Your IRP5 (or IT3(a) for earners below the tax threshold) is sometimes called your employee’s tax certificate. It shows both the amount of earnings you have made from your employer in a specific tax period as well as any amounts that have already been paid to SARS on your behalf as PAYE. It is an important part of establishing your tax liability in South Africa, so it is important you know exactly how to access and use it. We’ve assembled this guide to help.

How do I Request my IRP5 from SARS?

You should not have to request your IRP5 from SARS. Your employer is legally obliged to provide you with this return annually when they file it with SARS, or when you leave the company if you do not work for them for the full tax year. As such, it should appear already pre-populated on your eFiling income tax return when you go to file.

You will receive an IRP5 (or IT3(a) where you do not meet the threshold for tax from that employer) from every employer you have if you work multiple jobs. Should these not show on your tax return, you will need to request them from your employer. In the event you cannot access your IRP5/IT3(a) from an employer, please make an appointment with SARS to discuss your next steps, as this is a critical part of your tax return.

Where can I get an Old IRP5?

If you need an old IRP5, you may find it on your eFiling profile alongside the relevant income tax form form from that year. Alternatively, you may have print copies of the same, or have been emailed/received a print copy from your employer or ex-employer. If you cannot access an old IRP5 this way, you will need to request it from the employer. If they do not have it, they are legally obliged to provide you with a letter that states this and why.

What Documents are Needed for IRP5?

You do not need to provide documents for your IRP5. It is a document you will receive from your employer showing your remuneration from them that year. However, when you are brought on as an employee, your new employer will request both your ID and your tax number (if you have one) to facilitate them in the generation of their annual IRP5 returns for their employees.

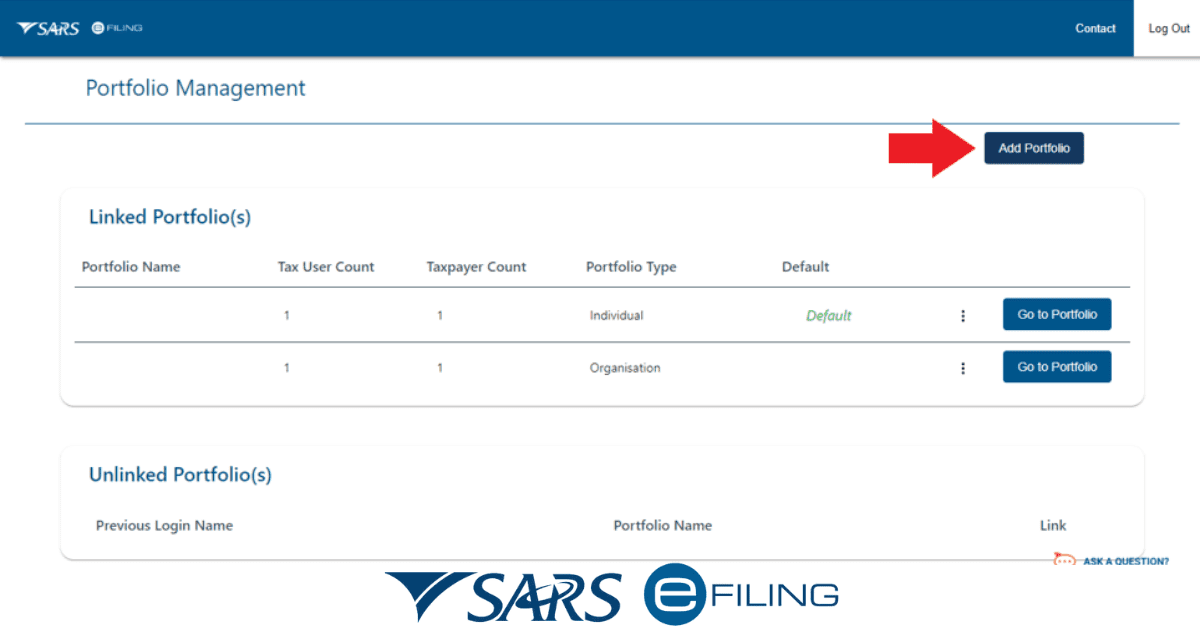

How do I Generate IRP5 on eFiling?

If you are an employee, you do not have to generate an IRP5 on eFiling at all. The IRP5 is a document which all employers must submit, for each employee, annually. It shows how much remuneration the employee received from the company.

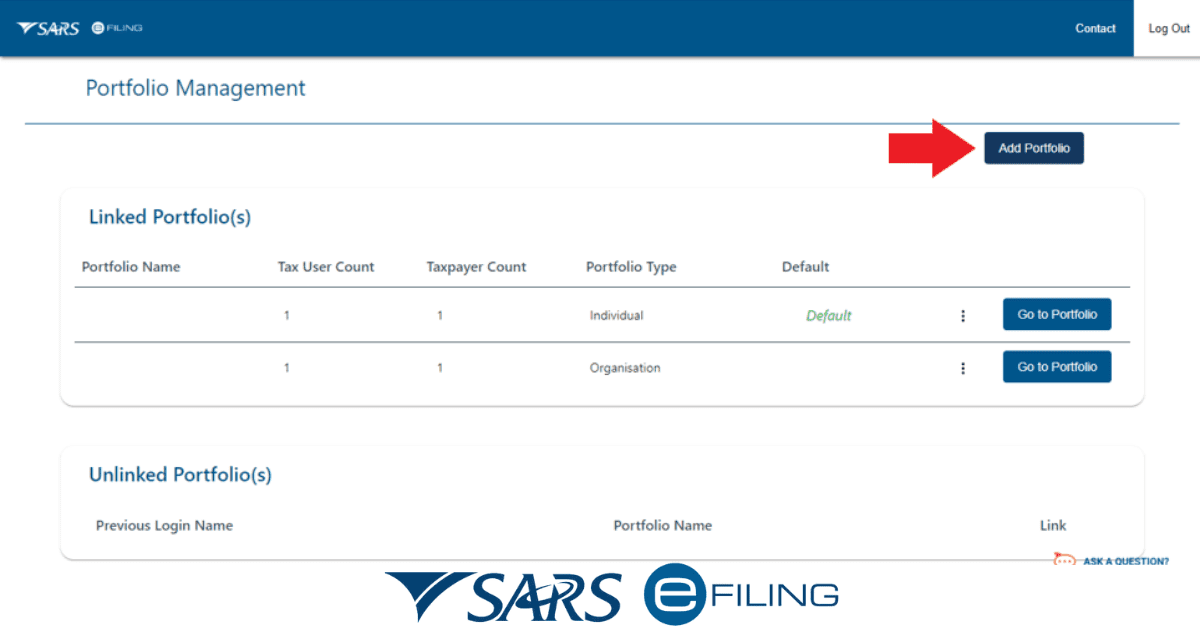

If you are an employer, you can generate and file the IRP5s (or IT3(a)s) for your staff by heading to this tax type on your company’s eFiling.

What Happens if my IRP5 is not on eFiling?

If your IRP5 is not showing on eFiling for the income tax year, you need to request it from your company. If you cannot get the IRP5 from them, you need to make an appointment at your nearest SARS branch to further discuss your options with them. The employer is legally obligated to provide you with this document.

How do I Request an IRP5 from my Employer?

You simply need to request that your employer provides you with your IRP5 for the time you worked there. Typically, you will approach the HR department at larger companies, or whoever handles salary payments for the company. There is nothing wrong with escalating the matter to higher management if you cannot get a response, as they are obliged legally to provide you with it. In the case of older IRP5s, if they cannot provide you with a historic copy, then they must give you a letter for SARS explaining why the document is unavailable.

Do note that if you work for foreign companies who do not file their own tax in SA, they may not file IRP5s, but should be willing to state this in a letter and help you prove your income source.

What Happens if You Don’t Have an IRP5?

Ultimately, you are still obliged to pay your tax, even if you have a belligerent or uncooperative company that will not respond to an IRP5 request, or if your employer does not file IRP5s due to being a foreign company. Unfortunately, the onus is on you to prove the tax you have paid, so if PAYE has been ‘withheld’ and not paid over to SARS, you will still be liable for the full tax amount.

This is why it is best to meet with SARS and potentially report the employer for fraud if they have been withholding PAYE without paying it over to SARS. To resolve your personal tax matter, you will likely have to submit payslips and bank statements to prove your income to SARS, which is why it is best to make an appointment to discuss this problem with them.

How do I Download the IRP5 from Easyfile?

To keep a copy of your IRP5, you can simply download the pdf from the link next to the document on eFiling or Easyfile.

What is the Difference Between IRP5 and Tax Certificate?

The IRP5 (where PAYE was withheld and paid) or IT3(a) (where no tax was due or tax was not withheld as PAYE) are the same thing as an ‘employees tax certificate’.

As you can see, the ITP5/IT3(a) is a critical part of proving both your tax obligations and any tax that has been withheld as PAYE from your salary. This makes it a very important document for employees and employers alike, and the core of your income tax return annually too.