You may have heard of the four main credit bureaus in South Africa. They are Experian, TransUnion, Compuscan, and XDS. They obtain their information from various sources such as banks, shops where credit is extended, utility companies that offer services on credit, and courts. They then use this acquired information to calculate your credit score. However, every bureau has its rhythm for doing this, so it will not be the same among all the bureaus.

This article is written about Experian, which happens to be among the largest and most popular credit bureaus in South Africa. In this view, we will explain the ranges of Experian credit scores and how a good one would be. We will also compare ClearScore with Experian credit scores and why the numbers differ. This further answers why ClearScore may be higher than Experian.

What are the Experian credit score ranges?

Experian uses a scoring system called Sigma, which ranges between 0 to 740. The higher the score, the better your profile is on your credit score and the less risky debtor in not repaying, says Experian. The scores are broadly categorized into five bands by Experian, each demonstrating different creditworthiness and risk levels. Below are the Experian score bands and how ClearScore, a free online service to view your Experian credit score and report, refers to these:

| Credit score | Experian band | ClearScore name |

| 0-599 | Very poor | Let’s start climbing |

| 599-615 | Poor | On the up |

| 616-633 | Fair | On good ground |

| 634-657 | Good | Looking bright |

| 658-740 | Excellent | Soaring high |

What is a good Experian credit score in South Africa?

In 2026, South Africa’s average credit score was a ‘Good’ 649, indicating moderate default risk. However, an above-average score doesn’t guarantee credit approval or the best deals, as lenders assess specific requirements and affordability. To enhance your Experian score, pay bills fully and punctually, keep credit balances low, regularly check and dispute credit report errors, apply for credit only when necessary, diversify your credit types (revolving, instalment, service), and maintain a long, positive credit history by keeping your oldest accounts active.

How does ClearScore compare to Experian credit score?

ClearScore, a free online service, grants you access to your Experian credit score and report anytime, anywhere. It doesn’t calculate your score but mirrors Experian’s. Hence, your ClearScore and Experian scores should match, provided they’re updated simultaneously. ClearScore may present and explain your credit information differently, using its terminology for Experian’s score bands. It also offers a list of factors influencing your score, tips, and offers to enhance your credit health. ClearScore isn’t a credit bureau, so it can’t modify or erase your credit report information. If you spot errors or inconsistencies, you must contact Experian directly or via ClearScore’s contact form to dispute them.

Why is the Experian score different than TransUnion?

As previously noted in the text, the largest four credit bureaus in South Africa are Experian, Transunion, Compuscan, and XDS. That is why different information and scores may be found by means of each of the credit bureaus:

- Not all creditors report in all the credit bureaus. Some might only be reporting amongst specific bureaus or none at all. This means some given bureaus may have more or less information from your credit accounts than others.

- Lenders may be forwarding info to varied agencies at different instances. For instance, your credit card agency could report your profile to Experian the first week of the month, TransUnion the second, and Compuscan the third week of the same month. This signifies that your credit statements might not get updated simultaneously and display different amounts and settlements.

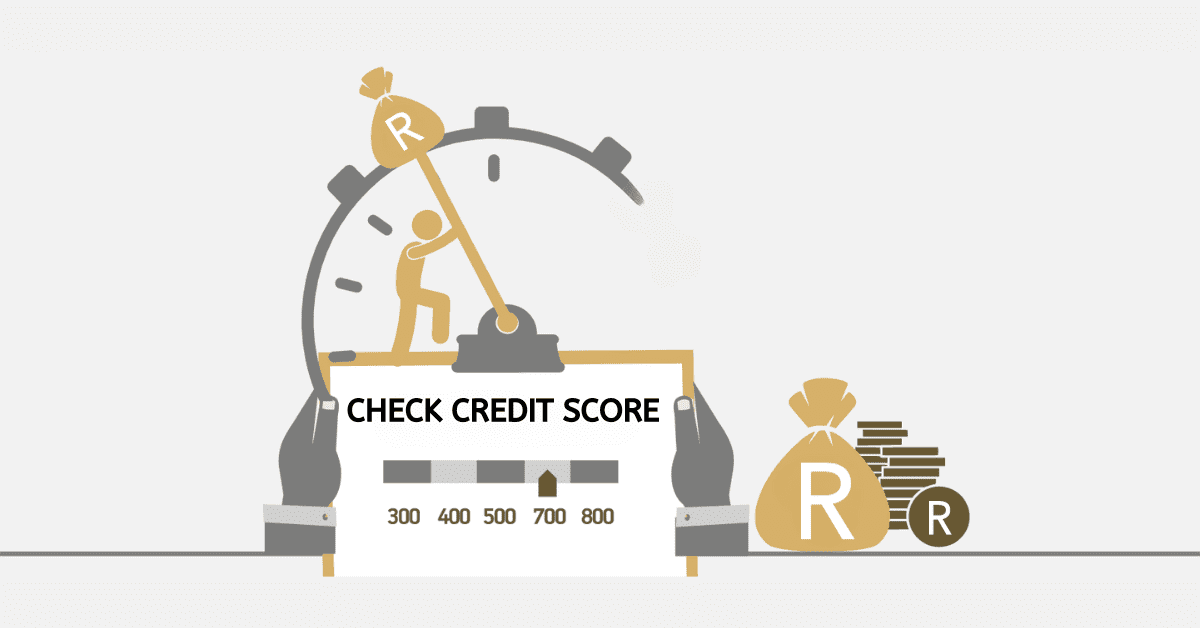

- Every credit bureau has its unique score model and range. Each bureau maintains its division of weighting and measurements for quantifying the credit score level using the information to hand. They do not have a uniform scoring range, making it difficult to compare your credit scores from one to another. For instance, TransUnion applies the scoring called EMPIRICA, scoring 0-999; for Experian, it applies Sigma, whereby the scores range between 0-740.

So, different credit scores from the different credit bureaus will be expected. But this doesn’t mean one score is more accurate or important than another. All credit bureaus work similarly as set by their regulated rules and regulations by the National Credit Regulator. They all strive to give an unbiased and reliable verdict on your credit risk. The best to understand your credit health is to review all four bureaus’ credit scores and reports and look for the trends and patterns that impact your credit score.

Why is ClearScore higher than Experian?

ClearScore, a platform that presents your Experian credit score and report, doesn’t inherently rank higher than Experian. The confusion may stem from ClearScore’s unique terminology for Experian’s score bands. For instance, a ‘Good’ Experian score of 650 is termed ‘Looking bright’ by ClearScore. This doesn’t imply a superior score but reflects ClearScore’s positive language approach.

Additionally, ClearScore offers a list of factors influencing your score, coupled with tips and offers to enhance your credit health. While these features foster optimism and motivation toward your credit situation, they don’t alter or inflate your score. Your ClearScore and Experian credit scores should align if they’re updated simultaneously. Remember, ClearScore’s encouraging language and additional features are designed to help you understand and improve your credit health, not to misrepresent your credit score.