One popular means of long-term wealth building in South Africa is through share investments. There are so many companies listed on the Johannesburg Stock Exchange, and it becomes an uphill battle trying to work out what shares are ideal in terms of growth and profitability. That is why, in this article, we are going to show you some of the best South African shares one can buy today, anchoring our focus on critical reasons those stocks will be an excellent choice for investors. We look at how you can identify top-performing shares

Which Are the Best South African Shares to Buy Now?

Key features to focus on when one decides which shares to buy could include the following:

- Company Fundamentals: High earnings growth, low indebtedness, and sustained profitability are significant pluses. Companies that dominate their industries or enjoy competitive advantages generally make for safer investments.

- Dividends paid: Companies paying consistent dividends usually show that the companies are healthy, speaking financially. Besides several prospects of gains on capital, dividends signify passive income to investors.

- Market Trends: One needs to look at the current economic climate and sectoral direction. During innovative periods, technology firms do very well, while resource companies thrive during commodity booms.

- Quality of Management: Any successful company owes part of its success to the leadership. A capitalist should only venture into firms where the management teams are composed of individuals who are seasoned, trustworthy and have made prudent decisions in the past.

Strong stocks are differentiated from weak ones through deep research into the monetary statements of the firm, positioning in the industry, and general market trends. Many financial metrics, including the price-to-earnings ratio, return on equity, and earnings per share, give further insight.

What Are the Top Five Shares to Purchase Today?

- MTN Group

This firm is one of the most prominent telecommunication organizations in Africa. Besides that, it operates in almost every nation on the African continent, offering mobile phone services and data packages. Due to continued growth in mobile technologies across the African continent, MTN has continued its expansion, hence being a good stock to hold. This company prides itself on a vast customer base and, from that, develops a robust infrastructure that is in its favor.

- Naspers (NPN)

Naspers is a behemoth in technology and media since it was described as the world’s biggest consumer internet company. Holding giant-size stakes in significant businesses such as Tencent, their standing will continue to stand firm in China’s growing tech market. Despite the fact that Naspers has gone through one or two minor setbacks, their diversified portfolio in global tech investments makes them one of the strongest contenders, marking high potential for growth.

- Anglo American Platinum

This group maintains a great position within the commodities market. The increasing demand across the globe for precious metals, particularly electric vehicle batteries, and green energy, means the firm has ample reason to provide solid growth for those interested in the resource sector.

- Shoprite Holdings

It remains the biggest chain of supermarkets in the SA nation, with a reputation as one of the largest retailers on the African continent. Through the year-on-year sales increase, the firm has attained widespread access to the continent and hence is considered a core venture in the consumer goods/products sector. The rise of the middle class on the African continent brings with it increased demand for consumer goods/products and, thus, enterprises like Shoprite.

- Capitec Bank Holdings

It has been disrupting the traditional banking model with a single simplified, low-cost banking profile. Today, the organization is one of the fastest-growing monetary institutions in the nation, enjoying rapid growth in its client base. Novelty in the field of banking and strong earnings growth make the group very enticing as a venturing option in the financials.

How Do You Make Cash on Shares?

There are two main ways: capital appreciation and dividends.

Capital appreciation refers to some increase in value over time in your stock. You buy when the price is relatively low and then sell it later at a higher price; the profit you establish from this is your capital appreciation. For instance, when you purchase shares in a firm at R 100 for every share, then the shares are later sold at R 150 for every share, and you have achieved a capital appreciation of R 50 for every share. The secret of capital appreciation is buying shares when they are undervalued or during high market growth.

The dividend is the prize or return one announces to be given to the owners or the shareholders, generally out of the profits made by the company. Companies earning steadily with a sound cash flow policy typically pay part of their gains to the investors in the form of dividends. Payment through dividends provides regular income for those well-established companies.

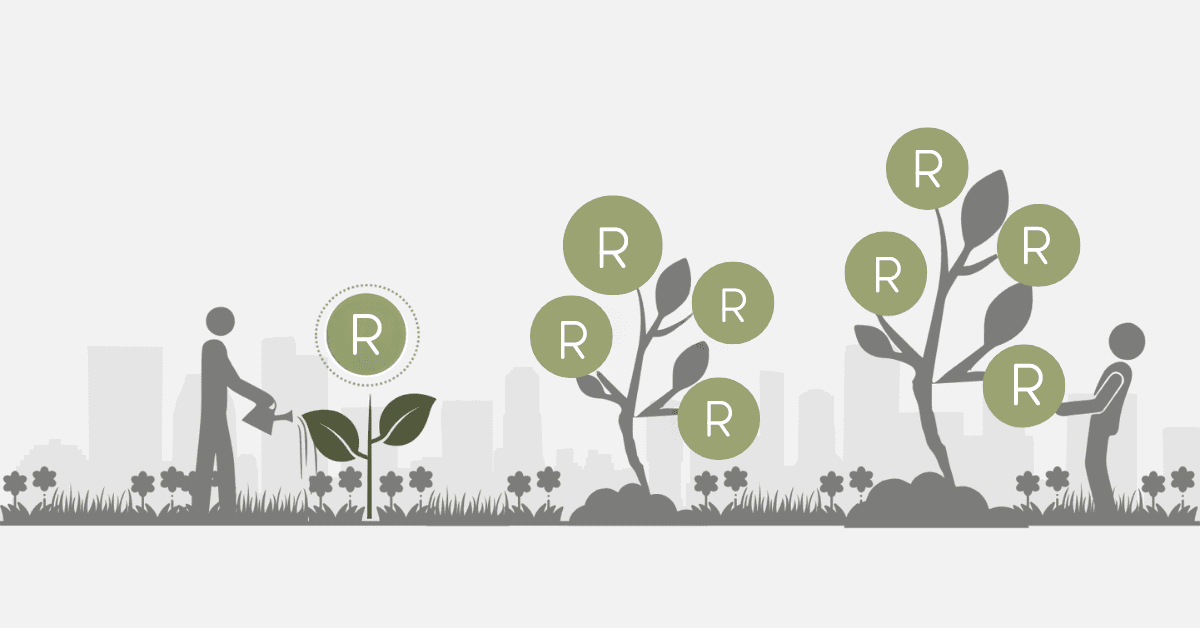

The key to making much money with stocks lies in taking a long-term approach. The whole concept of trying to time the market just for small gains is risky since the market at any given time can be volatile. Instead, focus on companies with good fundamentals whose stocks, held for a considerable period, result in significant returns both on capital appreciation and dividends.

How Much Money Can You Make From Stocks in a Month?

The differences that one may receive from the stock in a month are enormous and depend on many variables, including:

- Market Conditions: These are the general states of the stock market. When the market is in a bull state, the stocks are highly likely to appreciate. On the other hand, when the market is in bear mode, such prices drop. That might be a determinant of how much one makes in any particular month.

- Type of Stock: The more high-growth stocks, such as technology companies, provide a more incredible opportunity for quick, significant gains but are more volatile. Looking toward blue-chip stocks when considering larger companies helps to stabilize the investment; this generally means slower growth. These are what will influence monthly earnings.

- Investment size: This may also be one major factor, as much as the amount you invest in capital matters a lot. Using the same idea above, if you invested R10 000 into that stock that rose by 5% the next one month, you would make a profit of R 500. In comparison, with the use of the same stock, you would realize R5 000 if you were able to invest up to R100 000.

- Dividend: You are also rewarded for your venture if the invested firm pays dividends through declaring regular dividends. Assume you own 1000 stocks in a firm that pays a dividend of R1 per share. You, in such cases, would receive R 1,000 as a dividend reward.

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)