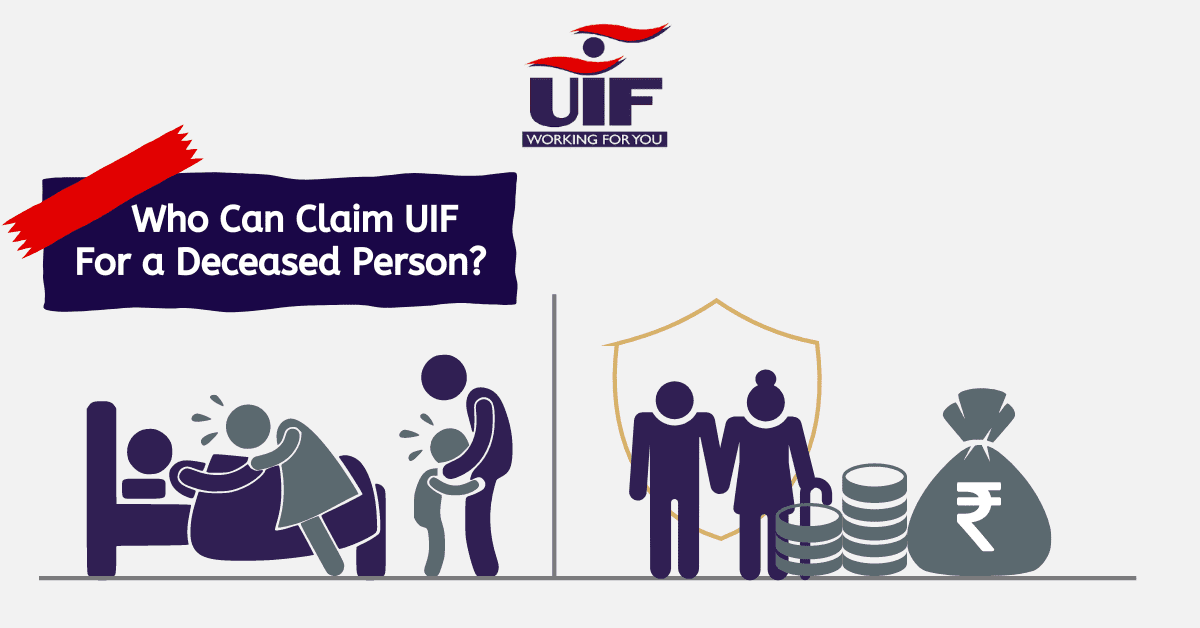

The Unemployment Insurance Fund (UIF) is specifically meant to provide short-term financial relief to employees when they become unemployed or cannot work because of retrenchment, maternity, illness, or adoption. If the breadwinner dies, the dependents will get UIF benefits.

To be eligible for UIF benefits, each employee must contribute to the fund every month. The contributions you can make to the fund depend on factors like your salary and the time you have been employed. Read on to learn how much UIF takes from your salary.

How Much Does UIF Take From Your Salary?

UIF mainly covers domestic or other commercial workers who work for more than 24 hours per month. These people are required by law to make contributions to the fund each month.

The employer deducts 1% of your gross salary every month and contributes it to the fund. An employee also contributes 1% of their salary to the UIF. Altogether, the money deducted from your salary toward UIF contributions is 2%. The employer pays the money on your behalf.

Although the money deducted may seem to be a small amount, it will accumulate over time, and you can claim benefits from the fund in time of need. From 1 June 2021, the ceiling for maximum earnings was pegged at R17 712 per month or R212 544 per year. If your earn more than this figure, the ceiling amount will be used to calculate your UIF contribution.

For instance, if you earn more than R17 712 per month, your maximum contribution to UIF will be R177.12 per month. However, some people who earn more than this fund have benefited from other funds, so they will not qualify for UIF payments.

The money deducted from your salary must be paid to UIF within seven after each month’s end when the money is deducted. This means that your employer has seven days into the new month to pay your contributions to the fund. All payments should be made on the last business day if the deadline falls on a weekend or public holiday.

How Is UIF Payment Calculated?

The monthly contributions you make to UIF constitute the total amount you will get when you file a claim for benefits. Once your funds are finished, you cannot continue enjoying the money you no longer have.

To calculate the UIF payment, you are entitled to get, you first need to know your daily remuneration.

For instance, if you earn R5000, you need to multiply it by 12, which represents each month of the year.

Therefore R5000 x 12 = R60 000. A year has 365 days, so you must divide the value of your annual earnings by the number of days: R60 000 / 365 = R164.38. It means R164.38 becomes your daily remuneration.

Determine Your Pay Scale and Benefits

The next step is to determine the benefits you are entitled to get when you file a claim. Based on your salary, you will get a percentage of the money you would have earned daily. The highest amount you can get is 58% of the money you would earn daily. The highest percentage is offered to employees with lower salaries, while those with higher salaries will receive lower percentages.

If your daily earnings are R164.38, you deserve to get 58% of this amount which is R95.34. Therefore, R95.34 is the amount you will get in daily benefits. It is crucial to remember that the UIF benefits you receive mainly depend on the period you have been contributing to the fund. Those with high salaries will get percentages that range from 36 to 56.

The employees who have contributed to UIF for more than four years are entitled to get benefits worth 365 days. However, for those who have contributed for a shorter period, their benefits are determined by the credits they have accumulated. For instance, you will get one credit for the five days worked.

Do You Calculate UIF on Gross Salary?

Your employer will deduct 2% from your gross salary (they contribute 1%, and you also contribute 1%). After the UIF deductions, the employee will be left with a basic or net salary. The gross salary is the initial amount that a worker is supposed to get before deductions.

All deductions are taken from your gross salary, and the remainder is known as your net salary. This is the money you can take home and use the way you want. After the deductions of UIF contribution and other expenses, if any, you will be left with a basic salary. Other deductions that can be made from your gross salary can include medical insurance or loans.

What Is the UIF Limit?

The UIF limit was pegged at R17 712 per month or R212 544 per year. This limit still applies for 2025 since there has been no review up to date. This means the maximum UIF contribution each employee can make is R177.12 per month.

If you earn more than R17 712 per month, you will not pay more than the stipulated ceiling of R177.12 toward your UIF contributions. Any excess amount should not be viewed as remuneration, which can end up being included in what you pay to the fund.

If you get regular weekly payments, the cap will be distributed across your pay periods. This can lead to a reduced payment toward UIF during the last payment period of the month. It is essential to track all your payments to ensure there are no arrears.

When you are a domestic worker and work for more than 24 hours a month, you are supposed to contribute to the UIF. A total of 2% of your salary will be deducted by your employer and channeled toward UIF contributions. However, the monetary value of your monthly contributions to the fund depends on your salary. You can use these tips to calculate the money you should contribute to the fund or the payment you will get when you apply for UIF benefits in the event of unemployment, maternity leave, illness, or adoption.