It is very important to understand how to handle debt and your credit score if you want to stay financially stable and disciplined.

Debt review, which is not always known correctly, gives people a structured way to deal with their debt and a way to get back in charge of their finances.

One way that debt review tries to help people make repayment plans that work with their unique financial situations is by looking at their income, spending, and debts.

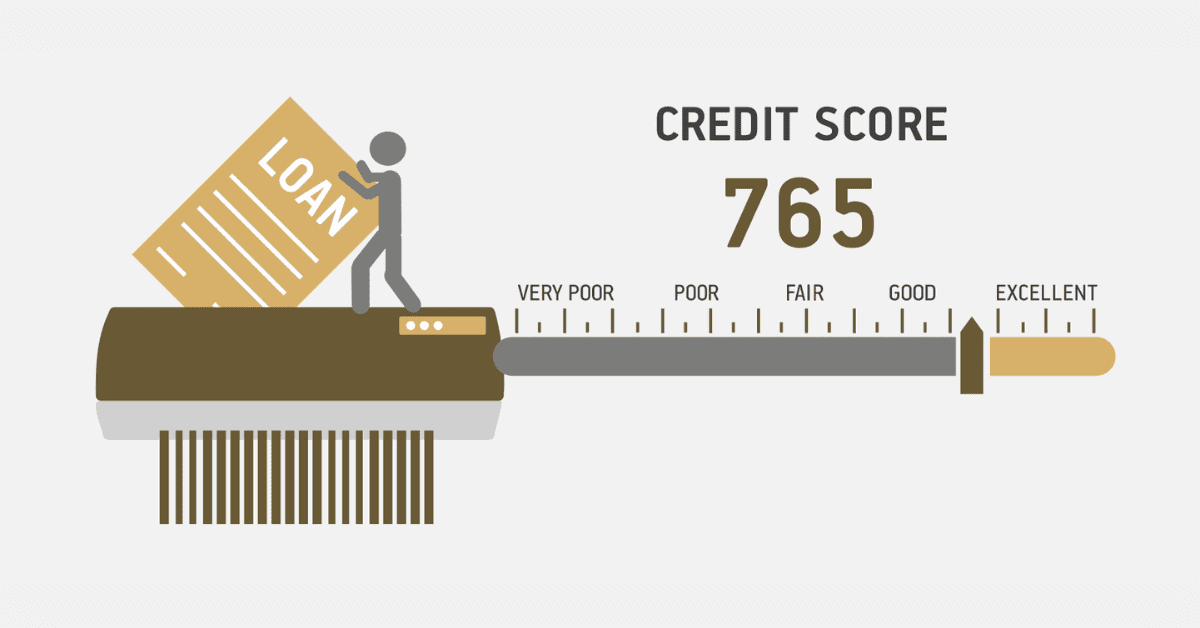

Credit scores are also necessary to get access to financial possibilities. It is important to know how credit scores are generated and the different things that can change them so that you can make smart financial decisions.

In this blog post, we will analyse how debt review affects credit score, the consequences of debt review in South Africa, and the realities that await your credit score after debt review.

How does debt review affect credit score?

Debt review can have a big effect on a person’s credit score, which can have good and bad effects on their finances.

On the bright side, reviewing your debt has more pros than cons.

Debt review is a well-organized way for people who are having money problems to get control of their finances. Participating in a debt review program gives people the chance to work out better terms for paying back their debts with their creditors. They can also combine their debts into one and make a more reasonable plan for paying them back. By sticking to this strict plan, people can show credit bureaus that they are responsible for their debt, which could gradually make them more creditworthy.

Even so, there are some problems with the process of reviewing debt. During the review process, people who are getting debt counselling are usually flagged as such, which lenders may see as a bad sign and could make it harder for them to get more credit.

Credit scores can also go down if payments are missed or made late during the review time.

In the end, debt review gives people a structured way to deal with their debt, which may help their credit scores by promoting good money habits. There are, however, some short-term limits on credit access, and if they are not carefully handled, there is a chance that credit damage will get worse. In the end, a person’s credit score depends on how hard they work at improving it and how careful they are with their money.

What are the consequences of debt review in South Africa?

In South Africa debt review also has big effects. It makes it harder for them to get more credit during the review time, which could limit their financial options. The fact that someone is being reviewed for debt also shows up in credit files, which can hurt their credit score. In the future, this could make it hard for them to get loans or find homes. Also, reviewing debt can often extend the time it takes to pay back the debt, leading to higher interest rates and longer periods of financial trouble. Debt review can unfortunately come with a social stigma that can hurt a person’s image and sense of self-worth. Also, if you do not follow the debt review plan, your creditors may take legal action, like seizing your assets. Because of this, people should carefully think about the possible outcomes before choosing to go through a debt review, which provides a structured way to handle debt.

What kind of debt affects your credit score?

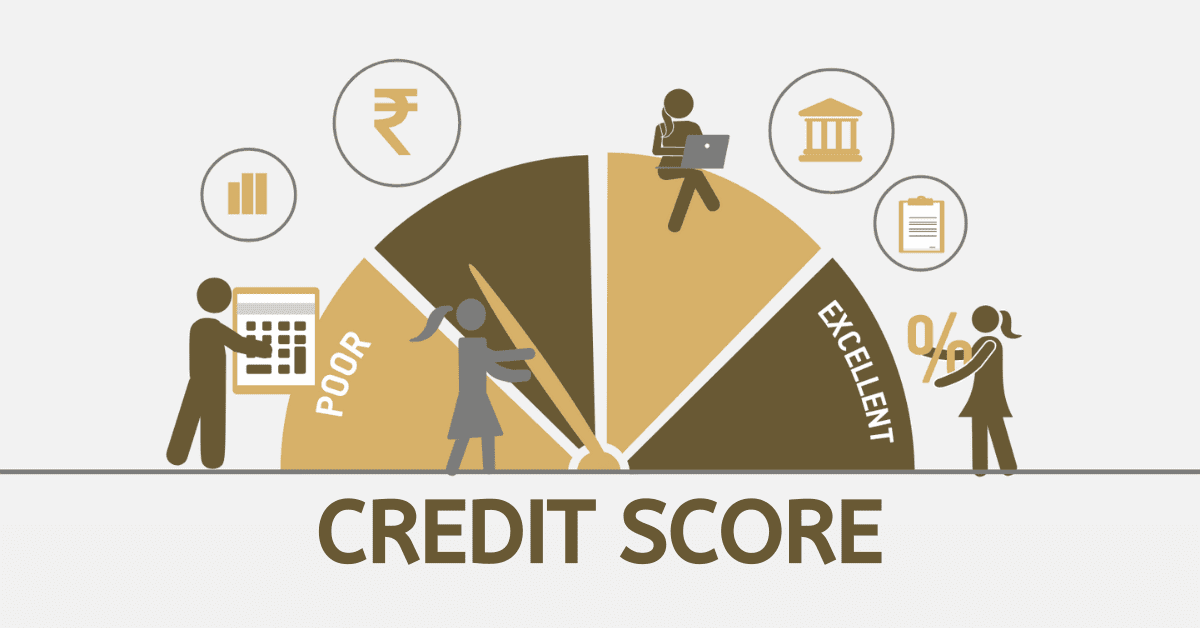

One thing you must understand is that debt is not the only thing that affects your credit score. The components that make up the credit score are more than the debt you can imagine.

When it comes to debt, payment history is considered to be the main set. Certainly, the other subset has an influence but not directly on the debt.

Personal loans, car loans, mortgages, student loans are all sorts of debt that can affect your credit score.

What happens once debt review is over

Debt review is part of the fundamentals of every credit score. It is certainly a must for every individual who has one credit to at least go through a debt review. Although there are negative effects of debt review, the overall review has a positive impact on your credit score.

Once the debt review is over, creditors take off the “review flag” from your credit profile. The debt counsellor may contact your lenders, creditors and credit bureau who were involved in this credit bureau to give them the final verdict. Once all is set, your clearance certificate will be issued to you.

How long does it take to build a credit score after a debt review?

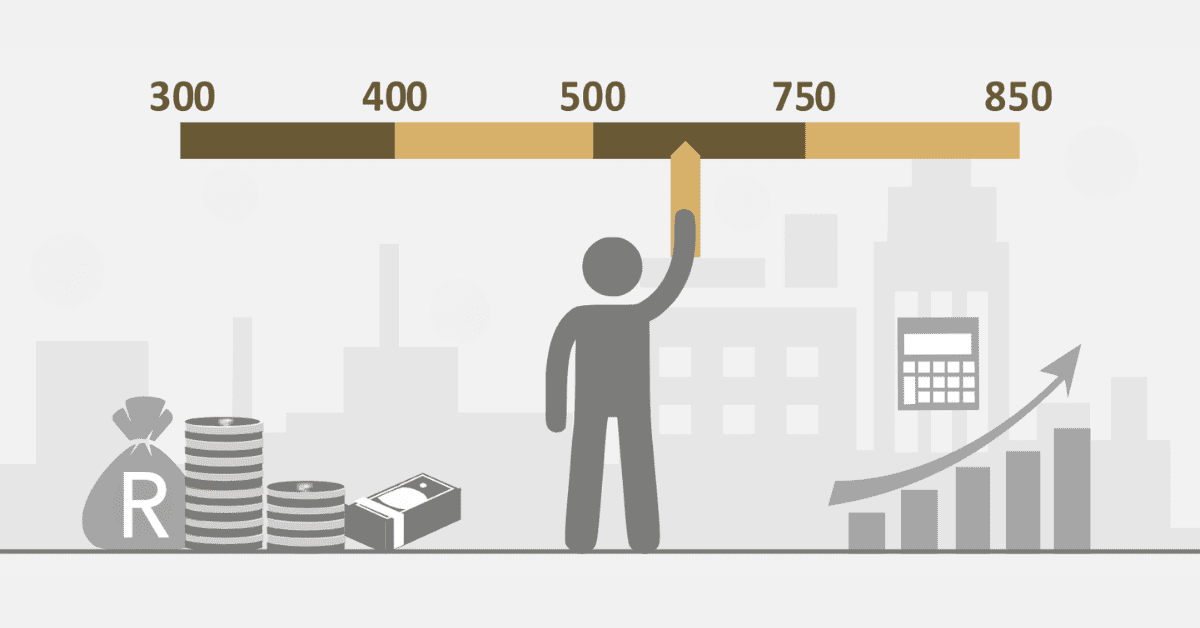

Based on past events, building credit after debt review usually takes a very short time. This is because your credit is well analysed and assessed to see the shortfalls. This evaluation is done to improve your credit score.

Ideally, a credit score should start looking good after 90 days of the debt review.

What are the disadvantages of getting into debt review?

Some of the cons of getting into debt review can be psychological and can give you a mental breakdown. At the same time, some may also affect your financial activities.

Here are some of the disadvantages of getting into debt review.

You can not do as much with your money while your debt is being reviewed. You might have to stick to a strict budget and get permission before making big financial choices.

- The payback period is usually pushed back during debt review. This means that you will be in debt for longer and may end up paying more interest overall.

- During the debt review process, your credit score will go down, which will make it harder for you to get credit in the future.

- You usually can get new credit while your debt is being reviewed, which makes it harder to make big purchases or investments.

- If you do not follow the terms of the debt review, your creditors may go to court to collect the debt, putting even more stress on your finances.

- Managing your debt all the time can make you more stressed and anxious, which can hurt your health as a whole.