Finding the right agent and the right property can be draining. What makes this process entirely different is the need for an estate agent to perform a credit check and, surprisingly, the cost involved.

In South Africa, the law allows estate agents to provide housing assistance, including renting, selling, leasing, etc. But what may seem surprising to new tenants or some existing tenants is the act of a credit check.

It has been established and confirmed that in South Africa, a landlord needs to know your credit score. This will reveal your creditworthiness and ability to repay any loan.

The credit check has become a necessity for many estate agents in South Africa and requires some amount of money for this. But who pays for these checks? And how much can this estate agent charge you for a credit check?

Some tenants may have many questions, and seeking the right information is the best way to clear these thoughts.

This piece will provide some information that tends to address how much an estate agent can charge for a credit check, how a credit check is done on a tenant and other related queries.

How much can an estate agent charge for a credit check

Credit checks are also used for a lot of other types of approvals, like buying a house or getting an apartment. A real estate agent may want to do a credit check as part of the application or approval process.

Owners should check the credit of all adults over 18 who want to rent an apartment. National Credit Act Regulations 18 (4) (e) and (5) say that a tenant must permit a landlord (real estate agent, realtor) to look at their credit record.

If you do not permit the real estate agency or landlord to check your credit, they can turn down your rental application.

The South African Rental Housing Act says that estate agents do not have to charge a set fee for checking the credit of potential renters.

This is because different services and housing prices make this happen. But one might wonder if these credit checks cover a wide area. No, unfortunately, the exact amount that will be charged for credit checks is not given.

However, most estate agents impose a non-refundable fee ranging from R150 to R700, according to research and engagement. The rental application process will not begin until the agent receives payment to cover the cost of the credit check.

And this could change depending on the city, the house type, and the real estate agent. Credit checks in major cities might cost you around R500. Never agree to pay more than the agreed-upon amount for a credit check without first negotiating with the agent.

What is a good credit score to rent in South Africa?

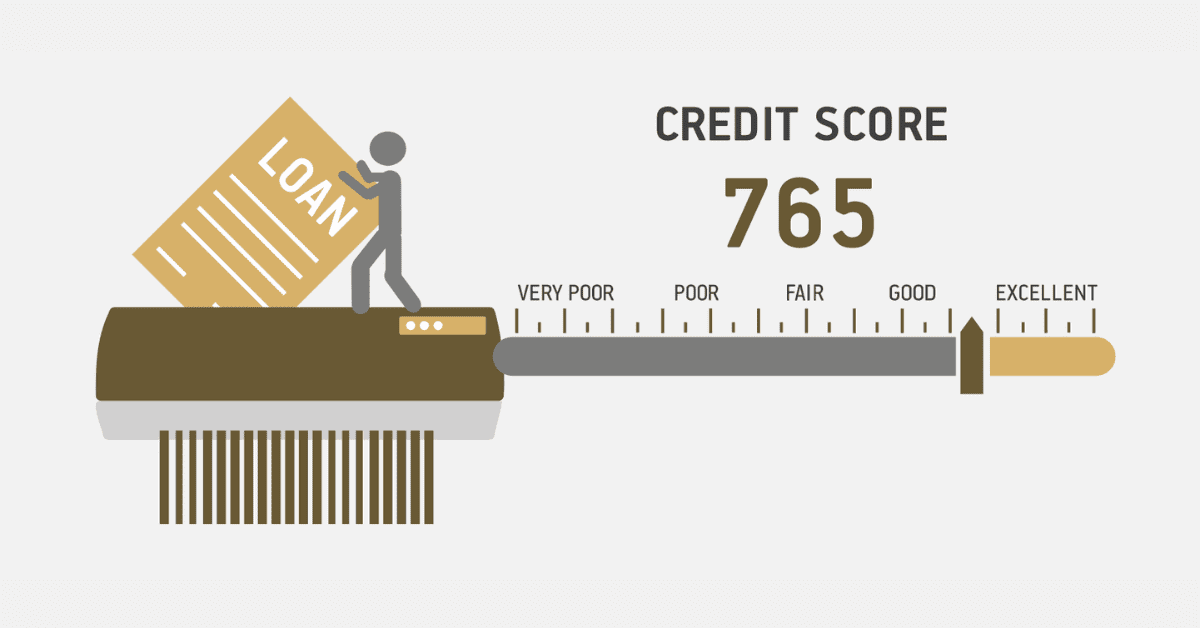

A credit score reflects how disciplined you have been with your debts. It is a way to zoom out your way of managing your debt on time and in place.

However, not all credit scores are considered good. What makes a credit score good for rent in South Africa?

Having a good credit score

In addition, having good credit does not mean you can pay the rent, but it does give you a better chance of getting the house than having bad credit.

In South Africa, a credit score of 650 or higher is considered good, and a score of 700 or higher is great.

There is less danger for lenders when you have a high credit score, which means you get better rates and pay less.

It is easier to get credit or any kind of loan if you have a good credit score. It can also affect other parts of your financial life, so you should work to raise your credit score over time.

How to do a credit check on a tenant in South Africa?

The credit check can be done on the tenant through a direct source and an indirect source. The direct source is where your real estate agent or landlord requests your authorization to your credit bureau to pull your credit report for review. This is done with the notice of the supposed tenant. With this check, the agent directly writes to the credit bureau to request your credit check.

The indirect way is using third-party options, although this can take some time. There is a tenant profile network system that has been created, this system is controlled by Lexsi Windeed in South Africa. Their system provides information about tenants and their credit history.

Before you can check any tenant credit, you must have registered with them. You must also have all the needed documents required to get this credit check done.

Once you have this platform, you can go through to request credit check information about a tenant.

Can a landlord ask for bank statements in South Africa?

It should not surprise you to find a landlord asking you for a bank statement in South Africa. This is because the landlord needs to understand your income and a bit of your expenses. The expenses part is to verify if you can cover all your utilities and perhaps have rented before. The income, on the other parts, verifies your ability to pay the rent. It is very normal for landlords in South Africa to ask for your bank statement. Should they ask, it is needed to provide them with a copy of all your bank statements that are fit to secure you a home.