Today, one of the most pivotal ways to create wealth and attain financial stability is placing investments in growing dynamic economies such as SA. Thus, first-time and established investors must use several investment opportunities to obtain maximum returns with the lowest possible risk. This article looks at six vital types of investments in South Africa.

Tax-Free Savings Accounts

These are excellent channels for investing, providing a perfect opportunity to grow money without being laden by taxes, whether on interest, dividends, or capital gains. They have been running since 2015, with the government enabling such contributions up to a set annual limit with a lifetime contribution cap.

Besides that, all the interest an individual earns regarding such accounts is completely tax-free; hence, it is very proper for long-term purposes such as retirement savings or education funding. Considering the flexibility and tax advantages that come along with TFSAs, it is no wonder a South African investor willing to enjoy maximum returns regarding devised investment schemes at their disposal while at the same time paying a small levy has easily welcomed the idea of TFSAs. A TFSA can be invested in cash, stocks, bonds, or unit trusts.

Money Market Funds

Money Market Funds are one of the best, safe, accessible, and particularly short-term solutions for investments in South Africa. Such funds invest primarily in a diversified portfolio of high-quality, short-term debt securities that are relatively low in liquid assets, notably treasury bills, commercial papers, and certificates of deposit.

An inalienable feature of money market investment is stability and liquidity, providing the best avenue to park your cash. At the same time, it earns a higher interest rate than you would with traditional savings. They are perfect for an at-risk investor or one who desires easy access to their capital. Money Market Funds in South Africa are managed and handled by cross institutions, relieving the investor’s anxiety for the safety of their capital while maintaining competitive yield. This balance constitutes a Money Market Fund in a balanced investment portfolio.

Fixed Deposits

Another set source of sure investment in South Africa includes fixed deposits because they guarantee the return of the same over the set period. Under this scenario, the investors place a lump sum for a predetermined term, which could range between some months to several years, and in return, an interest rate is fixed. Its fundamental charm lies in its simplicity and certainty regarding the amount of interest to be earned.

Fixed Deposits usually yield rates of interest higher than those of ordinary deposits or savings accounts. The former is convenient for conservative investors who need assured income with minimal risk. Generally, most banks in South Africa provide a range of these products. They often have flexible terms to suit various investment horizons or financial goals. This predictability and assurance of capital preservation make fixed deposits attractive for those seeking low-risk assets to balance their portfolios.

Unit Trusts

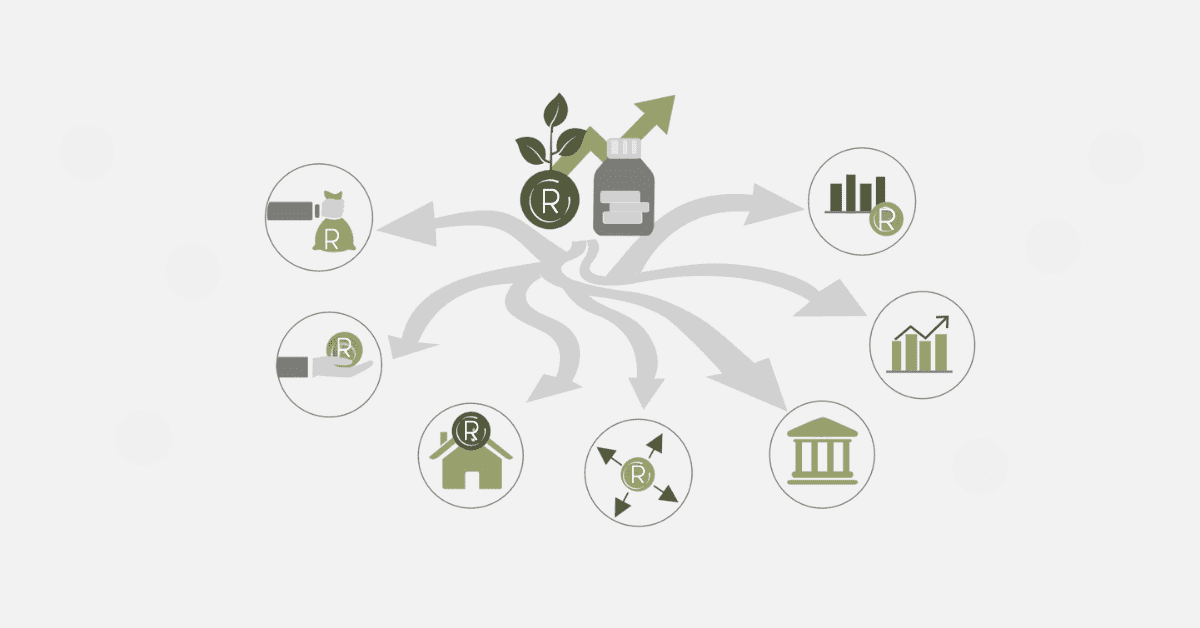

Unit trusts are collective investment plans by which various investors pool money for investment in a portfolio diversified by the financial assets managed. In South Africa, unit trusts appeal to as many first-time as well as seasoned investors due to the diversification of the investments, professional management of funds, and accessibility.

Such funds may adopt a diversified investment manner in most asset classes, such as equities, bonds, property, and money market instruments, which gives them exposure to various sectors and markets. The risk is, therefore, reduced through diversification, and professional management ensures such a high degree of expertise. Numerous unit trusts are available, so investors can choose those that best suit their desired risk level and declared objectives. This flexibility and the potential for capital growth make Unit Trusts an attractive way to build a solid investment portfolio.

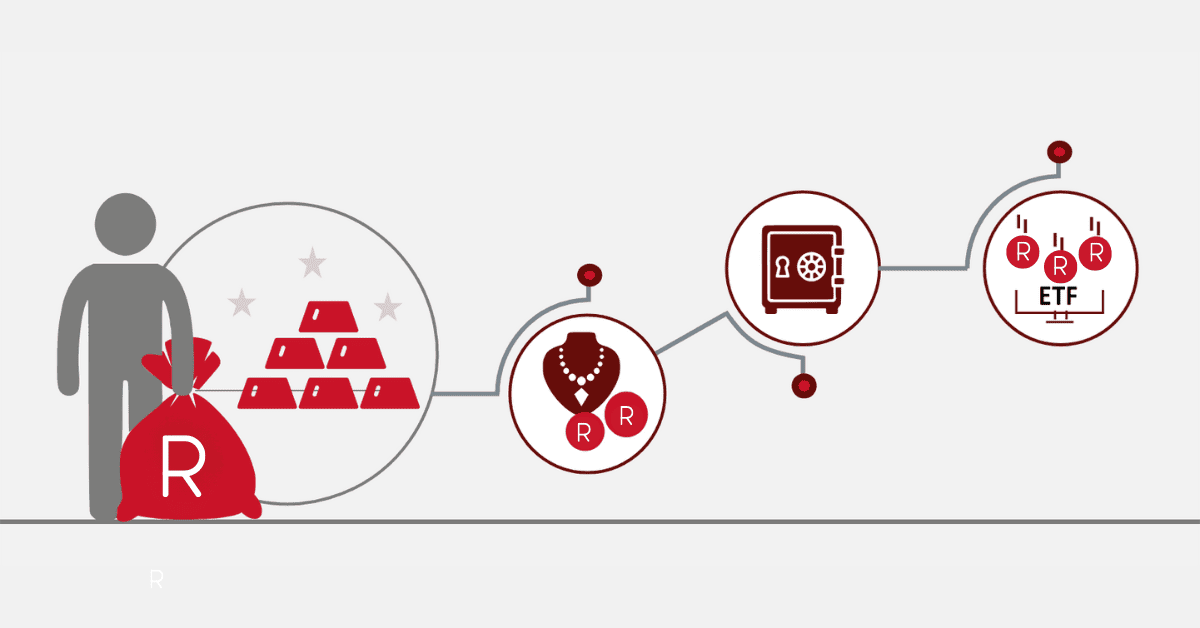

Exchange Traded Funds

The ETF is a low-cost, flexible investment solution that has gained considerable popularity in South Africa. As the name indicates, they are investment funds traded on stock exchanges, much like any other individual stock. They generally follow an index, sector, or commodity performance to give investors the most convenient exposure to a large market or access to a free market or single asset class. An ETF’s most appealing features are that it manages low fees, offers transparency, and has convenient daily trading at market prices.

ETFs provide diversified exposure experienced by both greenhorns and seasoned investors and allow market performance exposure that is convenient to consider. There are diverse ETF funds available in South Africa, from those that track the JSE Top 40 Index to sector-specific and internationally invested ETFs. This makes them quite versatile and efficient at boosting any other investment that may be held.

A Stockbroking Account

This is essential for investors who wish to deal directly with the stock market. It allows the capitalists to access the market to purchase and sell shares belonging to listed companies on the Johannesburg Stock Exchange and other global markets. A share account offers exposure to many investment opportunities, from the most well-known big companies to the little ones geared toward growth. Several of those are reputable brokerage firms located within South Africa. Brokers provide these accounts supported by internet trading facilities, research support, and backup via telephones.

Opening a Stockbroking Account lets investors control their investment choices, diversify their portfolios, and re-earn extraordinary returns. For those with the time to spare to research this and follow up on their investments, the stockbroking account offers instrumental comparisons for those looking to build wealth towards financial independence.

Final Thoughts

One of the primary considerations for attaining one’s financial goals and financial stability over the long run is choosing the right investment vehicle. South Africa has a host of different types of investment options available, each coming with its definite advantages and risks. You can enjoy tax efficiency in TFSA, stability in money market funds and fixed deposits, diversification as clearly illustrated by unit trusts and ETFs, and control inherent in a stockbroking account. Knowing and understanding these investments and matching them with your financial objectives will significantly help you have a robust, diversified investment portfolio that will stand the test of time.

![Internal Rate of Return [IRR] – Calculation](https://www.searche.co.za/wp-content/uploads/internal-rate-of-return.webp)

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)