Buying a home is almost everyone’s dream. You want to get yourself a safe space that is yours, and just yours, to enjoy. As with all dreams, however, reality is always ready to throw a cold bucket of water at you and make you face the facts instead. If your current credit score is so low that you fall into the nebulous ‘blacklisted’ category, you probably won’t qualify for a home loan- right now. However, there’s plenty you can do to correct this, and we have some great advice for you.

Am I Blacklisted?

Let’s start with some blacklisting facts. Firstly, the term doesn’t really exist! There is no blacklist, no one tracks it, and you aren’t on it. That probably doesn’t make you feel better about your chances of getting a home loan right now, but it is important to understand.

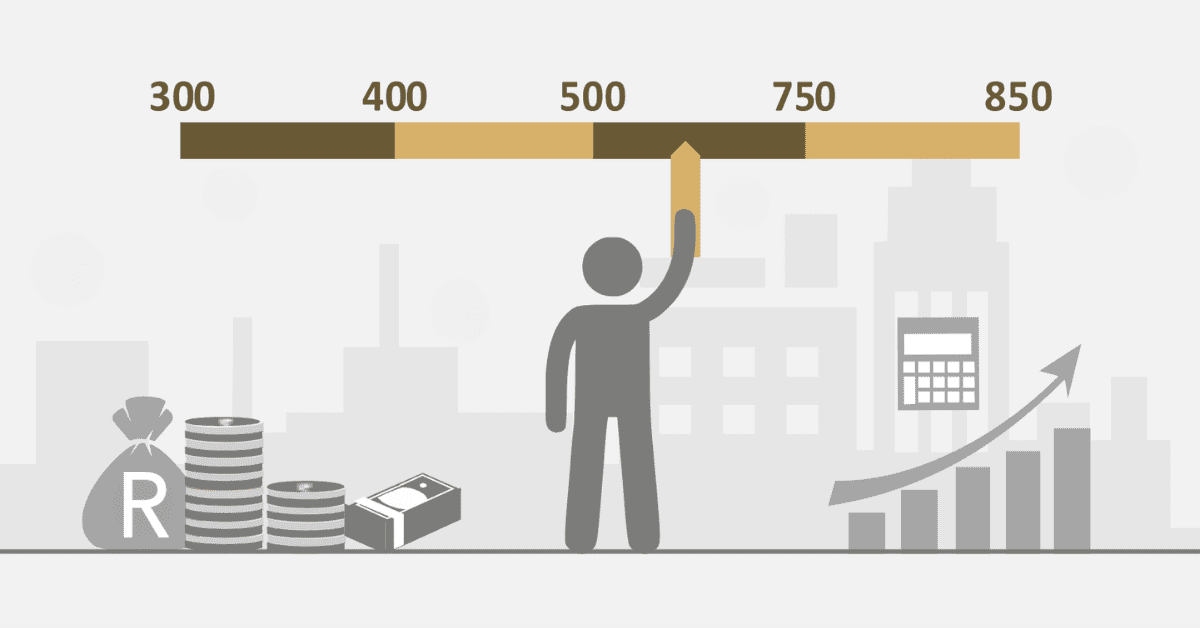

Blacklisting is a very old term dating to the start of credit reports in South Africa. Back then, credit bureaus only tracked your negative credit information. The entire system is different today, and both positive and negative credit behaviors are used to compile your credit score. So please don’t think of blacklisting as some permanent burden you have to bear. All that’s wrong is you have a rather bad credit score. It can be fixed. For this article, we will use the term ‘blacklisted’ for people with a credit score in the 450 range or lower.

Don’t imagine that means you are scott-free at 451, however. Anything below 580 is considered poor, and even a fair or better score may not be enough for a home loan. The criteria are very stringent. You have a long way to go before you will easily qualify for a home loan. It can be done, so keep faith.

Can I Buy a House If I am Blacklisted?

None of that is good news for people who are looking for credit, however. If you have such a poor credit score you consider yourself blacklisted, you will not qualify for a large loan like a home loan. Right now, that is. However, your credit score is not set in stone forever. No matter how bad your current financial and debt situation is, you can always take steps to improve it. With conscious effort and some hard work on rehabilitating your credit, you can revisit your hope of home ownership in the future. Sometimes all you need is 6 months or a year of effort to completely turn your credit score around.

What if you aren’t looking for a loan, however? Then the answer is much more positive. Yes, you can buy a house if you are ‘blacklisted’. The term only applies to your credit score and loan eligibility. If you have the cash to make the purchase outright, or another means to fund it, there will be nothing standing in your way except possibly a poor perception from vendors. You should be able to work through this to everyone’s satisfaction.

How to Get a Home Loan If You are Blacklisted

If you are ‘blacklisted,’ i.e. have a particularly poor credit score, you simply aren’t going to get a home loan the traditional way. No matter how much you earn. Lenders have seen that you have poor credit habits- like paying late, skipping payments, or defaulting on debt. They aren’t going to take a big risk like a home loan on a candidate with poor creditworthiness.

You do have some options, however. You may be able to have someone with a better credit record stand surety. If you are married and have a spouse with a good credit record and a high enough salary, they may be able to take out the home loan without your financial history being needed. If you own other valuable assets, like another property, you might be able to offer them as surety for the loan instead.

By far the simplest route, however, would be to take charge of your credit history

Now you can take steps to correct this. Settle outstanding debts, communicate with lenders to make payment plans, and improve your general behavior with credit. You may even want to enter into a process called debt review to take charge of the situation. A little diligence will turn your credit score around faster than you think, and you could soon qualify for the home loan of your dreams.

Does Any South African Bank Give Loans to Blacklisted People?

Of all the financial services providers in the market, the banks have some of the most stringent lending criteria. You will not get a home loan as a ‘blacklisted’ person from a South African Bank. African Bank has developed a reputation for having slightly lower lending criteria than the major banks, but this is for smaller loans (like personal loans), and only to a certain point. They do not offer home loan products at all.

Which Loan Company is Best for Bad Credit?

So, as we have seen, you probably won’t get a home loan unless you improve your credit score. If you ‘only’ have bad credit, not credit so poor it counts as ‘blacklisted’, you may be able to approach a loan company that specializes in bad credit loans. Probably not for something as large as a home loan, though that depends on exactly how bad your credit really is. There are a few providers that will work with some types of low-credit-score loan seekers.

Whatever you do, make sure to only approach companies that are registered with the NCR (National Credit Regulator) and are registered financial services providers. When you are frustrated or desperate, you are also a target for fraudsters and loan sharks. Their promises will sound wonderful, but you will get badly hurt in the long run- and still have a poor credit score to fix.

This article may seem a little negative. However, remember the most important lesson of all. Your credit score is not permanent, and can be improved. Some people with excellent credit scores today have been blacklisted in the past. If you’re dreaming of owning your own home, let that be the inspiration you need to help you take ownership of your credit score today. The keys to your new home could be in your hands sooner than you think!