One’s credit score holds significant sway over their opportunities in life in South Africa. Creditworthiness plays a vital role in the decision-making process for lenders, affecting loan approvals, interest rates, and even job eligibility. Having a high credit score can provide individuals with more favourable financial terms, making it easier to access loans for education, housing, or entrepreneurship with lower interest rates.

On the other hand, having a low credit score can restrict your financial options, resulting in higher interest rates and limited access to credit. These factors can be a disadvantage to one’s ability to buy a home, establish a business, or pursue higher education.

In South Africa, where economic disparities are a norm, having a strong credit score can be a valuable asset for achieving financial empowerment and upward mobility.

In addition, credit histories are frequently reviewed by landlords and employers, which can impact rental and employment opportunities. It is important to understand that having a positive credit profile has a significant impact on various aspects of life in South Africa.

What is the relation between medical account and credit score? Let us find out more about how medical accounts and debt can affect your credit score in South Africa.

Can a medical account affect your credit score in South Africa?

In South Africa, medical accounts typically do not have a direct impact on your credit score. When calculating credit scores, credit bureaus in the country primarily consider financial and credit-related information. Medical expenses are generally not shared with credit bureaus unless they lead to unpaid debts that are then passed on to debt collection agencies.

Failure to pay medical debts can result in the account being sent to a collections agency, which could have a negative impact on your credit score when reported to credit bureaus.

Ensuring the security of your credit is of utmost importance. It is essential to maintain open lines of communication with medical providers, establish payment arrangements when needed, and promptly resolve any unpaid bills.

The burden of unpaid medical bills can harm mental health, adding to the already difficult circumstances faced by those in this situation.

How Does Medical Debt Affect Your Credit Score?

Usually, credit bureaus do not receive information about medical expenses unless they become unpaid debts that are then passed on to debt collection agencies.

However, it is important to be careful, as unpaid medical bills that are sent to collections can indirectly affect your credit score. Medical care is undoubtedly a crucial aspect of maintaining good health, but the financial burden of expensive medical bills can take a toll on your bank account.

As long as you make timely payments, your credit will remain unaffected by medical bills. Nevertheless, unpaid medical debt is treated in a slightly distinct manner compared to other forms of consumer debt. Typically, credit bureaus do not get reports from healthcare service providers about the medical bills of individuals.

Therefore, your debt would need to be sold to a collection agency before it shows up on your credit report.

Ignoring medical bills can have a detrimental effect on your credit score. Debt collection agencies have the authority to handle unpaid medical bills and may choose to report the debt to credit bureaus. This could lead to a decrease in your credit score, which may make it difficult for you to obtain loans, mortgages, or other types of credit in the future.

What affects your credit score South Africa?

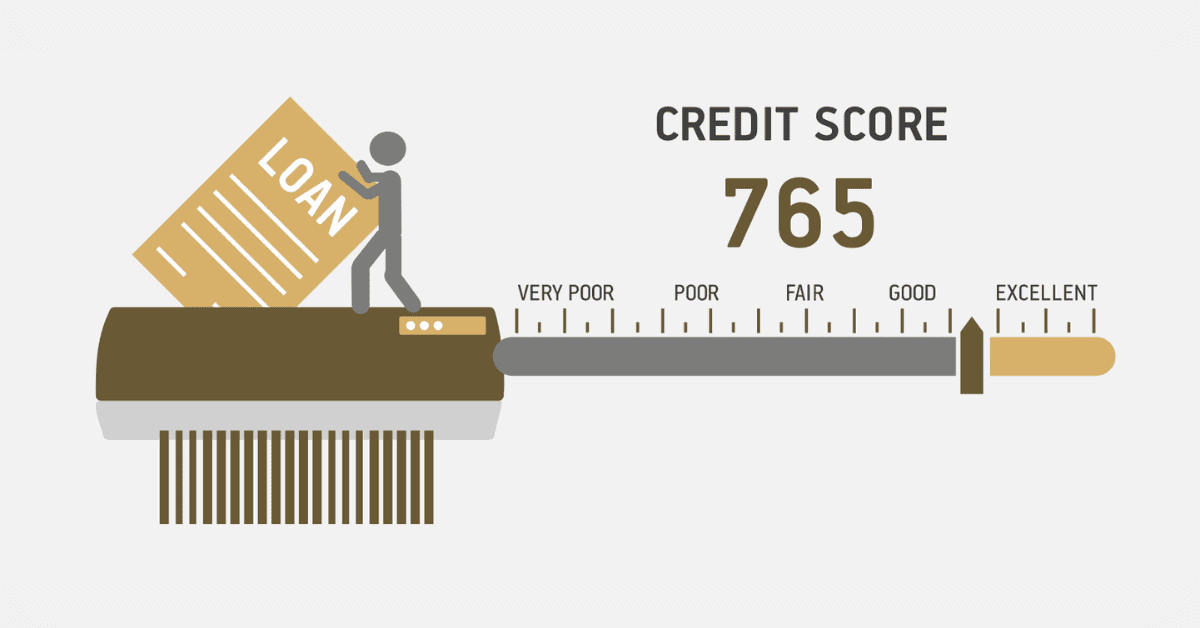

Various factors influence your credit score in South Africa. Your payment history plays a crucial role in determining your credit score. Defaults and late payments can significantly harm your credit score. The amount of debt you have about your credit limits, also known as credit utilisation, can affect your credit score.

Other factors to consider are the length of your credit history, the types of credit accounts you hold, and the frequency of recent credit applications. Publicly accessible records, like judgements and bankruptcies, can have significant adverse effects. It is crucial to regularly monitor your credit report for any inaccuracies and promptly correct them. Establishing and maintaining a positive credit score in South Africa requires responsible financial behaviour, making timely payments, and keeping a balanced credit profile.

What happens if you are not paying medical bills in South Africa?

Not paying medical bills in South Africa can have serious consequences. Hospitals have the option to pursue legal action, which could lead to a court judgment and the possibility of asset seizure, taking over your wages.

Unsettled bills can affect credit scores, making it challenging to obtain loans or engage in financial transactions.

As part of the consequences of not paying medical bills in South Africa, healthcare providers have the right to deny services to individuals who default.

Always ensure to address your financial difficulties with your healthcare provider to support and provide you with a payment plan before the issue is escalated.

Any hospital that may find it difficult to get their medical bills from a patient can obtain court permission to freeze your account or take any asset that could be used to offset the bills.

One can not be jailed for not paying medical bills in South Africa, however, it does not guarantee you to practice this habit since there are serious repercussions for such an act.