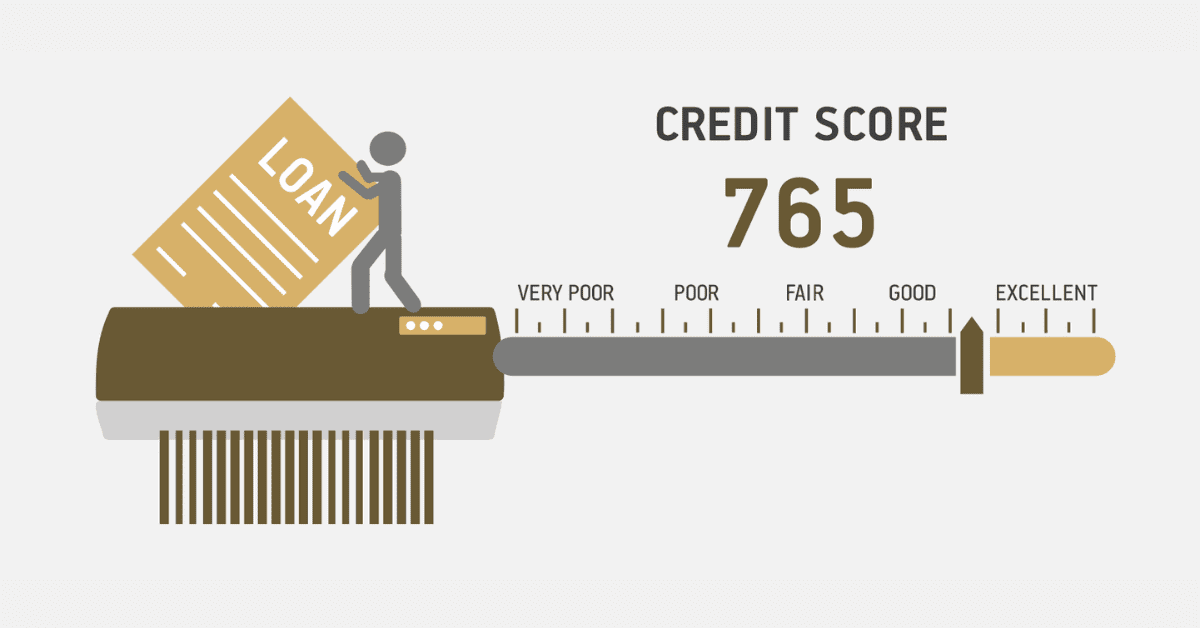

The first step to a healthy credit report is knowing exactly where you stand with the credit bureaus- and understanding what that data means. A credit score is a notional number based on a series of rather sophisticated financial ‘predictions,’ made by skilled actuaries. They are used by lenders to decide how much of a risk loaning you money would be. This is called your creditworthiness.

It doesn’t stop there, however. It will also impact how favorable your interest rate and loan terms are. In some cases, other interested parties, like potential landlords, will use your credit score as an assessment, too. So a good credit score is really important. While the whole credit report environment can seem very intimidating (and sometimes baffling), getting to grips with this complex world starts with getting a credit report. Today we will walk you through everything to know about getting your free credit score report, and what your options are.

How Can I Get My Full Credit Report for Free?

In South Africa, every consumer is entitled to one free credit report every 12 months, from each of the country’s 4 major credit bureaus: XDS, TransUnion, Experian, and Compuscan. It is super simple to get, too. You can either phone their call center (expect some identity verification questions), or hop onto their online portals to request one. Very soon, you will have your credit report in your hands.

As this credit report comes from the source of the credit score, they will offer you the most comprehensive and best possible picture of your credit history. You will find out exactly what data each is tracking, and what lenders have reported about you. However, while the cost of pulling another credit report within 12 months is very low, later copies won’t be free. You need to monitor your credit report a little more carefully than that, especially if you are trying to fix bad credit.

There are now a wealth of third-party options to get a free credit report more regularly. As these reports don’t come directly from the credit bureaus themselves (and often aggregate, or combine, data from 2 or more credit bureaus), they aren’t quite as accurate. However, they are more than enough to let you monitor the general trend of your credit score, track any changes to your report, and alert you if you need to take action. Reliable and trusted names include Mycreditcheck.co.za, Kudough, and ClearScore.

But wait, there’s more, as Verimark used to say! In the same vein- promoting financial literacy and a better understanding of our credit health- many banks and financial institutions have adopted a similar program. Th is is typically a small widget you can access on your banking app

Is it Safe to Get a Free Credit Report?

Yes, it is perfectly safe to get a free credit report in any of the ways we outlined above- directly from the credit bureaus, through a trusted and reputable online third party, or via your bank if they offer the service. That doesn’t mean you can just click on the first ‘free credit report’ link you see on Google, though! Be certain to stick with the tried and trusted providers if you want to use a third-party service. If you are approaching the credit bureaus directly, double-check that you are on their real online portal, not a scam or spoofed site.

What is the Best Free Credit Report to Get?

Naturally, getting your free annual credit report directly from the credit bureaus themselves is the very best option. However, you are limited to only one report from each bureau in a 12-month period. If you want to use third-party options that offer more regular updates through your banking app or online reports, you need to be a little selective.

We highly recommend sticking with the two best-known and longest-established services. That’s Kudough and ClearScore. Both are great, but you might want to opt for ClearScore. It has an easy-to-understand interface, is completely free, and sends you direct reminders via email regularly. It uses Experian’s data (aggregated with a rather small secondary credit bureau), and is pretty accurate.

How Can I Check My Credit Score Without Damaging It?

Time for some more good news. If you have heard that checking your credit score will damage it, they have their facts wrong. Only ‘hard’ inquiries will (temporarily affect your credit score. That means a super-serious inquiry for a lender who has the intention to offer you a financial product you have applied for and which is doing their due diligence. Checking your own credit report is, in contrast, a ‘soft’ inquiry. These leave no record at all.

So check your credit score as much as you would like- it is the best way to stay informed and take control of your creditworthiness that there is!