, in turn, has tax-efficient investment growth. The TFAs also give you a perfect place for long-term savings because you will not be charged any kind of tax on the growth or withdrawal of money from the account; thus, it is one of the ideal vehicles for creating wealth over time.

How to Double Your Money in South Africa?

Doubling one’s money is every investor’s dream, but for this piping dream to come true, you must include strategic planning and be ready for risks. Long-term investment in the stock market proves to be one of the surer ways to double your money.

Invest in companies with enormous prospects for growth, especially in growing industries like technology, renewable energy, or financial services. This will ensure that substantial returns are guaranteed after some time. To that effect, compound interest-earning returns on your principal and the returns from the principal will greatly facilitate.

Another avenue is investment in high-growth sectors through ETFs or mutual funds. These funds let you spread your risk by investing in a basket of companies. Over time, overall growth in those markets can lead to the potential doubling of your money.

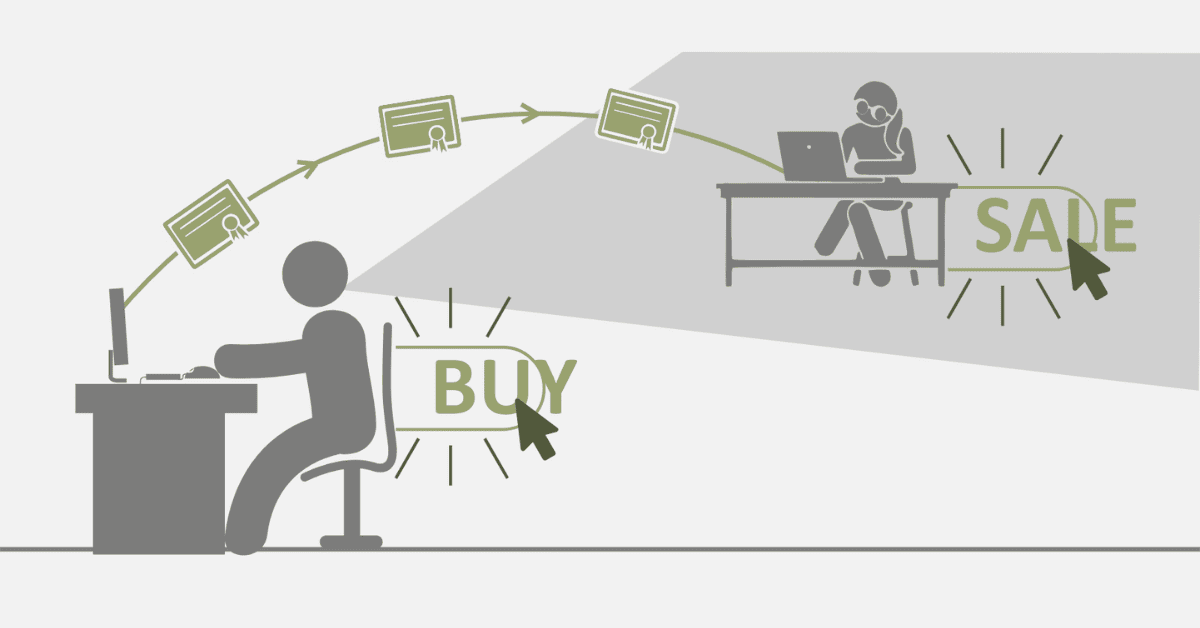

Those with a higher risk appetite might double into starting small businesses. This may be in online, e-commerce, or local retail. A well-executed idea for a company will have your capital grow fast, especially if you tap into emerging trends or underserved markets.

What is the Most Fruitful Business to Start with 100k?

R100 000 provides good initial capital that one can confidently use to start a small and potentially lucrative business in South Africa. An individual may invest in several enterprises initially, but among the most lucrative are e-commerce, agriculture, and providing certain services, such as cleaning or house maintenance.

E-commerce overheads are minimal and can scale up phenomenally. The idea is to create an online store for local and international products. Apparel, handicrafts, and other niche items targeting a vast audience with minimal upfront investments in physical store infrastructure are the way to go.

Agriculture is also a strong choice, especially in a country like South Africa, which has the land and climate to support such activity. It could be on a small scale, but starting an operation of organic vegetables, poultry, or beekeeping brings in consistent profits as more and more people demand fresher, locally produced goods.

Last but not least, service-oriented businesses are very lucrative: cleaning services, mobile car washes, or home repair businesses. This is due to the relatively low starting costs and because such companies satisfy relevant needs.

How Much Cash Can You Keep at Home in South Africa?

Although nobody can technically charge you for keeping any amount of money at home in South Africa, financial experts strongly recommend that you should not keep junk cash outside the secure financial institutions. There is every chance of theft, fire, and other unforeseen risks with the coins kept at home. You would also lose the opportunity to accrue interest on that money. If left in a savings account or ventured into financial instruments, you would have accrued this cash.

Most banks and other financial institutions in SA offer many kinds of accounts with options to earn interest so that one can develop his or her savings safely. Such high-interest savings accounts or fixed deposits, for example, will keep the money safe but facilitate moderate growth over time.

Good advice will be to have no more than an emergency fund at home, enough for a couple of days of living. The rest of the money must be invested or put into interest-yielding accounts so that money keeps growing.

What is the Safest South Africa Investment with the Highest Return?

Government bonds and fixed deposits remain your best options if you seek the safest investments with the highest returns. Government bonds, especially those of South Africa, have been among the safest investments since the government assures the bonds, and you have the assurance of regular interest payments. Here, you get a fixed income on the investment with a minimum risk over the loss of your capital. Its return depends on the bond’s term; typically, the higher the maturity period of that bond, the higher the return.

Fixed deposits with reputable banks are also safe and predictable. A fixed deposit means you agree to keep your money locked up for a few months or several years and receive a guaranteed interest rate. While their returns ain’t as high as equity investments, fixed deposits provide more security to the risk-averse investor.

The capital growth with income that investors can gain within the balance mutual funds or dividend-paying stock will attract investors who are reasonably tolerant of risk. This spreads investment in other fields and limits this risk, which may also provide a higher return over fixed-income securities.