Getting employment in South Africa is tough. Our official unemployment rate is well over 30%, and unemployment among youth is trending upwards of 50%. The last thing anyone wants is yet another hurdle to getting the job they need! However, credit scores are becoming increasingly important as a decision-making factor for South African employers. Here’s what you need to know.

Do Employers Check Credit Scores in South Africa?

Employers, especially private sector employers, do have the right to check your credit score in South Africa. However, they cannot legally do so without informing you fully about the process and you consenting to the screening. Even more importantly, this must be delivered in writing, not a verbal agreement. There is also a push, not yet fully realized, to confine these searches to ‘legitimate’ financial positions and not just any employment sector. There are still plenty of jobs that will not run a credit check at all.

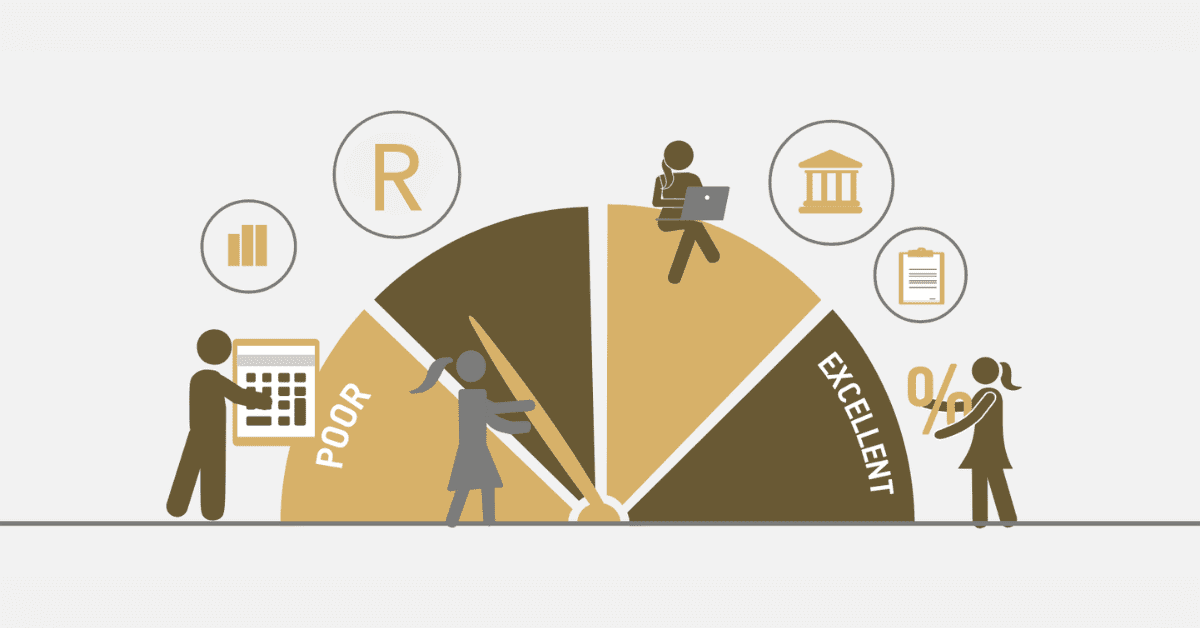

What Jobs Check Your Credit Score

Strictly speaking, the only industries that can require a credit check as part of the employment process are those where the jobseeker would have financial responsibility. While this mostly targets high-profile professions like banking, chartered accounting, and financial service providers, it also impacts entry-level positions like cashiers.

However, as there is no strict legislation against credit checks by employers, they are often used even in industries where your financial background is irrelevant to your job performance. Here, they have become a divisive thorn in the labor arena.

Can You Be Denied a Job Because of Bad Credit in South Africa?

Regrettably, private employers can deny jobseekers work based on a host of factors in South Africa, including a bad credit record. It would only become problematic legally if you can prove it as discrimination against a protected class (for eg., race, religion, or sexuality). Being in debt, or having a poor credit score, is not a protected class under South African law, and so could be used as a reason to deny an applicant a job. They may not even reveal to you that that was the determining factor, either.

This has become a very divisive issue in South Africa. After all, how can anyone address their debt load and better themselves if they can’t find employment because of it? Employers will commonly claim that a poor credit score means employees will be more prone to corruption or theft. Interestingly, this has never correlated with scientific data on the matter, which clearly shows no such tendency exists, and TransUnion’s U.S. arm has more-or-less admitted that outright. Even if this concern was valid, it also shouldn’t apply to industries other than those where clean financial management matters, like banks and fintech services.

Additionally, some argue that this sort of discrimination should

Alas, all the think-pieces and opinions in the world cannot change cold hard facts. So for now, know that you can be denied a job due to a bad credit score in South Africa, even though it is widely held to be a problematic stance and wrong of employers to do so, especially in non-financial industries.

Can Debt Prevent You From Getting a Job?

As we looked at above, debt can prevent you from getting a job, regrettably. Employers can check your credit score (with your consent), and if they do not like what they see, there is no legal compulsion to give you a fair chance.

It has only recently become standard for South African employers to run these checks, and there are signs that the information revealed is not being used fairly or even reasonably. Instead, it is often being leveraged into a kind of ‘character test’ to gauge job performance and trustworthiness, despite there being no scientific evidence for this use and this type of testing going against the spirit, if not the letter, of the Employment Equity Act.

There is good news, however. Being in quite a high amount of debt is utterly normal for South Africans, even though that is problematic in itself. The average debt-to-income ratio in South Africa is around 65%, one of the highest in the world! Having a fair, or even ‘high poor’ credit score is unlikely to be a deterrent to most employers. Nor will being in active debt review. What will stand out is multiple judgments, defaulted accounts, and other high-risk bad credit behaviors. Remember that many employers won’t even ask to look at your credit score- it is not yet a universal step in the employment process.

So don’t panic. Instead, take steps to address your debt, boost your credit score, and keep improving your financial health as you can!